-

Football and falls as first humanoid robot games launch in China

Football and falls as first humanoid robot games launch in China

-

'Like hell': Indoor heat overwhelms Saudi Arabia's cooks, bakers

-

On VJ day, king pays tribute to UK veterans, warns of war's 'true cost'

On VJ day, king pays tribute to UK veterans, warns of war's 'true cost'

-

Stocks mostly higher before US-Russia summit

-

Bayern's Bundesliga crown up for grabs after rocky summer

Bayern's Bundesliga crown up for grabs after rocky summer

-

Arsenal face revamped Man Utd as new-look Liverpool open Premier League season

-

South Korea president vows to build 'military trust' with North

South Korea president vows to build 'military trust' with North

-

'Never again': Indigenous Bolivians sour on socialism

-

Indonesia's president touts economy, social welfare drive

Indonesia's president touts economy, social welfare drive

-

World plastic pollution treaty talks collapse with no deal

-

Facing US tariffs, India's Modi vows self-reliance

Facing US tariffs, India's Modi vows self-reliance

-

Trump to meet Putin in high-stakes Alaska summit

-

Indian rescuers scour debris after 60 killed in flood

Indian rescuers scour debris after 60 killed in flood

-

Ivory Coast village reburies relatives as rising sea engulfs cemetery

-

Stressed UK teens seek influencers' help for exams success

Stressed UK teens seek influencers' help for exams success

-

National Guard deploys 800 personnel for DC mission, says Pentagon

-

Japan emperor expresses 'deep remorse' 80 years after WWII

Japan emperor expresses 'deep remorse' 80 years after WWII

-

With waters at 32C, Mediterranean tropicalisation shifts into high gear

-

Historic Swedish church being moved as giant mine casts growing shadow

Historic Swedish church being moved as giant mine casts growing shadow

-

Malawi's restless youth challenged to vote in September polls

-

Indonesian roof tilers flex muscles to keep local industry alive

Indonesian roof tilers flex muscles to keep local industry alive

-

World's first humanoid robot games begin in China

-

Scott Barrett returns to lead All Blacks against Argentina

Scott Barrett returns to lead All Blacks against Argentina

-

Five things to know about Nigeria's oil sector

-

New compromise but still no deal at plastic pollution talks

New compromise but still no deal at plastic pollution talks

-

France's Cernousek seizes lead at LPGA Portland Classic

-

Putin-Trump summit: What each side wants

Putin-Trump summit: What each side wants

-

Desperate Myanmar villagers scavenge for food as hunger bites

-

Qualifier Atmane stuns Rune to set up Sinner semi-final in Cincinnati

Qualifier Atmane stuns Rune to set up Sinner semi-final in Cincinnati

-

Hong Kong tycoon Jimmy Lai's security trial delayed over health concerns

-

Asia stocks mixed before US-Russia summit

Asia stocks mixed before US-Russia summit

-

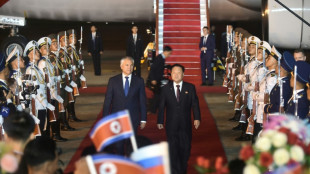

Putin hails North Korean troops as 'heroic' in letter to Kim

-

Fleeing the heat, tourists explore Rome at night, underground

Fleeing the heat, tourists explore Rome at night, underground

-

Online cockfighting thrives in Philippines despite ban and murders

-

Keeping cool with colours -- Vienna museum paints asphalt to fight heat

Keeping cool with colours -- Vienna museum paints asphalt to fight heat

-

Raising the bar: Nepal's emerging cocktail culture

-

El Salvador plans 600 mass trials for suspected gang members

El Salvador plans 600 mass trials for suspected gang members

-

Trump's tariffs drown Brazil's fish industry

-

Hong Kong tycoon Jimmy Lai's collusion trial resumes after delay

Hong Kong tycoon Jimmy Lai's collusion trial resumes after delay

-

Britain's Princess Anne turns 75 with typically minimal fuss

-

Japan posts modest growth despite US tariffs

Japan posts modest growth despite US tariffs

-

Rugby Championship kicks off amid uncertain future

-

Israeli far-right minister backs contentious West Bank settlement plan

Israeli far-right minister backs contentious West Bank settlement plan

-

Hot putter carries MacIntyre to three-shot lead at BMW Championship

-

'Ridiculous': How Washington residents view the new troops in town

'Ridiculous': How Washington residents view the new troops in town

-

Global plastic pollution treaty talks extended in 'haze' of confusion

-

Trump's tariffs have not reduced Panama Canal traffic -- yet

Trump's tariffs have not reduced Panama Canal traffic -- yet

-

YouTube turns to AI to spot children posing as adults

-

Sky's the limit for Duplantis ahead of 'super-sick' Tokyo worlds

Sky's the limit for Duplantis ahead of 'super-sick' Tokyo worlds

-

New clashes in Serbia as political crisis escalates

China's economy likely grew 5.1% in Q1 on export surge: AFP poll

China is expected to post first-quarter growth of around five percent on Wednesday, buoyed by exporters rushing to stave off higher US tariffs but still weighed by sluggish domestic consumption, analysts say.

Beijing and Washington are locked in a fast-moving, high-stakes game of brinkmanship since US President Donald Trump launched a global tariff assault that has particularly targeted Chinese imports.

Tit-for-tat exchanges have seen US levies imposed on China rise to 145 percent, and Beijing setting a retaliatory 125 percent toll on US imports.

Official data Wednesday will offer a first glimpse into how those trade war fears are affecting the Asian giant's fragile economic recovery, which was already feeling the pressure of persistently low consumption and a property market debt crisis.

Analysts polled by AFP forecast the world's number two economy to have grown 5.1 percent from January to March -- down from 5.4 the previous quarter.

Figures released Monday showed Beijing's exports soared more than 12 percent on-year in March, smashing expectations, with analysts attributed it to a "frontloading" of orders ahead of Trump's so-called "Liberation Day" tariffs on April 2.

They also expect that to have boosted economic growth in the first quarter.

However, they warned the GDP reading may prove to be a rare bright spot in a year that promises more woe for the world's second-largest economy.

"China's economy is facing pressure on multiple fronts," Sarah Tan, an economist at Moody's Analytics, said.

"The export bright spot is fading as tariff hikes from the US took effect," she added.

"Domestic demand remains sluggish amid elevated unemployment and a property market stuck in correction," Tan said.

The first quarter was likely "quite good", Alicia Garcia-Herrero, Asia Pacific chief economist at Natixis, told AFP, but the second "will be much worse".

She pointed to "lots of additional exports to the US to avoid additional tariffs".

Also helping to prop up results during the period was the increased consumption during Lunar New Year celebrations when millions of people travelled back to their hometowns, she said.

- Help wanted -

Beijing announced a string of aggressive measures to reignite the economy last year, including interest rate cuts, cancelling restrictions on homebuying, hiking the debt ceiling for local governments and bolstering support for financial markets.

But after a blistering market rally last year fuelled by hopes for a long-awaited "bazooka stimulus", optimism waned as authorities refrained from providing a specific figure for the bailout or fleshing out any of the pledges.

And analysts expect Beijing to jump in with extra support to cushion the tariff pain.

Key to that will be stabilising the long-suffering real estate services sector, which now makes up six percent of GDP, according to analyst Guo Shan.

"If China could withstand its real estate adjustment in the past three years, it should be able to manage the US tariffs, especially if it can stabilise the real estate sector this year," Guo, a partner with Chinese consultancy firm Hutong Research, told AFP.

Tan at Moody's Analytics also said she expected Beijing to pull fiscal and monetary levers this year.

"The government will roll out more stimulus targeted towards households, and the People's Bank of China will likely slash key lending rates," she added.

China is trying to tariff-proof its economy by boosting consumption and investing in key industries.

But the escalating rift between the two countries could hit hundreds of billions of dollars in trade and batter a key economic pillar made even more vital in the absence of vigorous domestic demand.

"Against this backdrop, we consider significant downside risk to China's GDP growth," ANZ analysts wrote in a note.

An "extreme scenario" would be China experiencing another external shock like it did in the 2008 financial crisis, analysts said.

Growth in the second quarter would likely be worse given the tariff dynamics, Guo told AFP.

"Exports will decline, and investment may also slow as uncertainties affect companies' decision making," Guo said.

China's top leaders last month set an ambitious annual growth target of around five percent, vowing to make domestic demand its main economic driver.

Many economists consider that goal to be ambitious given the problems facing the economy.

S.Barghouti--SF-PST