-

Scotland spoil Italy's T20 World Cup debut with big win

Scotland spoil Italy's T20 World Cup debut with big win

-

Stocks track Wall St rally as Tokyo hits record on Takaichi win

-

Israeli president says 'we will overcome evil' at Bondi Beach

Israeli president says 'we will overcome evil' at Bondi Beach

-

Munsey leads Scotland to 207-4 against Italy at T20 World Cup

-

Venezuela's Machado says ally 'kidnapped' after his release

Venezuela's Machado says ally 'kidnapped' after his release

-

Japan restarts world's biggest nuclear plant again

-

Bangladesh poll rivals rally on final day of campaign

Bangladesh poll rivals rally on final day of campaign

-

Third impeachment case filed against Philippine VP Duterte

-

Wallaby winger Nawaqanitawase heads to Japan

Wallaby winger Nawaqanitawase heads to Japan

-

Thailand's Anutin rides wave of nationalism to election victory

-

Venezuela's Machado says ally kidnapped by armed men after his release

Venezuela's Machado says ally kidnapped by armed men after his release

-

Maye longs for do-over as record Super Bowl bid ends in misery

-

Seahawks' Walker rushes to Super Bowl MVP honors

Seahawks' Walker rushes to Super Bowl MVP honors

-

Darnold basks in 'special journey' to Super Bowl glory

-

Japan's Takaichi may struggle to soothe voters and markets

Japan's Takaichi may struggle to soothe voters and markets

-

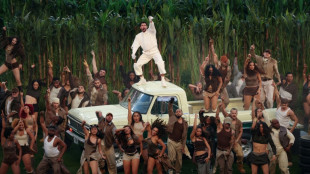

Bad Bunny celebrates Puerto Rico at Super Bowl, angering Trump

-

Seahawks soar to Super Bowl win over Patriots

Seahawks soar to Super Bowl win over Patriots

-

'Want to go home': Indonesian crew abandoned off Africa demand wages

-

Asian stocks track Wall St rally as Tokyo hits record on Takaichi win

Asian stocks track Wall St rally as Tokyo hits record on Takaichi win

-

Hong Kong sentences pro-democracy mogul Jimmy Lai to 20 years in jail

-

Bad Bunny celebrates Puerto Rico in joyous Super Bowl halftime show

Bad Bunny celebrates Puerto Rico in joyous Super Bowl halftime show

-

Three prominent opposition figures released in Venezuela

-

Japan PM Takaichi basks in historic election triumph

Japan PM Takaichi basks in historic election triumph

-

Israeli president says 'we shall overcome this evil' at Bondi Beach

-

'Flood' of disinformation ahead of Bangladesh election

'Flood' of disinformation ahead of Bangladesh election

-

Arguments to begin in key US social media addiction trial

-

Gotterup tops Matsuyama in playoff to win Phoenix Open

Gotterup tops Matsuyama in playoff to win Phoenix Open

-

New Zealand's Christchurch mosque killer appeals conviction

-

Leonard's 41 leads Clippers over T-Wolves, Knicks cruise

Leonard's 41 leads Clippers over T-Wolves, Knicks cruise

-

Patriots-Seahawks Super Bowl approaches as politics swirl

-

Trump says China's Xi to visit US 'toward the end of the year'

Trump says China's Xi to visit US 'toward the end of the year'

-

Real Madrid edge Valencia to stay on Barca's tail, Atletico slump

-

Malinin keeps USA golden in Olympic figure skating team event

Malinin keeps USA golden in Olympic figure skating team event

-

Lebanon building collapse toll rises to 9: civil defence

-

Real Madrid keep pressure on Barca with tight win at Valencia

Real Madrid keep pressure on Barca with tight win at Valencia

-

Dimarco helps Inter to eight-point lead in Serie A, Juve stumble

-

PSG trounce Marseille to move back top of Ligue 1

PSG trounce Marseille to move back top of Ligue 1

-

Two prominent opposition figures released in Venezuela

-

Hong Kong to sentence media mogul Jimmy Lai in national security trial

Hong Kong to sentence media mogul Jimmy Lai in national security trial

-

Lillard will try to match record with third NBA 3-Point title

-

Vonn breaks leg as crashes out in brutal end to Olympic dream

Vonn breaks leg as crashes out in brutal end to Olympic dream

-

Malinin enters the fray as Japan lead USA in Olympics team skating

-

Thailand's Anutin readies for coalition talks after election win

Thailand's Anutin readies for coalition talks after election win

-

Fans arrive for Patriots-Seahawks Super Bowl as politics swirl

-

'Send Help' repeats as N.America box office champ

'Send Help' repeats as N.America box office champ

-

Japan close gap on USA in Winter Olympics team skating event

-

Liverpool improvement not reflected in results, says Slot

Liverpool improvement not reflected in results, says Slot

-

Japan PM Takaichi basks in election triumph

-

Machado's close ally released in Venezuela

Machado's close ally released in Venezuela

-

Dimarco helps Inter to eight-point lead in Serie A

Rising student debt to worsen money woes of young Britons

Rhiannon Muise graduated from Edge Hill University in northwest England last year with a mountain of student debt, which is growing even larger due to surging inflation.

The 21-year-old dance and drama graduate said it will take a "lifetime" for her to pay back the £45,000 ($55,000) she owes for tuition fees and living expenses, particularly if she stays within her chosen field where salaries can be low.

Muise's plight echoes that of students across Britain, who are already struggling with a cost-of-living crisis.

Britons heading to university next year face major changes that critics argue will worsen the financial pain.

- Exhausting -

The pressure is "exhausting, especially for someone in their 20s who has just started thinking about their career", Muise told AFP.

Her current job as Edge Hill student engagement officer pays below the threshold that activates repayments.

UK graduates shoulder more debt than any other developed country, according to House of Commons Library data.

About 1.5 million students borrow nearly £20 billion in loans every year in England alone.

And on average, graduates of 2020 have amassed £45,000 in debt.

Zeno, a 25-year-old student in London who gave only his first name, said he owes just short of £75,000 for his loans.

Unless he "wins the lottery", he accepts he will probably be paying the money back from his salary for the next 30 years.

- Tuition fees -

University used to be free in the UK, with means-tested grants for the poorest students to cover living costs.

But after the sector was opened up in the 1990s, numbers surged and, despite protests from student bodies, tuition fees have been gradually introduced in the last decade to help universities meet costs.

With education a devolved matter for the governments in Scotland, Wales and Northern Ireland, different tuition fee arrangements are in place across the UK.

Accommodation and living costs are extra.

In England, undergraduate tuition fees are capped at £9,250 a year for UK and Irish students -- up from £3,375 in 2011 when the government cut most ongoing direct public funding.

The cap in Wales is £9,000 and £4,030 in Northern Ireland.

Scottish students studying in Scotland pay £1,820 but those from the rest of the UK attending universities north of the border with England pay £9,250.

- Inflation worry -

The picture is further complicated by rocketing inflation because the student loan interest rate is linked to the retail price index (RPI).

Loan interest is calculated by adding up to 3.0 percentage points to the RPI rate.

Inflation however soared to 30-year highs this year, particularly on rocketing energy costs and fallout from the Ukraine conflict.

Graduates could therefore pay an interest rate of 12 percent from September -- or more if prices rise even higher.

The UK government plays a large part in student financing, providing loans that only demand repayment when a graduate earns above a threshold of £27,295 per year.

What borrowers repay depends on how much they earn. Unlike private lenders, they have up to 30 years to repay. The debt is cancelled after this time.

"This system is more progressive than in the United States, with generous write-offs for lower-paid graduates," said Nick Hillman, director of the Higher Education Policy Institute in Oxford.

Current and recent students faced huge upheaval during courses due to coronavirus restrictions, with the pandemic also hitting job opportunities.

A combination of high debt repayments, high cost of living and wages that have failed to keep pace with inflation, add yet more stress.

- Conundrum -

Student finance poses a major conundrum for the public purse because the UK forecasts outstanding loans will top £560 billion by 2050.

From next year, Britain will lower the repayment threshold for new borrowers to £25,000 and lengthen the repayment time from 30 to 40 years.

This will however increase costs for low-earners, while benefiting richer graduates who can pay back more quickly.

The UK government forecasts however that half of new students will repay their loans in full under the new plan.

Student debt has long been a concern in the United States, where the Federal Reserve estimates that it amounts to a staggering $1.76 trillion.

US students on average have outstanding debt of close to $41,000, according to think-tank Education Data Initiative.

President Joe Biden this year extended a moratorium on student loan repayment and interest -- and is holding talks over partial debt write-offs.

D.Khalil--SF-PST