-

Solid gold, royal missives and Nobel noms: how to win Trump over

Solid gold, royal missives and Nobel noms: how to win Trump over

-

Canadian teen Mboko outlasts Osaka to win WTA Montreal crown

-

Trump to host Armenia, Azerbaijan for historic 'Peace Signing'

Trump to host Armenia, Azerbaijan for historic 'Peace Signing'

-

Israeli airline's Paris offices daubed with red paint, slogans

-

US raises bounty on Venezuela's Maduro to $50 mn

US raises bounty on Venezuela's Maduro to $50 mn

-

Lebanon cabinet meets again on Hezbollah disarmament

-

France's huge wildfire will burn for days: authorities

France's huge wildfire will burn for days: authorities

-

Bolivia right-wing presidential hopeful vows 'radical change'

-

Trump says would meet Putin without Zelensky sit-down

Trump says would meet Putin without Zelensky sit-down

-

Trump offers data to justify firing of labor stats chief

-

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

-

Disney settles Trump-supporting 'Star Wars' actor lawsuit

-

Trump moves to kill $7 billion in solar panel grants

Trump moves to kill $7 billion in solar panel grants

-

Venus Williams falls at first hurdle in Cincinnati

-

Mixed day for global stocks as latest Trump levies take effect

Mixed day for global stocks as latest Trump levies take effect

-

SpaceX agrees to take Italian experiments to Mars

-

US judge orders temporary halt to new 'Alligator Alcatraz' construction

US judge orders temporary halt to new 'Alligator Alcatraz' construction

-

US uses war rhetoric, Superman to recruit for migrant crackdown

-

US to rewrite its past national climate reports

US to rewrite its past national climate reports

-

U can't pay this: MC Hammer sued over delinquent car loan

-

WHO says nearly 100,000 struck with cholera in Sudan

WHO says nearly 100,000 struck with cholera in Sudan

-

Huge wildfire in southern France now under control

-

Kane scores as Bayern thump Spurs in pre-season friendly

Kane scores as Bayern thump Spurs in pre-season friendly

-

France strikes down return of banned bee-killing pesticide

-

Canada sends troops to eastern province as fire damage grows

Canada sends troops to eastern province as fire damage grows

-

OpenAI releases ChatGPT-5 as AI race accelerates

-

Plastic pollution treaty talks deadlocked

Plastic pollution treaty talks deadlocked

-

A French sailor's personal 'Plastic Odyssey'

-

Netanyahu says Israel to control not govern Gaza

Netanyahu says Israel to control not govern Gaza

-

Partey signs for Villarreal while on bail for rape charges

-

Wales have the talent to rise again, says rugby head coach Tandy

Wales have the talent to rise again, says rugby head coach Tandy

-

US partners seek relief as Trump tariffs upend global trade

-

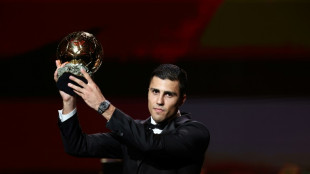

Five England players nominated for women's Ballon d'Or

Five England players nominated for women's Ballon d'Or

-

PSG dominate list of men's Ballon D'Or nominees

-

Americans eating (slightly) less ultra-processed food

Americans eating (slightly) less ultra-processed food

-

Man Utd agree 85m euro deal to sign Sesko: reports

-

France to rule on controversial bee-killing pesticide bill

France to rule on controversial bee-killing pesticide bill

-

Germany factory output falls to lowest since pandemic in 2020

-

Swiss to seek more talks with US as 'horror' tariffs kick in

Swiss to seek more talks with US as 'horror' tariffs kick in

-

Barcelona strip Ter Stegen of captain's armband

-

Trump demands new US census as redistricting war spreads

Trump demands new US census as redistricting war spreads

-

'How much worse could it get?' Gazans fear full occupation

-

France seeks to 'stabilise' wildfire raging in south

France seeks to 'stabilise' wildfire raging in south

-

Ski world champion Venier quits, saying hunger has gone

-

Israel security cabinet to discuss Gaza war plans

Israel security cabinet to discuss Gaza war plans

-

Deadly Indian Himalayan flood likely caused by glacier collapse, experts say

-

UK pensioner, student arrested for backing Palestine Action

UK pensioner, student arrested for backing Palestine Action

-

Israeli security cabinet to discuss future Gaza war plans

-

Antonio to leave West Ham after car crash

Antonio to leave West Ham after car crash

-

Kremlin says Trump-Putin meeting agreed for 'coming days'

| RBGPF | 1.42% | 76 | $ | |

| VOD | -0.36% | 11.26 | $ | |

| BTI | 0.51% | 56.69 | $ | |

| CMSC | 0.04% | 22.96 | $ | |

| BP | 0.91% | 34.19 | $ | |

| GSK | 2.21% | 37.58 | $ | |

| SCU | 0% | 12.72 | $ | |

| RYCEF | -0.21% | 14.45 | $ | |

| RIO | 1.12% | 60.77 | $ | |

| RELX | 1.03% | 49.32 | $ | |

| SCS | 0.06% | 16 | $ | |

| NGG | -0.31% | 72.08 | $ | |

| BCC | 0.32% | 83.19 | $ | |

| CMSD | -0.09% | 23.52 | $ | |

| BCE | 2.23% | 23.78 | $ | |

| JRI | 0.52% | 13.41 | $ | |

| AZN | 1.3% | 74.57 | $ |

Oil prices fall on hopes for Iran nuclear deal

Oil prices fell Thursday while global equities were mixed after President Donald Trump said the United States was close to making a deal on Iran's nuclear program.

Trump made the remarks in Qatar before flying to the United Arab Emirates for the third and final leg of a Gulf tour that began in Saudi Arabia.

Trump's comments came after Iran held its fourth round of talks with the US administration. Washington has said it wishes to avoid a threatened military strike by Israel on Tehran's contested nuclear program.

"Traders focused on the prospect of a US-Iran nuclear deal which could see economic sanctions lifted on the latter and potentially lead to greater supplies of oil," noted Russ Mould, investment director at AJ Bell.

Both main crude contracts fell by more than two percent in value on hopes that US sanctions on Iran might be lifted as part of the deal.

That could, in turn, increase the Islamic republic's oil exports.

In Europe, the main markets overcame early weakness to finish higher.

Sentiment in London was boosted by official data showing Britain's economy grew more than expected in the first quarter -- before UK business tax hikes and US tariffs took effect.

Back on Wall Street, both the Dow and S&P 500 rose, while the Nasdaq retreated following mixed US economic data.

Data showed US retail sales were near-flat in the United States in April, while US wholesale inflation unexpectedly fell during the month.

Shares in Walmart retreated after the retail giant warned of higher prices due to Trump's tariffs. CEO Doug McMillon welcomed a de-escalation of Washington's trade war with China but said the levies remained too high for the retailer to absorb.

"We will do our best to keep our prices as low as possible but given the magnitude of the tariffs, even at the reduced levels, we aren't able to absorb all the pressure," McMillon told investors.

Meanwhile, investors awaited fresh developments in trade talks, with countries looking to reach deals to avoid Trump's tariff blitz.

With excitement from the China-US detente fading, markets are seeking new catalysts.

"We're back into the vacuum where news about trade dominates everything," said Art Hogan of B. Riley Wealth Management.

After tumbling in early April following Trump's sweeping tariff plan, stocks have been on the upswing in recent weeks as the US president has retreated from some of the most onerous levies while announcing a trade deal with Britain and a de-escalation with China.

But Hogan said markets are bracing for a hit to inflation later in 2025 from the overall policy shift to higher tariffs.

- Key figures at around 2050 GMT -

West Texas Intermediate: DOWN 2.4 percent at $61.62 per barrel

Brent North Sea Crude: DOWN 2.4 percent at $64.53 per barrel

New York - Dow: UP 0.7 percent at 42,322.75 (close)

New York - S&P 500: UP 0.4 percent at 5,916.93 (close)

New York - Nasdaq Composite: DOWN 0.2 percent at 19,112.32 (close)

London - FTSE 100: UP 0.6 percent at 8,633.75 (close)

Paris - CAC 40: UP 0.2 percent at 7,853.47 (close)

Frankfurt - DAX: UP 0.7 percent at 23,695.59 (close)

Tokyo - Nikkei 225: DOWN 1.0 percent at 37,755.51 (close)

Hong Kong - Hang Seng Index: DOWN 0.8 percent at 23,453.16 (close)

Shanghai - Composite: DOWN 0.7 percent at 3,380.82 (close)

Euro/dollar: UP at $1.1185 from $1.1175 on Wednesday

Pound/dollar: UP at $1.3304 from $1.3263

Dollar/yen: DOWN at 145.65 yen from 146.75 yen

Euro/pound: DOWN at 84.07 from 84.23 pence

burs-jmb/acb

S.Barghouti--SF-PST