-

Jones places faith in Japan youth movement to sink Wales

Jones places faith in Japan youth movement to sink Wales

-

All Black wing Ioane warns 'dangerous' France are no B-team

-

'Significant declines' in some species after deep-sea mining: research

'Significant declines' in some species after deep-sea mining: research

-

Indonesia free meal plan stunted by delays, protests, poisonings

-

Russell heads into home British GP haunted by Verstappen rumours

Russell heads into home British GP haunted by Verstappen rumours

-

Djokovic wary of Evans threat, Krejcikova worships at 'temple of tennis'

-

Drought-hit Morocco turns to desalination to save vegetable bounty

Drought-hit Morocco turns to desalination to save vegetable bounty

-

Steve Smith back for second West Indies Test after dislocated finger

-

Asian stocks mixed as traders shrug at US-Vietnam trade deal

Asian stocks mixed as traders shrug at US-Vietnam trade deal

-

Holland completes All Blacks 'great story' to debut against France

-

China, EU should not 'seek confrontation': FM Wang

China, EU should not 'seek confrontation': FM Wang

-

'Big Comrade': Former defence chief takes reins as Thai PM

-

4 dead, 38 missing after ferry sinks on way to Indonesia's Bali

4 dead, 38 missing after ferry sinks on way to Indonesia's Bali

-

Thailand set for another acting PM after cabinet reshuffle

-

In US capital, Trump tariffs bite into restaurant profits

In US capital, Trump tariffs bite into restaurant profits

-

Sean Combs: music pioneer, entrepreneur -- and convicted felon

-

In California, fear of racial profiling grips Latino communities

In California, fear of racial profiling grips Latino communities

-

Home-grown players delight Wimbledon fans on hunt for 'new Andy Murray'

-

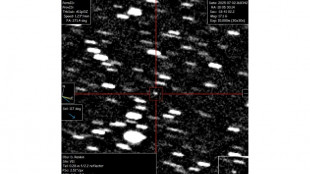

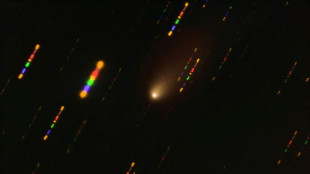

Third-ever confirmed interstellar object blazing through Solar System

Third-ever confirmed interstellar object blazing through Solar System

-

Joao Pedro arrival boosts Chelsea ahead of Palmeiras Club World Cup test

-

Lions start to roar in ominous Wallabies warning

Lions start to roar in ominous Wallabies warning

-

Kellaway, Tupou headline Waratahs team to face Lions

-

Four All Blacks debutants to face France in first Test

Four All Blacks debutants to face France in first Test

-

Ukraine scrambling for clarity as US downplays halt to arms shipments

-

Peru clinic that leaked Shakira medical record given hefty fine

Peru clinic that leaked Shakira medical record given hefty fine

-

UK's Starmer backs finance minister after tears in parliament

-

Trump tax bill stalled by Republican rebellion in Congress

Trump tax bill stalled by Republican rebellion in Congress

-

US stocks back at records as oil prices rally

-

Norway battle back to beat Swiss hosts in Euro 2025 opener

Norway battle back to beat Swiss hosts in Euro 2025 opener

-

Netanyahu vows to uproot Hamas as ceasefire proposals are discussed

-

Tarvet won't turn pro yet, despite pushing Alcaraz at Wimbledon

Tarvet won't turn pro yet, despite pushing Alcaraz at Wimbledon

-

Ukraine left scrambling after US says halting some arms shipments

-

India captain Gill's hundred repels England in second Test

India captain Gill's hundred repels England in second Test

-

Possible interstellar object spotted zooming through Solar System

-

Alcaraz ends Tarvet's Wimbledon adventure, Paolini crashes out

Alcaraz ends Tarvet's Wimbledon adventure, Paolini crashes out

-

Why is there no life on Mars? Rover finds a clue

-

Former finalist Paolini stunned as Wimbledon seeds continue to fall

Former finalist Paolini stunned as Wimbledon seeds continue to fall

-

Tesla reports lower car sales, extending slump

-

Finland open Women's Euro 2025 with win over Iceland

Finland open Women's Euro 2025 with win over Iceland

-

India captain Gill hits another hundred against England in 2nd Test

-

Hamas mulls truce proposals after Trump Gaza ceasefire push

Hamas mulls truce proposals after Trump Gaza ceasefire push

-

Alcaraz ends Tarvet's Wimbledon adventure, Sabalenka advances

-

Tears, prayers, exultation: Diddy radiates relief after partial acquittal

Tears, prayers, exultation: Diddy radiates relief after partial acquittal

-

Ruthless Alcaraz ends Tarvet's Wimbledon fairytale

-

Bangladesh collapse in ODI series opener to hand Sri Lanka big win

Bangladesh collapse in ODI series opener to hand Sri Lanka big win

-

Trump says Vietnam to face 20% tariff under 'great' deal

-

US senator urges bribery probe over Trump-Paramount settlement

US senator urges bribery probe over Trump-Paramount settlement

-

Nazi-sympathising singer's huge gig to paralyse Zagreb

-

Germany swelters as European heatwave moves eastwards

Germany swelters as European heatwave moves eastwards

-

Sabalenka tells troubled Zverev to talk to family about mental health issues

Tesla reports lower car sales but figures better than feared

Tesla reported another hefty drop in auto sales Wednesday, extending a difficult period amid intensifying electric vehicle competition and backlash over CEO Elon Musk's political activities.

The EV maker reported 384,122 deliveries in the second quarter, down 13.5 percent from the year-ago period. Shares rallied after the disclosure, which was better than some leading forecasts in recent days.

The sales figures released Wednesday, which are global, reflect the more contested nature of the EV market, which Tesla once dominated, but which now also features BYD and other low-cost Chinese companies, as well as legacy western automakers like General Motors, Toyota and Volkswagen.

But Musk's political activism on behalf of right-wing figures has also made the company a target of boycotts and demonstrations, weighing on sales. In recent days, Musk has revived a feud with US President Donald Trump, dragging Tesla shares lower on Tuesday.

The figures portend another poor round of earnings when Tesla reports results on July 23. Analysts currently project a drop of 16 percent to $1.2 billion in profits, according to S&P Capital IQ.

Tesla has faced questions about its dearth of new retail auto products to wow consumers after Musk's futuristic Cybertruck proved polarizing.

Analysts will be looking for an update on the state of new offerings after Tesla said in April that it planned "more affordable models" in the first half of 2025. The company has begun deliveries of its revamped Model Y in some markets, according to news reports.

Tesla launched a long-discussed robotaxi venture in Austin, Texas, lending momentum to Musk's branding of the company as at the forefront of autonomous and artificial intelligence technology.

But reports that the self-driving cars have driven recklessly have prompted oversight from US regulators.

Heading into Wednesday's sales figure release, notes from JPMorgan Chase and Deutsche Bank had forecast bigger drops in second-quarter deliveries, citing poor figures in Europe especially.

The JPMorgan note was especially bearish, setting a December share price target of $115, down more than 60 percent from today's levels and citing an expected drag from the elimination of US tax credits for EVs under Trump's legislation moving through Congress.

But Wedbush's Dan Ives said Wednesday's "better-than-feared" report set the stage for growth.

"If Musk continues to lead and remain in the driver's seat, we believe Tesla is on a path to an accelerated growth path over the coming years with deliveries expected to ramp in the back-half of 2025 following the Model Y refresh cycle," Ives said.

- Political wildcard -

A wildcard remains how Musk's shifting relationship with Trump could affect Tesla.

Musk donated more than $270 million to Trump's 2024 campaign, barnstorming key battleground states for the Republican.

After the election, he oversaw the launch of the "Department of Government Efficiency," a controversial initiative that eliminated thousands of government jobs that DOGE said were part of a pattern of waste, fraud and abuse.

But Musk has broken with Trump over the White House's flagship tax and spending bill, which Musk rated as wasteful and misguided.

Musk has called the bill "utterly insane and destructive" and accused bill supporters of backing "debt slavery."

In response, Trump has threatened to target Musk's business empire and warned of deporting the South African-born Musk. Tesla shares fell more than five percent on Tuesday following this back and forth.

"This high-profile feud introduces political risk," Briefing.com said in a note Tuesday.

"The personal nature of the conflict, amplified by Trump's comments implying Tesla's reliance on subsidies for survival, has sparked fears of broader policy shifts targeting Musk's business empire. This political uncertainty undermines investor confidence."

Tesla shares rose 2.8 percent early Wednesday.

F.AbuZaid--SF-PST