-

Football and falls as first humanoid robot games launch in China

Football and falls as first humanoid robot games launch in China

-

'Like hell': Indoor heat overwhelms Saudi Arabia's cooks, bakers

-

On VJ day, king pays tribute to UK veterans, warns of war's 'true cost'

On VJ day, king pays tribute to UK veterans, warns of war's 'true cost'

-

Stocks mostly higher before US-Russia summit

-

Bayern's Bundesliga crown up for grabs after rocky summer

Bayern's Bundesliga crown up for grabs after rocky summer

-

Arsenal face revamped Man Utd as new-look Liverpool open Premier League season

-

South Korea president vows to build 'military trust' with North

South Korea president vows to build 'military trust' with North

-

'Never again': Indigenous Bolivians sour on socialism

-

Indonesia's president touts economy, social welfare drive

Indonesia's president touts economy, social welfare drive

-

World plastic pollution treaty talks collapse with no deal

-

Facing US tariffs, India's Modi vows self-reliance

Facing US tariffs, India's Modi vows self-reliance

-

Trump to meet Putin in high-stakes Alaska summit

-

Indian rescuers scour debris after 60 killed in flood

Indian rescuers scour debris after 60 killed in flood

-

Ivory Coast village reburies relatives as rising sea engulfs cemetery

-

Stressed UK teens seek influencers' help for exams success

Stressed UK teens seek influencers' help for exams success

-

National Guard deploys 800 personnel for DC mission, says Pentagon

-

Japan emperor expresses 'deep remorse' 80 years after WWII

Japan emperor expresses 'deep remorse' 80 years after WWII

-

With waters at 32C, Mediterranean tropicalisation shifts into high gear

-

Historic Swedish church being moved as giant mine casts growing shadow

Historic Swedish church being moved as giant mine casts growing shadow

-

Malawi's restless youth challenged to vote in September polls

-

Indonesian roof tilers flex muscles to keep local industry alive

Indonesian roof tilers flex muscles to keep local industry alive

-

World's first humanoid robot games begin in China

-

Scott Barrett returns to lead All Blacks against Argentina

Scott Barrett returns to lead All Blacks against Argentina

-

Five things to know about Nigeria's oil sector

-

New compromise but still no deal at plastic pollution talks

New compromise but still no deal at plastic pollution talks

-

France's Cernousek seizes lead at LPGA Portland Classic

-

Putin-Trump summit: What each side wants

Putin-Trump summit: What each side wants

-

Desperate Myanmar villagers scavenge for food as hunger bites

-

Qualifier Atmane stuns Rune to set up Sinner semi-final in Cincinnati

Qualifier Atmane stuns Rune to set up Sinner semi-final in Cincinnati

-

Hong Kong tycoon Jimmy Lai's security trial delayed over health concerns

-

Asia stocks mixed before US-Russia summit

Asia stocks mixed before US-Russia summit

-

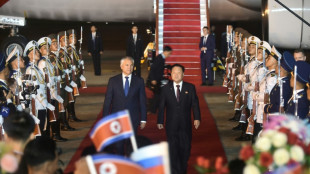

Putin hails North Korean troops as 'heroic' in letter to Kim

-

Fleeing the heat, tourists explore Rome at night, underground

Fleeing the heat, tourists explore Rome at night, underground

-

Online cockfighting thrives in Philippines despite ban and murders

-

Keeping cool with colours -- Vienna museum paints asphalt to fight heat

Keeping cool with colours -- Vienna museum paints asphalt to fight heat

-

Raising the bar: Nepal's emerging cocktail culture

-

El Salvador plans 600 mass trials for suspected gang members

El Salvador plans 600 mass trials for suspected gang members

-

Trump's tariffs drown Brazil's fish industry

-

Hong Kong tycoon Jimmy Lai's collusion trial resumes after delay

Hong Kong tycoon Jimmy Lai's collusion trial resumes after delay

-

Britain's Princess Anne turns 75 with typically minimal fuss

-

Japan posts modest growth despite US tariffs

Japan posts modest growth despite US tariffs

-

Rugby Championship kicks off amid uncertain future

-

Israeli far-right minister backs contentious West Bank settlement plan

Israeli far-right minister backs contentious West Bank settlement plan

-

Hot putter carries MacIntyre to three-shot lead at BMW Championship

-

'Ridiculous': How Washington residents view the new troops in town

'Ridiculous': How Washington residents view the new troops in town

-

Global plastic pollution treaty talks extended in 'haze' of confusion

-

Trump's tariffs have not reduced Panama Canal traffic -- yet

Trump's tariffs have not reduced Panama Canal traffic -- yet

-

YouTube turns to AI to spot children posing as adults

-

Sky's the limit for Duplantis ahead of 'super-sick' Tokyo worlds

Sky's the limit for Duplantis ahead of 'super-sick' Tokyo worlds

-

New clashes in Serbia as political crisis escalates

Asian stocks mixed as stability returns, autos lifted by exemption hope

Asian stocks were mixed Tuesday as some stability returned to markets after last week's rollercoaster ride, with auto firms boosted by Donald Trump's possible compromise over steep tariffs on the sector.

However, the US president's unorthodox approach to trade diplomacy continues to fuel uncertainty among investors, with speculation over new levies on high-end technology and pharmaceuticals dampening sentiment.

The announcement last week of exemptions for smartphones, laptops, semiconductors and other electronics -- all key Chinese-made products -- provided a little comfort, though Trump's suggestion they would be temporary tempered the optimism.

Traders gave a muted reaction to Treasury Secretary Scott Bessent's remarks Monday that a China-US deal could be done in an apparent olive branch as the two economic powerhouses trade tariff threats.

His comments came as Trump has hammered China with duties of up to 145 percent, while Beijing has imposed retaliatory measures of 125 percent.

"There's a big deal to be done at some point" Bessent said when asked by Bloomberg TV about the possibility that the world's largest economies would decouple. "There doesn't have to be" decoupling, he said, "but there could be."

Meanwhile, Trump aide Kevin Hassett said the White House had received "more than 10 deals where there's very, very good, amazing offers made to us", but did not specify which countries.

After a broadly positive day on Wall Street, Asian markets fluctuated.

Tokyo and Seoul were among the best performers thanks to a rally in autos after Trump said he was "very flexible" and "looking at something to help some of the car companies" hit by his 25 percent tariff on all imports.

Toyota and Mazda jumped five percent and Nissan more than three percent, while Seoul-listed Hyundai jumped more than four percent.

South Korea's announcement of plans to invest an additional $4.9 billion in the country's semiconductor sector gave a little lift to chip giants Samsung and SK hynix.

Sydney, Singapore, Taipei, Manila and Jakarta also rose. Hong Kong and Shanghai dipped with Wellington.

Federal Reserve governor Christopher Waller provided some support to markets after suggesting he would back the central bank to cut interest rates to help the economy, instead of focusing on higher inflation.

He pointed out that prices could see a transitory rise because of the tariffs but added that if Trump reverted to the crippling tariffs included in his "Liberation Day" on April 2 then officials would be ready to step in.

"If the slowdown is significant and even threatens a recession, then I would expect to favour cutting the... policy rate sooner, and to a greater extent than I had previously thought," he said in comments prepared for an event Monday.

"In my February speech, I referred to this as the world of 'bad news' rate cuts. With a rapidly slowing economy, even if inflation is running well above two percent, I expect the risk of recession would outweigh the risk of escalating inflation, especially if the effects of tariffs in raising inflation are expected to be short lived."

However, OANDA senior market analyst Kelvin Wong warned central bankers would face some tough choices.

"Combination of slowing growth and persistent inflation, hallmarks of a stagflation environment, poses a significant challenge for the US Federal Reserve, which may find it increasingly difficult to implement counter-cyclical monetary policies to support the economy," he said in a commentary.

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: UP 0.9 percent at 34,285.02 (break)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 21,379.50

Shanghai - Composite: DOWN 0.3 percent at 3,254.04

Dollar/yen: UP at 143.32 yen from 143.09 yen on Monday

Euro/dollar: DOWN at $1.1327 from $1.1356

Pound/dollar: DOWN at $1.3179 from $1.3189

Euro/pound: DOWN at 85.94 pence from 86.08 pence

West Texas Intermediate: UP 0.3 percent at $61.69 per barrel

Brent North Sea Crude: UP 0.2 percent at $65.03 per barrel

New York - Dow: UP 0.8 percent at 40,524.79 (close)

London - FTSE 100: UP 2.1 percent at 8,134.34

O.Farraj--SF-PST