-

Knicks reach NBA Cup final with 132-120 win over Magic

Knicks reach NBA Cup final with 132-120 win over Magic

-

Campaigning starts in Central African Republic quadruple election

-

NBA Cavs center Mobley out 2-4 weeks with left calf strain

NBA Cavs center Mobley out 2-4 weeks with left calf strain

-

Tokyo-bound United flight returns to Dulles airport after engine fails

-

Hawks guard Young poised to resume practice after knee sprain

Hawks guard Young poised to resume practice after knee sprain

-

Salah back in Liverpool fold as Arsenal grab last-gasp win

-

Raphinha extends Barca's Liga lead, Atletico bounce back

Raphinha extends Barca's Liga lead, Atletico bounce back

-

Glasgow comeback upends Toulouse on Dupont's first start since injury

-

Two own goals save Arsenal blushes against Wolves

Two own goals save Arsenal blushes against Wolves

-

'Quality' teens Ndjantou, Mbaye star as PSG beat Metz to go top

-

Trump vows revenge after troops in Syria killed in alleged IS ambush

Trump vows revenge after troops in Syria killed in alleged IS ambush

-

Maresca bemoans 'worst 48 hours at Chelsea' after lack of support

-

Teenage pair Ndjantou, Mbaye star as PSG beat Metz to go top

Teenage pair Ndjantou, Mbaye star as PSG beat Metz to go top

-

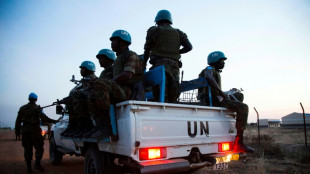

Drone strike in southern Sudan kills 6 UN peacekeepers

-

Crime wave propels hard-right candidate toward Chilean presidency

Crime wave propels hard-right candidate toward Chilean presidency

-

Terrific Terrier backheel helps lift Leverkusen back to fourth

-

'Magic' Jalibert guides Bordeaux-Begles past Scarlets

'Magic' Jalibert guides Bordeaux-Begles past Scarlets

-

Teenage pair Ndjantou and Mbaye star as PSG beat Metz to go top

-

Anglo-French star Jane Birkin gets name on bridge over Paris canal

Anglo-French star Jane Birkin gets name on bridge over Paris canal

-

US troops in Syria killed in alleged IS ambush

-

Jalibert masterclass guides Bordeaux-Begles past Scarlets

Jalibert masterclass guides Bordeaux-Begles past Scarlets

-

M23 marches on in east DR Congo as US vows action against Rwanda

-

Raphinha double stretches Barca's Liga lead in Osasuna win

Raphinha double stretches Barca's Liga lead in Osasuna win

-

Terrific Terrier returns Leverkusen to fourth

-

Colts activate 44-year-old Rivers for NFL game at Seattle

Colts activate 44-year-old Rivers for NFL game at Seattle

-

US troops in Syria killed in IS ambush attack

-

Liverpool's Slot says 'no issue to resolve' with Salah after outburst

Liverpool's Slot says 'no issue to resolve' with Salah after outburst

-

'Stop the slaughter': French farmers block roads over cow disease cull

-

Stormers see off La Rochelle, Sale stun Clermont in Champions Cup

Stormers see off La Rochelle, Sale stun Clermont in Champions Cup

-

Maresca hails Palmer as Chelsea return to winning ways against Everton

-

Hungarian protesters demand Orban quits over abuse cases

Hungarian protesters demand Orban quits over abuse cases

-

Belarus frees protest leader Kolesnikova, Nobel winner Bialiatski

-

Salah sets up goal on return to Liverpool action

Salah sets up goal on return to Liverpool action

-

Palmer strikes as Chelsea return to winning ways against Everton

-

Pogacar targets Tour de France Paris-Roubaix and Milan-San Remo in 2026

Pogacar targets Tour de France Paris-Roubaix and Milan-San Remo in 2026

-

Salah back in action for Liverpool after outburst

-

Atletico recover Liga momentum with battling win over Valencia

Atletico recover Liga momentum with battling win over Valencia

-

Meillard leads 'perfect' Swiss sweep in Val d'Isere giant slalom

-

Salah on Liverpool bench for Brighton match

Salah on Liverpool bench for Brighton match

-

Meillard leads Swiss sweep in Val d'Isere giant slalom

-

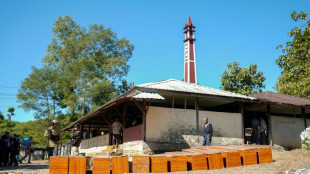

Indonesia flood death toll passes 1,000 as authorities ramp up aid

Indonesia flood death toll passes 1,000 as authorities ramp up aid

-

Cambodia shuts Thailand border crossings over deadly fighting

-

First urban cable car unveiled outside Paris

First urban cable car unveiled outside Paris

-

Vonn second behind Aicher in World Cup downhill at St Moritz

-

Aicher pips Vonn to downhill win at St Moritz

Aicher pips Vonn to downhill win at St Moritz

-

Thailand says 4 soldiers killed in Cambodia conflict, denies Trump truce claim

-

Fans vandalise India stadium after Messi's abrupt exit

Fans vandalise India stadium after Messi's abrupt exit

-

Women sommeliers are cracking male-dominated wine world open

-

Exhibition of Franco-Chinese print master Zao Wou-Ki opens in Hong Kong

Exhibition of Franco-Chinese print master Zao Wou-Ki opens in Hong Kong

-

Myanmar junta denies killing civilians in hospital strike

Oil prices dip, stocks mixed tracking Mideast unrest

Oil prices eased and stock markets diverged Wednesday as traders kept a close watch over the Israel-Iran conflict ahead of an interest-rate announcement from the US Federal Reserve.

Asia's main equity indices closed mixed and the picture was similar in European midday deals.

The dollar dropped against main rivals.

The Fed is widely expected to hold interest rates steady Wednesday, as officials gauge the impact of US tariffs on inflation -- and despite President Donald Trump's calls for rate cuts as the world's biggest economy faces pressure.

"Global market direction remains clouded by tariffs, complicated by the Middle Eastern conflict and confounded by the lack of any obvious positive catalysts," noted Richard Hunter, head of markets at Interactive Investor.

Oil prices pulled back very slightly, after surging Tuesday on fears of crude supplies tightening in the face of rising Middle East tensions.

Gas prices rose with concerns surrounding its supply.

Israel and Iran exchanged fire again Wednesday, the sixth day of strikes in their most intense confrontation in history, fuelling fears of a drawn-out conflict that could engulf the wider region.

There were signs also of possible US intervention after Trump called for Tehran's "unconditional surrender".

Of particular concern is the possibility of Iran shutting off the Strait of Hormuz, through which around one fifth of global oil supply is transported.

- Central banks -

Wall Street slid Tuesday as a below-forecast reading on US retail sales for May revived worries about the impact of tariffs on the economy.

That came as another report showed US factory output fell unexpectedly.

The data provided hope that the Fed would still cut interest rates this year.

The US central bank is due Wednesday to also release its rate and economic growth outlook for the rest of the year, which are expected to take account of Trump's tariff war.

"The Fed would no doubt be cutting again by now if not for the uncertainty regarding tariffs and a recent escalation of tensions in the Middle East," said KPMG senior economist Benjamin Shoesmith.

In a busy week for monetary policy, Sweden's central bank on Wednesday cut its key interest rate to try and boost the country's economy, as it cited risks linked to trade tensions and the escalating conflict in the Middle East.

The Bank of England is expected to keep its key rate steady Thursday, especially after official data Wednesday showed UK annual inflation fell less than expected in May.

The Bank of Japan on Tuesday kept interest rates unchanged and said it would taper its purchase of government bonds at a slower pace, as trade uncertainty threatens to weigh on the world's number four economy.

- Key figures at around 1040 GMT -

Brent North Sea Crude: DOWN 0.2 percent at $76.33 per barrel

West Texas Intermediate: DOWN 0.1 percent at $74.76 per barrel

London - FTSE 100: FLAT at 8,833.44 points

Paris - CAC 40: DOWN 0.2 percent at 7,668.79

Frankfurt - DAX: DOWN 0.4 percent at 23,344.78

Tokyo - Nikkei 225: UP 0.9 percent at 38,885.15 (close)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 23,710.69 (close)

Shanghai - Composite: FLAT at 3,388.81 (close)

New York - Dow: DOWN 0.7 percent at 42,215.80 (close)

Euro/dollar: UP at $1.1506 from $1.1488 on Tuesday

Pound/dollar: UP at $1.3454 from $1.3425

Dollar/yen: DOWN at 144.80 yen from 145.27 yen

Euro/pound: DOWN at 85.52 pence from 85.54 pence

burs-bcp/ajb/rl

Y.Zaher--SF-PST