-

Solid gold, royal missives and Nobel noms: how to win Trump over

Solid gold, royal missives and Nobel noms: how to win Trump over

-

Canadian teen Mboko outlasts Osaka to win WTA Montreal crown

-

Trump to host Armenia, Azerbaijan for historic 'Peace Signing'

Trump to host Armenia, Azerbaijan for historic 'Peace Signing'

-

Israeli airline's Paris offices daubed with red paint, slogans

-

US raises bounty on Venezuela's Maduro to $50 mn

US raises bounty on Venezuela's Maduro to $50 mn

-

Lebanon cabinet meets again on Hezbollah disarmament

-

France's huge wildfire will burn for days: authorities

France's huge wildfire will burn for days: authorities

-

Bolivia right-wing presidential hopeful vows 'radical change'

-

Trump says would meet Putin without Zelensky sit-down

Trump says would meet Putin without Zelensky sit-down

-

Trump offers data to justify firing of labor stats chief

-

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

-

Disney settles Trump-supporting 'Star Wars' actor lawsuit

-

Trump moves to kill $7 billion in solar panel grants

Trump moves to kill $7 billion in solar panel grants

-

Venus Williams falls at first hurdle in Cincinnati

-

Mixed day for global stocks as latest Trump levies take effect

Mixed day for global stocks as latest Trump levies take effect

-

SpaceX agrees to take Italian experiments to Mars

-

US judge orders temporary halt to new 'Alligator Alcatraz' construction

US judge orders temporary halt to new 'Alligator Alcatraz' construction

-

US uses war rhetoric, Superman to recruit for migrant crackdown

-

US to rewrite its past national climate reports

US to rewrite its past national climate reports

-

U can't pay this: MC Hammer sued over delinquent car loan

-

WHO says nearly 100,000 struck with cholera in Sudan

WHO says nearly 100,000 struck with cholera in Sudan

-

Huge wildfire in southern France now under control

-

Kane scores as Bayern thump Spurs in pre-season friendly

Kane scores as Bayern thump Spurs in pre-season friendly

-

France strikes down return of banned bee-killing pesticide

-

Canada sends troops to eastern province as fire damage grows

Canada sends troops to eastern province as fire damage grows

-

OpenAI releases ChatGPT-5 as AI race accelerates

-

Plastic pollution treaty talks deadlocked

Plastic pollution treaty talks deadlocked

-

A French sailor's personal 'Plastic Odyssey'

-

Netanyahu says Israel to control not govern Gaza

Netanyahu says Israel to control not govern Gaza

-

Partey signs for Villarreal while on bail for rape charges

-

Wales have the talent to rise again, says rugby head coach Tandy

Wales have the talent to rise again, says rugby head coach Tandy

-

US partners seek relief as Trump tariffs upend global trade

-

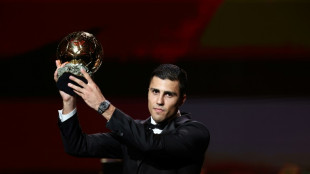

Five England players nominated for women's Ballon d'Or

Five England players nominated for women's Ballon d'Or

-

PSG dominate list of men's Ballon D'Or nominees

-

Americans eating (slightly) less ultra-processed food

Americans eating (slightly) less ultra-processed food

-

Man Utd agree 85m euro deal to sign Sesko: reports

-

France to rule on controversial bee-killing pesticide bill

France to rule on controversial bee-killing pesticide bill

-

Germany factory output falls to lowest since pandemic in 2020

-

Swiss to seek more talks with US as 'horror' tariffs kick in

Swiss to seek more talks with US as 'horror' tariffs kick in

-

Barcelona strip Ter Stegen of captain's armband

-

Trump demands new US census as redistricting war spreads

Trump demands new US census as redistricting war spreads

-

'How much worse could it get?' Gazans fear full occupation

-

France seeks to 'stabilise' wildfire raging in south

France seeks to 'stabilise' wildfire raging in south

-

Ski world champion Venier quits, saying hunger has gone

-

Israel security cabinet to discuss Gaza war plans

Israel security cabinet to discuss Gaza war plans

-

Deadly Indian Himalayan flood likely caused by glacier collapse, experts say

-

UK pensioner, student arrested for backing Palestine Action

UK pensioner, student arrested for backing Palestine Action

-

Israeli security cabinet to discuss future Gaza war plans

-

Antonio to leave West Ham after car crash

Antonio to leave West Ham after car crash

-

Kremlin says Trump-Putin meeting agreed for 'coming days'

| RBGPF | 1.42% | 76 | $ | |

| VOD | -0.36% | 11.26 | $ | |

| BTI | 0.51% | 56.69 | $ | |

| CMSC | 0.04% | 22.96 | $ | |

| BP | 0.91% | 34.19 | $ | |

| GSK | 2.21% | 37.58 | $ | |

| SCU | 0% | 12.72 | $ | |

| RYCEF | -0.21% | 14.45 | $ | |

| RIO | 1.12% | 60.77 | $ | |

| RELX | 1.03% | 49.32 | $ | |

| SCS | 0.06% | 16 | $ | |

| NGG | -0.31% | 72.08 | $ | |

| BCC | 0.32% | 83.19 | $ | |

| CMSD | -0.09% | 23.52 | $ | |

| BCE | 2.23% | 23.78 | $ | |

| JRI | 0.52% | 13.41 | $ | |

| AZN | 1.3% | 74.57 | $ |

Stock markets seek to hold onto gains

Global stock markets struggled for direction on Friday as they sought to hold onto weekly gains fuelled by the China-US trade war hiatus.

Equity markets have enjoyed one of their best weeks since US President Donald Trump's "Liberation Day" tariff bazooka last month caused indices to slump.

"The chief driver of global markets this week has been improving US trade relations, especially with China," said Kathleen Brooks, research director at XTB.

"However, as we end the week, this is fading," she added.

The United States and China on Monday announced they would slash their tit-for-tat tariffs for 90 days to allow for talks, but considerable levies remain in place.

Investors are now awaiting signals from the US president on progress in trade talks, as countries seek deals to avoid his steeper levies, as well as more information about their economic impact.

Analysts warn that initial optimism of the US-China trade truce may have been overdone given that tariffs remain in place and pose a threat to economic growth.

A "baseline" 10-percent tariff on US imports of goods from nearly every country remains in place.

"Even if more trade deals are announced, it is still the case that tariffs on goods entering the US will be much higher than anyone dared to contemplate," said IG chief market analyst Chris Beauchamp.

Analysts and investors worry that higher prices will lead to economic growth slowing.

April US inflation data released this week came in lower than expected, although analysts said the impact of tariffs is more likely to be visible in May or June data.

Top US retailer Walmart warned Thursday that it will begin raising prices soon due to tariffs.

Analysts will be scrutinising US consumer sentiment data due out later Friday.

"This will be a closely watched report to see if it reveals improved consumer attitudes about personal finances and inflation following the 90-day pause for reciprocal tariff rates and sharp recovery in the stock market," said Patrick O'Hare at Briefing.com.

Oil prices rebounded after tumbling Thursday on the possibility a breakthrough in Iran nuclear talks, fuelled by Trump saying progress had been made on a deal.

The dollar edged down against the euro and the yen on raised expectations that the Federal Reserve would still cut interest rates this year following mixed inflation data.

Luxury stocks were bolstered after Cartier-owner Richemont posted higher net profit and sales, driven by resilience in its jewellery business, despite the sector struggling with weak demand from China.

Shares in Danish drugmaker Novo Nordisk, known for its blockbuster diabetes and weight-loss treatments Ozempic and Wegovy, dropped 2.5 percent after it announced the departure of its chief executive.

Novo Nordisk's share price fallen by more than half since June 2024 as it faces more competition.

E-commerce titan Alibaba shed over six percent in Hong Kong after reporting a disappointing rise in first-quarter revenue amid sluggish consumer spending in China.

- Key figures at around 1330 GMT -

New York - Dow: DOWN less than 0.1 percent at 42,298.25 points

New York - S&P 500: UP 0.1 percent at 5,923.80

New York - Nasdaq Composite: UP 0.2 percent at 19,151.26

London - FTSE 100: UP 0.2 percent at 8,654.75

Paris - CAC 40: FLAT at 7,856.37

Frankfurt - DAX: FLAT at 23,686.75

Tokyo - Nikkei 225: FLAT at 37,753.72 (close)

Hong Kong - Hang Seng Index: DOWN 0.5 percent at 23,345.05 (close)

Shanghai - Composite: DOWN 0.4 percent at 3,367.46 (close)

Euro/dollar: UP at $1.1193 from $1.1185 on Thursday

Pound/dollar: DOWN at $1.3286 from $1.3304

Dollar/yen: DOWN at 145.56 yen from 145.65 yen

Euro/pound: UP at 84.29 from 84.07 pence

Brent North Sea Crude: UP 0.7 percent at $64.98 per barrel

West Texas Intermediate: UP 0.7 percent at $61.55 per barrel

burs-rl/lth

K.AbuDahab--SF-PST