-

Partey signs for Villarreal while on bail for rape charges

Partey signs for Villarreal while on bail for rape charges

-

Wales have the talent to rise again, says rugby head coach Tandy

-

US partners seek relief as Trump tariffs upend global trade

US partners seek relief as Trump tariffs upend global trade

-

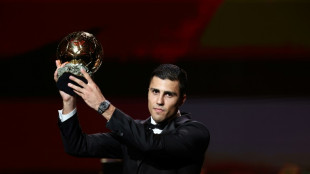

Five England players nominated for women's Ballon d'Or

-

PSG dominate list of men's Ballon D'Or nominees

PSG dominate list of men's Ballon D'Or nominees

-

Americans eating (slightly) less ultra-processed food

-

Man Utd agree 85m euro deal to sign Sesko: reports

Man Utd agree 85m euro deal to sign Sesko: reports

-

France to rule on controversial bee-killing pesticide bill

-

Germany factory output falls to lowest since pandemic in 2020

Germany factory output falls to lowest since pandemic in 2020

-

Swiss to seek more talks with US as 'horror' tariffs kick in

-

Barcelona strip Ter Stegen of captain's armband

Barcelona strip Ter Stegen of captain's armband

-

Trump demands new US census as redistricting war spreads

-

'How much worse could it get?' Gazans fear full occupation

'How much worse could it get?' Gazans fear full occupation

-

France seeks to 'stabilise' wildfire raging in south

-

Ski world champion Venier quits, saying hunger has gone

Ski world champion Venier quits, saying hunger has gone

-

Israel security cabinet to discuss Gaza war plans

-

Deadly Indian Himalayan flood likely caused by glacier collapse, experts say

Deadly Indian Himalayan flood likely caused by glacier collapse, experts say

-

UK pensioner, student arrested for backing Palestine Action

-

Israeli security cabinet to discuss future Gaza war plans

Israeli security cabinet to discuss future Gaza war plans

-

Antonio to leave West Ham after car crash

-

Kremlin says Trump-Putin meeting agreed for 'coming days'

Kremlin says Trump-Putin meeting agreed for 'coming days'

-

Bank of England cuts rate as keeps watch over tariffs

-

Maddison set to miss most of Spurs season after knee injury

Maddison set to miss most of Spurs season after knee injury

-

Plastic pollution treaty talks stuck in 'dialogue of the deaf'

-

Stock markets brush aside higher US tariffs

Stock markets brush aside higher US tariffs

-

Siemens warns US tariffs causing investment caution

-

Influx of Afghan returnees fuels Kabul housing crisis

Influx of Afghan returnees fuels Kabul housing crisis

-

Israeli security cabinet to hold talks over future Gaza war plans

-

Macron urges tougher line in standoff with Algeria

Macron urges tougher line in standoff with Algeria

-

UK says first migrants held under return deal with France

-

Ukraine's funeral workers bearing the burden of war

Ukraine's funeral workers bearing the burden of war

-

India exporters say 50% Trump levy a 'severe setback'

-

Germany factory output lowest since pandemic in 2020

Germany factory output lowest since pandemic in 2020

-

Thailand and Cambodia agree to extend peace pact

-

Third-hottest July on record wreaks climate havoc

Third-hottest July on record wreaks climate havoc

-

Trump-Putin meeting agreed for 'coming days', venue set: Kremlin

-

Frankfurt sign Japan winger Doan until 2030

Frankfurt sign Japan winger Doan until 2030

-

Swiss reel from 'horror scenario' after US tariff blow

-

Apple to hike investment in US to $600 bn over four years

Apple to hike investment in US to $600 bn over four years

-

Asian markets rise as traders look past Trump chip threat

-

Higher US tariffs kick in for dozens of trading partners

Higher US tariffs kick in for dozens of trading partners

-

Deliveroo slips back into loss on DoorDash takeover costs

-

'Dog ate my passport': All Black rookie in Argentina trip pickle

'Dog ate my passport': All Black rookie in Argentina trip pickle

-

US tariffs prompt Toyota profit warning

-

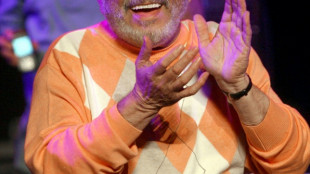

Eddie Palmieri, Latin music trailblazer, dies at 88

Eddie Palmieri, Latin music trailblazer, dies at 88

-

Japan's World Cosplay Summit to escape summer heat in 2027

-

China exports top forecasts as EU, ASEAN shipments offset US drop

China exports top forecasts as EU, ASEAN shipments offset US drop

-

Cockatoos can bust a move: Australian research

-

Arrest warrant sought for South Korea's ex-first lady Kim

Arrest warrant sought for South Korea's ex-first lady Kim

-

Khachanov topples Zverev to book ATP Toronto title clash with Shelton

| SCU | 0% | 12.72 | $ | |

| CMSC | -0.04% | 22.94 | $ | |

| RELX | 1.02% | 49.315 | $ | |

| NGG | -0.26% | 72.115 | $ | |

| RBGPF | 1.42% | 76 | $ | |

| CMSD | -0.21% | 23.49 | $ | |

| VOD | -0.76% | 11.215 | $ | |

| GSK | 2.39% | 37.65 | $ | |

| SCS | 0.78% | 16.115 | $ | |

| RYCEF | 0.14% | 14.5 | $ | |

| BCC | 0.53% | 83.359 | $ | |

| BTI | 0.16% | 56.49 | $ | |

| AZN | 0.77% | 74.17 | $ | |

| JRI | 0.37% | 13.39 | $ | |

| BP | 0.75% | 34.135 | $ | |

| BCE | 1.42% | 23.585 | $ | |

| RIO | 1.09% | 60.75 | $ |

European stocks sink as Trump puts EU in tariff crosshairs

European stock markets tumbled Friday after US President Donald Trump ended a lull in his trade war as he raised the spectre of hitting imports from the European Union with a massive 50-percent tariff.

The Paris CAC 40 index and Frankfurt DAX fell by around three percent at one point, with shares in luxury and car companies taking a hit, before paring back some losses.

London's FTSE 100, which had been up earlier, fell into the red. The DAX was also higher earlier in the day as German economic growth data was revised up.

US stock futures -- contracts that indicate how markets will open -- were also in negative territory.

Trump's new threats revived investor concerns about his trade policies after a recent deal with Britain and a tariffs truce with China.

"All the optimism over trade deals wiped out in minutes –- seconds, even," said Fawad Razaqzada, market analyst at StoneX.

Trump said on his Truth Social platform that he was "recommending a straight 50% Tariff on the European Union" from June 1 as "discussions with them are going nowhere!"

The US president had announced 20 percent tariffs on EU goods last month but suspended the measure to give space for negotiations.

Trump, however, maintained a 10 percent levy on imports from the 27-nation bloc and nearly every other nation around the world, along with 25 percent duties on the car, steel and aluminium industries.

He also threatened on Friday to hit Apple with a 25 percent tariff if its iPhones are not manufactured in the United States.

His social media outburst rocked stock markets which had steadied following losses over concerns about the ballooning US debt and rising US borrowing costs.

Investors were already on edge after Moody's stripped the United States of its top-tier credit rating and the House of Representative approved Trump's tax cut plan, which critics say would add to the country's debt pile.

The yield -- or borrowing costs -- on 10-year and 30-year US government bonds surged this week as investors worry about the fiscal health of the world's biggest economy.

The yields eased late Thursday.

Trump's tax package, which now goes to the Senate, had faced scepticism from fiscal hawks who fear the country is headed for bankruptcy.

Independent analysts warn it would increase the deficit by as much as $4 trillion over a decade.

But the White House insists it will spur growth of up to 5.2 percent, ensuring it adds nothing to the $36 trillion national debt -- growth projections that are well outside the mainstream consensus.

Oil prices also reversed course to fall by around one percent following Trump's new tariff threats.

- Key figures at around 1235 GMT -

London - FTSE 100: DOWN 0.9 percent at 8,658.03 points

Paris - CAC 40: DOWN 2.3 percent at 7,684.35

Frankfurt - DAX: DOWN 2.1 percent at 23,501.11

Tokyo - Nikkei 225: UP 0.5 percent at 37,160.47 (close)

Hong Kong - Hang Seng Index: UP 0.2 percent at 23,601.26 (close)

Shanghai - Composite: DOWN 0.9 percent at 3,348.37 (close)

New York - Dow: FLAT at 41,859.09 (close)

Euro/dollar: UP at $1.1337 from $1.1281 on Thursday

Pound/dollar: UP at $1.3506 from $1.3419

Dollar/yen: DOWN at 142.53 yen from 143.99 yen

Euro/pound: DOWN at 83.94 pence from 84.07 pence

Brent North Sea Crude: DOWN 1.0 percent at $63.81 per barrel

West Texas Intermediate: DOWN 1.1 percent at $60.55 per barrel

Z.AbuSaud--SF-PST