-

For children of deported parents, lonely journeys to a new home

For children of deported parents, lonely journeys to a new home

-

Hungary winemakers fear disease may 'wipe out' industry

-

Chile picks new president with far right candidate the front-runner

Chile picks new president with far right candidate the front-runner

-

German defence giants battle over military spending ramp-up

-

Knicks reach NBA Cup final as Brunson sinks Magic

Knicks reach NBA Cup final as Brunson sinks Magic

-

Quarterback Mendoza wins Heisman as US top college football player

-

Knicks reach NBA Cup final with 132-120 win over Magic

Knicks reach NBA Cup final with 132-120 win over Magic

-

Campaigning starts in Central African Republic quadruple election

-

NBA Cavs center Mobley out 2-4 weeks with left calf strain

NBA Cavs center Mobley out 2-4 weeks with left calf strain

-

Tokyo-bound United flight returns to Dulles airport after engine fails

-

Hawks guard Young poised to resume practice after knee sprain

Hawks guard Young poised to resume practice after knee sprain

-

Salah back in Liverpool fold as Arsenal grab last-gasp win

-

Raphinha extends Barca's Liga lead, Atletico bounce back

Raphinha extends Barca's Liga lead, Atletico bounce back

-

Glasgow comeback upends Toulouse on Dupont's first start since injury

-

Two own goals save Arsenal blushes against Wolves

Two own goals save Arsenal blushes against Wolves

-

'Quality' teens Ndjantou, Mbaye star as PSG beat Metz to go top

-

Trump vows revenge after troops in Syria killed in alleged IS ambush

Trump vows revenge after troops in Syria killed in alleged IS ambush

-

Maresca bemoans 'worst 48 hours at Chelsea' after lack of support

-

Teenage pair Ndjantou, Mbaye star as PSG beat Metz to go top

Teenage pair Ndjantou, Mbaye star as PSG beat Metz to go top

-

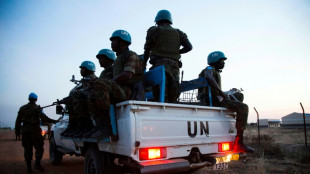

Drone strike in southern Sudan kills 6 UN peacekeepers

-

Crime wave propels hard-right candidate toward Chilean presidency

Crime wave propels hard-right candidate toward Chilean presidency

-

Terrific Terrier backheel helps lift Leverkusen back to fourth

-

'Magic' Jalibert guides Bordeaux-Begles past Scarlets

'Magic' Jalibert guides Bordeaux-Begles past Scarlets

-

Teenage pair Ndjantou and Mbaye star as PSG beat Metz to go top

-

Anglo-French star Jane Birkin gets name on bridge over Paris canal

Anglo-French star Jane Birkin gets name on bridge over Paris canal

-

US troops in Syria killed in alleged IS ambush

-

Jalibert masterclass guides Bordeaux-Begles past Scarlets

Jalibert masterclass guides Bordeaux-Begles past Scarlets

-

M23 marches on in east DR Congo as US vows action against Rwanda

-

Raphinha double stretches Barca's Liga lead in Osasuna win

Raphinha double stretches Barca's Liga lead in Osasuna win

-

Terrific Terrier returns Leverkusen to fourth

-

Colts activate 44-year-old Rivers for NFL game at Seattle

Colts activate 44-year-old Rivers for NFL game at Seattle

-

US troops in Syria killed in IS ambush attack

-

Liverpool's Slot says 'no issue to resolve' with Salah after outburst

Liverpool's Slot says 'no issue to resolve' with Salah after outburst

-

'Stop the slaughter': French farmers block roads over cow disease cull

-

Stormers see off La Rochelle, Sale stun Clermont in Champions Cup

Stormers see off La Rochelle, Sale stun Clermont in Champions Cup

-

Maresca hails Palmer as Chelsea return to winning ways against Everton

-

Hungarian protesters demand Orban quits over abuse cases

Hungarian protesters demand Orban quits over abuse cases

-

Belarus frees protest leader Kolesnikova, Nobel winner Bialiatski

-

Salah sets up goal on return to Liverpool action

Salah sets up goal on return to Liverpool action

-

Palmer strikes as Chelsea return to winning ways against Everton

-

Pogacar targets Tour de France Paris-Roubaix and Milan-San Remo in 2026

Pogacar targets Tour de France Paris-Roubaix and Milan-San Remo in 2026

-

Salah back in action for Liverpool after outburst

-

Atletico recover Liga momentum with battling win over Valencia

Atletico recover Liga momentum with battling win over Valencia

-

Meillard leads 'perfect' Swiss sweep in Val d'Isere giant slalom

-

Salah on Liverpool bench for Brighton match

Salah on Liverpool bench for Brighton match

-

Meillard leads Swiss sweep in Val d'Isere giant slalom

-

Indonesia flood death toll passes 1,000 as authorities ramp up aid

Indonesia flood death toll passes 1,000 as authorities ramp up aid

-

Cambodia shuts Thailand border crossings over deadly fighting

-

First urban cable car unveiled outside Paris

First urban cable car unveiled outside Paris

-

Vonn second behind Aicher in World Cup downhill at St Moritz

Turkey halts four-month streak of rate cuts

Turkey's central bank on Thursday bowed to market pressure and halted a four-month streak of interest rate cuts that saw inflation soar and the currency collapse.

The bank left its policy rate at 14 percent two days after President Recep Tayyip Erdogan -- a fervent opponent of high interest rates -- said future reductions could come "gradually and without any rush".

Erdogan has been waging a "war of economic independence" designed to break Turkey's dependence on foreign currency inflows by boosting cheap lending and revving up exports.

But the policies have seen the emerging country's economy spin dangerously out of control.

Turkey's annual inflation rate has shot to a 19-year high of 36 percent and is expected to keep climbing.

The lira lost 44 percent of its value against the dollar and became the world's worst-performing emerging market currency last year.

And the central bank's net reserves -- a gauge of both Turkey's economic health and ability to withstand a potential banking crisis -- have dropped from $21.1 billion (18.6 billion euros) in mid-December to $7.9 billion on January 7.

"The sharp falls in the lira risk entrenching inflation at very high levels," Jason Tuvey of Capital Economics said in a note to clients.

"And the weak lira could cause vulnerabilities in the banking sector to crystallise."

- 'Bad policy for longer' -

Erdogan has cited Islamic rules against usury to justify his belief that high interest rates cause inflation. Economists almost universally agree that the opposite is true.

Central banks hike rates in order to raise the cost of doing business when the economy is growing too fast. This helps bring down prices by reducing demand.

High rates also help support currencies by raising the return on local bank deposits and investments.

But Erdogan says Turkey has developed a "new economic model" for achieving sustainable growth.

The central bank attributed the spike in inflation from 21.3 percent in November to 36.2 percent last month to "distorted pricing behaviour (caused by) unhealthy price formations in the foreign exchange market".

It also blamed outside factors such as high commodity prices and global supply chain bottlenecks caused by the coronavirus pandemic.

The lira edged up slightly after the announcement to around 13.3 to the dollar.

Economists believe the bank would need to hike its policy rate substantially in order to solve Turkey's accumulating problems.

"No change (means) bad policy for longer," emerging markets economist Timothy Ash of BlueBay Asset Management remarked after the rate decision.

- 'Lira is our money'

Turks had been converting their liras into gold and dollars in order to shield themselves from price increases and an erosion of their purchasing power.

The government has tried to stem this tide by creating new bank deposits that effectively tie the value of the lira to the dollar.

Erdogan says the new scheme has attracted 163 billion liras ($12.2 billion).

He has also appealed on Turks' sense of patriotism while urging them to hold on to their liras.

"The Turkish lira is our money," he said in a traditional New Year's Eve address. "That is how we move forward -- not with this or that currency."

Yet fresh data released on Thursday showed that 62.2 percent of all Turks' deposits were still held in dollars.

The figure was down by just 1.4 percentage points on the week.

Economists believe that the mechanism is having only a marginal effect because it forces individuals and businesses to hold liras in the new deposits for at least three months.

Exporters are also unhappy with a new requirement to sell a quarter of their hard currency proceeds to the central bank.

F.Qawasmeh--SF-PST