-

Trump vows revenge after troops in Syria killed in alleged IS ambush

Trump vows revenge after troops in Syria killed in alleged IS ambush

-

Maresca bemoans 'worst 48 hours at Chelsea' after lack of support

-

Teenage pair Ndjantou, Mbaye star as PSG beat Metz to go top

Teenage pair Ndjantou, Mbaye star as PSG beat Metz to go top

-

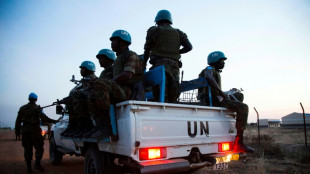

Drone strike in southern Sudan kills 6 UN peacekeepers

-

Crime wave propels hard-right candidate toward Chilean presidency

Crime wave propels hard-right candidate toward Chilean presidency

-

Terrific Terrier backheel helps lift Leverkusen back to fourth

-

'Magic' Jalibert guides Bordeaux-Begles past Scarlets

'Magic' Jalibert guides Bordeaux-Begles past Scarlets

-

Teenage pair Ndjantou and Mbaye star as PSG beat Metz to go top

-

Anglo-French star Jane Birkin gets name on bridge over Paris canal

Anglo-French star Jane Birkin gets name on bridge over Paris canal

-

US troops in Syria killed in alleged IS ambush

-

Jalibert masterclass guides Bordeaux-Begles past Scarlets

Jalibert masterclass guides Bordeaux-Begles past Scarlets

-

M23 marches on in east DR Congo as US vows action against Rwanda

-

Raphinha double stretches Barca's Liga lead in Osasuna win

Raphinha double stretches Barca's Liga lead in Osasuna win

-

Terrific Terrier returns Leverkusen to fourth

-

Colts activate 44-year-old Rivers for NFL game at Seattle

Colts activate 44-year-old Rivers for NFL game at Seattle

-

US troops in Syria killed in IS ambush attack

-

Liverpool's Slot says 'no issue to resolve' with Salah after outburst

Liverpool's Slot says 'no issue to resolve' with Salah after outburst

-

'Stop the slaughter': French farmers block roads over cow disease cull

-

Stormers see off La Rochelle, Sale stun Clermont in Champions Cup

Stormers see off La Rochelle, Sale stun Clermont in Champions Cup

-

Maresca hails Palmer as Chelsea return to winning ways against Everton

-

Hungarian protesters demand Orban quits over abuse cases

Hungarian protesters demand Orban quits over abuse cases

-

Belarus frees protest leader Kolesnikova, Nobel winner Bialiatski

-

Salah sets up goal on return to Liverpool action

Salah sets up goal on return to Liverpool action

-

Palmer strikes as Chelsea return to winning ways against Everton

-

Pogacar targets Tour de France Paris-Roubaix and Milan-San Remo in 2026

Pogacar targets Tour de France Paris-Roubaix and Milan-San Remo in 2026

-

Salah back in action for Liverpool after outburst

-

Atletico recover Liga momentum with battling win over Valencia

Atletico recover Liga momentum with battling win over Valencia

-

Meillard leads 'perfect' Swiss sweep in Val d'Isere giant slalom

-

Salah on Liverpool bench for Brighton match

Salah on Liverpool bench for Brighton match

-

Meillard leads Swiss sweep in Val d'Isere giant slalom

-

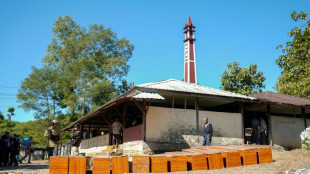

Indonesia flood death toll passes 1,000 as authorities ramp up aid

Indonesia flood death toll passes 1,000 as authorities ramp up aid

-

Cambodia shuts Thailand border crossings over deadly fighting

-

First urban cable car unveiled outside Paris

First urban cable car unveiled outside Paris

-

Vonn second behind Aicher in World Cup downhill at St Moritz

-

Aicher pips Vonn to downhill win at St Moritz

Aicher pips Vonn to downhill win at St Moritz

-

Thailand says 4 soldiers killed in Cambodia conflict, denies Trump truce claim

-

Fans vandalise India stadium after Messi's abrupt exit

Fans vandalise India stadium after Messi's abrupt exit

-

Women sommeliers are cracking male-dominated wine world open

-

Exhibition of Franco-Chinese print master Zao Wou-Ki opens in Hong Kong

Exhibition of Franco-Chinese print master Zao Wou-Ki opens in Hong Kong

-

Myanmar junta denies killing civilians in hospital strike

-

Why SpaceX IPO plan is generating so much buzz

Why SpaceX IPO plan is generating so much buzz

-

Thailand continues Cambodia strikes despite Trump truce calls

-

US envoy to meet Zelensky, Europe leaders in Berlin this weekend

US envoy to meet Zelensky, Europe leaders in Berlin this weekend

-

North Korea acknowledges its troops cleared mines for Russia

-

US unseals warrant for tanker seized off Venezuelan coast

US unseals warrant for tanker seized off Venezuelan coast

-

Cambodia says Thailand still bombing hours after Trump truce call

-

Machado urges pressure so Maduro understands 'he has to go'

Machado urges pressure so Maduro understands 'he has to go'

-

Leinster stutter before beating Leicester in Champions Cup

-

World stocks mostly slide, consolidating Fed-fuelled gains

World stocks mostly slide, consolidating Fed-fuelled gains

-

Crypto firm Tether bids for Juventus, is quickly rebuffed

Oil prices fall, stocks rise as Iran-Israel war fears ease

Stocks rose and oil prices retreated Monday as fears of a wider Middle East conflict eased even as Israel and Iran pounded each other with missiles for a fourth day.

The dollar and safe-haven gold declined slightly.

"As things stand, investors seem less fearful than they were going into the weekend of the possibility that the war between Israel and Iran spreads across the Middle East, and beyond," said David Morrison, senior market analyst at financial services provider Trade Nation.

"It appears that most of the Israeli airstrikes and missile launches avoided the most significant parts of Iran’s energy infrastructure. And so far Iran's retaliation has done relatively little damage," he added.

Wall Street opened in the green, with the tech-heavy Nasdaq up around one percent in early deals, while London, Paris and Frankfurt were all higher in afternoon trading.

That tracked gains in Asia, where Tokyo closed up 1.3 percent, boosted by a weaker yen, while Hong Kong and Shanghai also advanced.

Israel's surprise strike against Iranian military and nuclear sites on Friday -- killing top commanders and scientists -- sent crude prices soaring as much as 13 percent at one point on fears about supplies from the region.

However, concerns over the conflict spreading appeared to have eased, with both main oil contracts retreating by more than one percent on Monday.

Analysts said the recent decision by the OPEC+ group of crude producing nations, led by Saudi Arabia and Russia, to raise output again in July also played a role.

"Financial markets are very good at absorbing geopolitical risk, and OPEC+'s supply boost is also helping to cushion the blow," said Kathleen Brooks, research director at trading group XTB.

"There may need to be a major escalation in the conflict before we get another sharp upswing in oil and gold prices," she added.

Analysts had warned that the spike could send inflation surging globally again, dealing a blow to long-running efforts by governments and central banks to get it under control.

Investors were gearing up for monetary policy decisions this week from the US Federal Reserve, Bank of England and Bank of Japan.

All are expected to stand pat but traders will be keeping a close watch on their statements for clues on interest-rate outlooks, with US officials under pressure from President Donald Trump to cut borrowing costs.

There was little major reaction to data showing China's factory output grew slower than expected last month as trade war pressures bit, while retail sales topped forecasts.

Also in focus is the G7 summit in the Canadian Rockies, which kicked off Sunday, where the Middle East crisis will be discussed along with trade after Trump's tariff blitz.

In corporate news, shares in Nippon Steel rose more than three percent in Tokyo after Trump on Friday signed an executive order approving its $14.9 billion merger with US Steel, bringing an end to the long-running saga.

Shares in Gucci owner Kering climbed over 11 percent in Paris on reports that the outgoing boss of French automaker Renault would take over as chief executive of the struggling luxury group.

Renault shares shed almost eight percent percent, following its announcement on Sunday that Luca de Meo would step down in July.

- Key figures at around 1340 GMT -

West Texas Intermediate: DOWN 1.4 percent at $71.96 per barrel

Brent North Sea Crude: DOWN 1.3 percent at $73.29 per barrel

New York - Dow: UP 0.6 percent at 42,458.20 points

New York - S&P 500: UP 0.8 percent at 6,022.67

New York - Nasdaq: UP 1.0 percent at 19,593.77

London - FTSE 100: UP 0.3 percent at 8,876.07

Paris - CAC 40: UP 0.6 percent at 7,728.56

Frankfurt - DAX: UP 0.2 percent at 23,565.34

Tokyo - Nikkei 225: UP 1.3 percent at 38,311.33 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 24,060.99 (close)

Shanghai - Composite: UP 0.4 percent at 3,388.73 (close)

Euro/dollar: UP at $1.1595 from $1.1540 on Friday

Pound/dollar: UP at $1.3601 from $1.3560

Dollar/yen: DOWN at 143.88 yen from 144.04 yen

Euro/pound: UP at 85.22 pence from 85.11 pence

Z.AlNajjar--SF-PST