-

'Amazing' feeling for Rees-Zammit on Wales return after NFL adventure

'Amazing' feeling for Rees-Zammit on Wales return after NFL adventure

-

'Cruel' police raids help, not hinder, Rio's criminal gangs: expert

-

S. African president eyes better US tariff deal 'soon'

S. African president eyes better US tariff deal 'soon'

-

Sinner cruises in Paris Masters opener, Zverev keeps title defence alive

-

Winter Olympics - 100 days to go to 'unforgettable Games'

Winter Olympics - 100 days to go to 'unforgettable Games'

-

Kiwi Plumtree to step down as Sharks head coach

-

France to charge Louvre heist suspects with theft and conspiracy

France to charge Louvre heist suspects with theft and conspiracy

-

US media mogul John Malone to step down as head of business empire

-

'Never been this bad': Jamaica surveys ruins in hurricane's wake

'Never been this bad': Jamaica surveys ruins in hurricane's wake

-

France adopts consent-based rape law

-

Zverev survives scare to kickstart Paris Masters title defence

Zverev survives scare to kickstart Paris Masters title defence

-

Rabat to host 2026 African World Cup play-offs

-

Wolvaardt-inspired South Africa crush England to reach Women's World Cup final

Wolvaardt-inspired South Africa crush England to reach Women's World Cup final

-

US says not withdrawing from Europe after troops cut

-

WHO urges Sudan ceasefire after alleged massacres in El-Fasher

WHO urges Sudan ceasefire after alleged massacres in El-Fasher

-

Under-fire UK govt deports migrant sex offender with £500

-

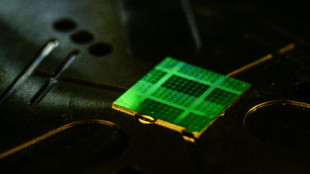

AI chip giant Nvidia becomes world's first $5 trillion company

AI chip giant Nvidia becomes world's first $5 trillion company

-

Arsenal depth fuels Saka's belief in Premier League title charge

-

Startup Character.AI to ban direct chat for minors after teen suicide

Startup Character.AI to ban direct chat for minors after teen suicide

-

132 killed in massive Rio police crackdown on gang: public defender

-

Pedri joins growing Barcelona sickbay

Pedri joins growing Barcelona sickbay

-

Zambia and former Chelsea manager Grant part ways

-

Russia sends teen who performed anti-war songs back to jail

Russia sends teen who performed anti-war songs back to jail

-

Caribbean reels from hurricane as homes, streets destroyed

-

Boeing reports $5.4-bn loss on large hit from 777X aircraft delays

Boeing reports $5.4-bn loss on large hit from 777X aircraft delays

-

Real Madrid's Vinicius says sorry for Clasico substitution huff

-

Dutch vote in snap election seen as test for Europe's far-right

Dutch vote in snap election seen as test for Europe's far-right

-

Jihadist fuel blockade makes daily life a struggle for Bamako residents

-

De Bruyne goes under the knife for hamstring injury

De Bruyne goes under the knife for hamstring injury

-

Wolvaardt's 169 fires South Africa to 319-7 in World Cup semis

-

EU seeks 'urgent solutions' with China over chipmaker Nexperia

EU seeks 'urgent solutions' with China over chipmaker Nexperia

-

Paris prosecutor promises update in Louvre heist probe

-

Funds for climate adaptation 'lifeline' far off track: UN

Funds for climate adaptation 'lifeline' far off track: UN

-

Record Vietnam rains kill seven and flood 100,000 homes

-

Markets extend record run as trade dominates

Markets extend record run as trade dominates

-

Sudan govt accuses RSF of attacking mosques in El-Fasher takeover

-

Rain washes out 1st Australia-India T20 match

Rain washes out 1st Australia-India T20 match

-

Spain's Santander bank posts record profit

-

FIA taken to court to block Ben Sulayem's uncontested candidacy

FIA taken to court to block Ben Sulayem's uncontested candidacy

-

Chemicals firm BASF urges EU to cut red tape as profit dips

-

Romania says US will cut some troops in Europe

Romania says US will cut some troops in Europe

-

Israel hits dozens of targets as Gaza sees deadliest night since truce

-

Mercedes-Benz reassures on Nexperia chips as profit plunges

Mercedes-Benz reassures on Nexperia chips as profit plunges

-

France tries Bulgarians over defacing memorial in Russia-linked case

-

BBC says journalist questioned and blocked from leaving Vietnam

BBC says journalist questioned and blocked from leaving Vietnam

-

UK drugmaker GSK lifts 2025 guidance despite US tariffs

-

Mercedes-Benz profit plunges on China slump and US tariffs

Mercedes-Benz profit plunges on China slump and US tariffs

-

South Korea gifts Trump replica of ancient golden crown

-

Record Vietnam rains kill four and flood 100,000 homes

Record Vietnam rains kill four and flood 100,000 homes

-

Norway's energy giant Equinor falls into loss

| CMSD | -0.28% | 24.57 | $ | |

| JRI | -1.59% | 13.83 | $ | |

| BCC | -2.74% | 70.44 | $ | |

| CMSC | 0.28% | 24.327 | $ | |

| RIO | 0.83% | 72.59 | $ | |

| SCS | -3.96% | 16.045 | $ | |

| NGG | -1.28% | 75.68 | $ | |

| RYCEF | -0.65% | 15.36 | $ | |

| RBGPF | -0.11% | 79 | $ | |

| BTI | -1.44% | 51.715 | $ | |

| AZN | -0.79% | 81.96 | $ | |

| BP | 2.27% | 35.26 | $ | |

| GSK | 4.9% | 45.95 | $ | |

| BCE | -0.62% | 23.425 | $ | |

| RELX | -3.31% | 44.75 | $ | |

| VOD | -2.86% | 11.895 | $ |

Stocks rally as traders cheer Trump-Xi meeting plan

Most stock markets rallied Friday after the White House confirmed President Donald Trump would meet China's Xi Jinping next week, stoking optimism for a cooling of trade tensions between the economic superpowers.

The gains came as the surge in oil prices sputtered, having seen huge rises over the previous two days on news that Washington had imposed sanctions on two Russian crude giants in a bid to bring an end to the Ukraine war.

Equities have endured a volatile period after the US president sparked fresh trade war fears two weeks ago by threatening to hit Beijing with 100 percent tariffs over its recent controls on rare-earth minerals, sparking tit-for-tat measures.

However, the row has calmed down since then, soothing nerves, and on Thursday White House Press Secretary Karoline Leavitt announced Trump would meet his Chinese counterpart on October 30, on the sidelines of the APEC summit in South Korea.

"I think we're going to come out very well and everyone's going to be very happy," Trump said later Thursday regarding his sit-down with Xi.

The face-to-face will be the first since Trump returned to power in January.

China's commerce minister Wang Wentao provided an extra sense of optimism Friday by telling reporters that the two sides "can find ways to resolve each other's concerns".

That came as a new round of trade talks between high-level officials from both countries got underway in Malaysia.

Equity traders gave big cheer to the news, with all three main indexes on Wall Street finishing well up and pushing back towards records.

And Asia was happy to pick up the baton.

Tokyo climbed more than one percent, while Hong Kong, Shanghai, Seoul, Singapore, Bangkok and Indonesia were also in positive territory, though Sydney, Manila and Mumbai fell.

London, Paris and Frankfurt opened with gains.

Tech firms were again among the best performers, helped by a strong revenue forecast from US giant Intel Corp.

Oil prices edged down slightly after soaring around eight percent this week following Trump's decision to hit Russia's two largest oil companies, Rosneft and Lukoil, saying his peace talks with President Vladimir Putin were not going "anywhere".

The move was joined by another round of measures by the European Union as leaders try to pressure Moscow to end its three-and-a-half-year invasion of Ukraine.

According to industry analysts, the two companies account for just over half of Russia's oil output, and both also produce natural gas.

While observers said the move could tip the crude market into a deficit next year, they warned the impact depended on the effectiveness of enforcement.

"Seeing is believing here," said National Australia Bank's Ray Attrill.

"While the news has seen Brent crude rise from $63 to $66 a barrel (and from $61 at the start of the week), the reality is likely to be that Russian oil will before too long continue to be exported in similar quantities as now, via ever-circuitous routes and elaborate disguises."

Investors are now keenly awaiting the release later in the day of US consumer price data, which has been delayed by the government shutdown in Washington.

But while the reading will be closely watched for its implications for Federal Reserve policy, markets widely expect the central bank to cut interest rates again when it meets next week.

- Key figures at around 0715 GMT -

Tokyo - Nikkei 225: UP 1.4 percent at 49,299.65 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 25,150.80

Shanghai - Composite: UP 0.7 percent at 3,950.31 (close)

London - FTSE 100: UP 0.1 percent at 9,590.25

West Texas Intermediate: DOWN 0.7 percent at $61.39 per barrel

Brent North Sea Crude: DOWN 0.7 percent at $65.54 per barrel

Euro/dollar: DOWN at $1.1612 from $1.1615 on Thursday

Pound/dollar: DOWN at $1.3329 from $1.3323

Dollar/yen: UP at 152.94 from 152.60 yen

Euro/pound: DOWN at 87.12 pence from 87.18 pence

New York - Dow: UP 0.3 percent at 46,734.61 (close)

G.AbuGhazaleh--SF-PST