-

Solid gold, royal missives and Nobel noms: how to win Trump over

Solid gold, royal missives and Nobel noms: how to win Trump over

-

Canadian teen Mboko outlasts Osaka to win WTA Montreal crown

-

Trump to host Armenia, Azerbaijan for historic 'Peace Signing'

Trump to host Armenia, Azerbaijan for historic 'Peace Signing'

-

Israeli airline's Paris offices daubed with red paint, slogans

-

US raises bounty on Venezuela's Maduro to $50 mn

US raises bounty on Venezuela's Maduro to $50 mn

-

Lebanon cabinet meets again on Hezbollah disarmament

-

France's huge wildfire will burn for days: authorities

France's huge wildfire will burn for days: authorities

-

Bolivia right-wing presidential hopeful vows 'radical change'

-

Trump says would meet Putin without Zelensky sit-down

Trump says would meet Putin without Zelensky sit-down

-

Trump offers data to justify firing of labor stats chief

-

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

-

Disney settles Trump-supporting 'Star Wars' actor lawsuit

-

Trump moves to kill $7 billion in solar panel grants

Trump moves to kill $7 billion in solar panel grants

-

Venus Williams falls at first hurdle in Cincinnati

-

Mixed day for global stocks as latest Trump levies take effect

Mixed day for global stocks as latest Trump levies take effect

-

SpaceX agrees to take Italian experiments to Mars

-

US judge orders temporary halt to new 'Alligator Alcatraz' construction

US judge orders temporary halt to new 'Alligator Alcatraz' construction

-

US uses war rhetoric, Superman to recruit for migrant crackdown

-

US to rewrite its past national climate reports

US to rewrite its past national climate reports

-

U can't pay this: MC Hammer sued over delinquent car loan

-

WHO says nearly 100,000 struck with cholera in Sudan

WHO says nearly 100,000 struck with cholera in Sudan

-

Huge wildfire in southern France now under control

-

Kane scores as Bayern thump Spurs in pre-season friendly

Kane scores as Bayern thump Spurs in pre-season friendly

-

France strikes down return of banned bee-killing pesticide

-

Canada sends troops to eastern province as fire damage grows

Canada sends troops to eastern province as fire damage grows

-

OpenAI releases ChatGPT-5 as AI race accelerates

-

Plastic pollution treaty talks deadlocked

Plastic pollution treaty talks deadlocked

-

A French sailor's personal 'Plastic Odyssey'

-

Netanyahu says Israel to control not govern Gaza

Netanyahu says Israel to control not govern Gaza

-

Partey signs for Villarreal while on bail for rape charges

-

Wales have the talent to rise again, says rugby head coach Tandy

Wales have the talent to rise again, says rugby head coach Tandy

-

US partners seek relief as Trump tariffs upend global trade

-

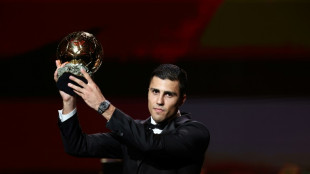

Five England players nominated for women's Ballon d'Or

Five England players nominated for women's Ballon d'Or

-

PSG dominate list of men's Ballon D'Or nominees

-

Americans eating (slightly) less ultra-processed food

Americans eating (slightly) less ultra-processed food

-

Man Utd agree 85m euro deal to sign Sesko: reports

-

France to rule on controversial bee-killing pesticide bill

France to rule on controversial bee-killing pesticide bill

-

Germany factory output falls to lowest since pandemic in 2020

-

Swiss to seek more talks with US as 'horror' tariffs kick in

Swiss to seek more talks with US as 'horror' tariffs kick in

-

Barcelona strip Ter Stegen of captain's armband

-

Trump demands new US census as redistricting war spreads

Trump demands new US census as redistricting war spreads

-

'How much worse could it get?' Gazans fear full occupation

-

France seeks to 'stabilise' wildfire raging in south

France seeks to 'stabilise' wildfire raging in south

-

Ski world champion Venier quits, saying hunger has gone

-

Israel security cabinet to discuss Gaza war plans

Israel security cabinet to discuss Gaza war plans

-

Deadly Indian Himalayan flood likely caused by glacier collapse, experts say

-

UK pensioner, student arrested for backing Palestine Action

UK pensioner, student arrested for backing Palestine Action

-

Israeli security cabinet to discuss future Gaza war plans

-

Antonio to leave West Ham after car crash

Antonio to leave West Ham after car crash

-

Kremlin says Trump-Putin meeting agreed for 'coming days'

| RBGPF | 1.42% | 76 | $ | |

| VOD | -0.36% | 11.26 | $ | |

| BTI | 0.51% | 56.69 | $ | |

| CMSC | 0.04% | 22.96 | $ | |

| BP | 0.91% | 34.19 | $ | |

| GSK | 2.21% | 37.58 | $ | |

| SCU | 0% | 12.72 | $ | |

| RYCEF | -0.21% | 14.45 | $ | |

| RIO | 1.12% | 60.77 | $ | |

| RELX | 1.03% | 49.32 | $ | |

| SCS | 0.06% | 16 | $ | |

| NGG | -0.31% | 72.08 | $ | |

| BCC | 0.32% | 83.19 | $ | |

| CMSD | -0.09% | 23.52 | $ | |

| BCE | 2.23% | 23.78 | $ | |

| JRI | 0.52% | 13.41 | $ | |

| AZN | 1.3% | 74.57 | $ |

US loses last triple-A credit rating as Moody's cuts on growing govt debt

The United States lost its last triple-A credit rating from a major agency on Friday as Moody's announced a downgrade, citing rising levels of government debt and dealing a blow to Donald Trump's narrative of economic strength and prosperity.

The downgrade to Aa1 from Aaa adds to the bad news for the US president, coming on the same day his flagship spending bill failed to pass a key vote in Congress due to opposition from several Republican fiscal hawks.

Explaining its decision, the ratings agency noted "the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns."

In its decision, Moody's warned that it expects federal deficits to widen to almost nine percent of economic output by 2035, up from 6.4 percent last year, "driven mainly by increased interest payments on debt, rising entitlement spending, and relatively low revenue generation."

As a result, it expects the federal debt burden to increase to "about" 134 percent of Gross Domestic Product (GDP) by 2035, compared to 98 percent last year.

Moody's decision to downgrade the United States from its top credit rating mirrors similar decisions from the two other major US ratings agencies, S&P and Fitch.

S&P was the first to cut its rating for the United States back in 2011, during Barack Obama's first term in office, citing its concerns that a debt management plan "would be necessary to stabilize the government's medium-term debt dynamics."

Twelve years later, Fitch followed suit, warning of "a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters."

Moody's echoed its peers in its decision Friday, noting in a statement that "successive US administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs."

"We do not believe that material multi-year reductions in mandatory spending and deficits will result from current fiscal proposals under consideration," it added, flagging that it expected larger deficits to continue over the next decade.

"The US' fiscal performance is likely to deteriorate relative to its own past and compared to other highly-rated sovereigns," Moody's said.

The Moody's decision comes amid a tough fight in Congress to pass Trump's much-touted "big, beautiful" spending bill, which aims to revamp and renew a roughly $5 trillion extension of his 2017 tax relief, paid for at least partially through deep cuts to the Medicaid health insurance program that covers more than 70 million low-income people.

On Friday, the agency also changed its outlook from "negative" to "stable," noting that despite the United States' poor record tackling rising government debt levels, the country "retains exceptional credit strengths such as the size, resilience and dynamism of its economy and the role of the US dollar as global reserve currency."

V.Said--SF-PST