-

New-look Liverpool kick off Premier League season after spending spree

New-look Liverpool kick off Premier League season after spending spree

-

Football and falls as first humanoid robot games launch in China

-

'Like hell': Indoor heat overwhelms Saudi Arabia's cooks, bakers

'Like hell': Indoor heat overwhelms Saudi Arabia's cooks, bakers

-

On VJ day, king pays tribute to UK veterans, warns of war's 'true cost'

-

Stocks mostly higher before US-Russia summit

Stocks mostly higher before US-Russia summit

-

Bayern's Bundesliga crown up for grabs after rocky summer

-

Arsenal face revamped Man Utd as new-look Liverpool open Premier League season

Arsenal face revamped Man Utd as new-look Liverpool open Premier League season

-

South Korea president vows to build 'military trust' with North

-

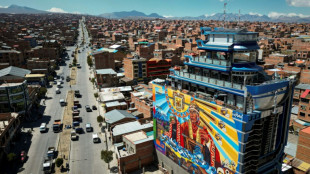

'Never again': Indigenous Bolivians sour on socialism

'Never again': Indigenous Bolivians sour on socialism

-

Indonesia's president touts economy, social welfare drive

-

World plastic pollution treaty talks collapse with no deal

World plastic pollution treaty talks collapse with no deal

-

Facing US tariffs, India's Modi vows self-reliance

-

Trump to meet Putin in high-stakes Alaska summit

Trump to meet Putin in high-stakes Alaska summit

-

Indian rescuers scour debris after 60 killed in flood

-

Ivory Coast village reburies relatives as rising sea engulfs cemetery

Ivory Coast village reburies relatives as rising sea engulfs cemetery

-

Stressed UK teens seek influencers' help for exams success

-

National Guard deploys 800 personnel for DC mission, says Pentagon

National Guard deploys 800 personnel for DC mission, says Pentagon

-

Japan emperor expresses 'deep remorse' 80 years after WWII

-

With waters at 32C, Mediterranean tropicalisation shifts into high gear

With waters at 32C, Mediterranean tropicalisation shifts into high gear

-

Historic Swedish church being moved as giant mine casts growing shadow

-

Malawi's restless youth challenged to vote in September polls

Malawi's restless youth challenged to vote in September polls

-

Indonesian roof tilers flex muscles to keep local industry alive

-

World's first humanoid robot games begin in China

World's first humanoid robot games begin in China

-

Scott Barrett returns to lead All Blacks against Argentina

-

Five things to know about Nigeria's oil sector

Five things to know about Nigeria's oil sector

-

New compromise but still no deal at plastic pollution talks

-

France's Cernousek seizes lead at LPGA Portland Classic

France's Cernousek seizes lead at LPGA Portland Classic

-

Putin-Trump summit: What each side wants

-

Desperate Myanmar villagers scavenge for food as hunger bites

Desperate Myanmar villagers scavenge for food as hunger bites

-

Qualifier Atmane stuns Rune to set up Sinner semi-final in Cincinnati

-

Hong Kong tycoon Jimmy Lai's security trial delayed over health concerns

Hong Kong tycoon Jimmy Lai's security trial delayed over health concerns

-

Asia stocks mixed before US-Russia summit

-

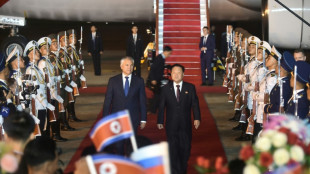

Putin hails North Korean troops as 'heroic' in letter to Kim

Putin hails North Korean troops as 'heroic' in letter to Kim

-

Fleeing the heat, tourists explore Rome at night, underground

-

Online cockfighting thrives in Philippines despite ban and murders

Online cockfighting thrives in Philippines despite ban and murders

-

Keeping cool with colours -- Vienna museum paints asphalt to fight heat

-

Raising the bar: Nepal's emerging cocktail culture

Raising the bar: Nepal's emerging cocktail culture

-

El Salvador plans 600 mass trials for suspected gang members

-

Trump's tariffs drown Brazil's fish industry

Trump's tariffs drown Brazil's fish industry

-

Hong Kong tycoon Jimmy Lai's collusion trial resumes after delay

-

Britain's Princess Anne turns 75 with typically minimal fuss

Britain's Princess Anne turns 75 with typically minimal fuss

-

Japan posts modest growth despite US tariffs

-

Rugby Championship kicks off amid uncertain future

Rugby Championship kicks off amid uncertain future

-

Israeli far-right minister backs contentious West Bank settlement plan

-

Hot putter carries MacIntyre to three-shot lead at BMW Championship

Hot putter carries MacIntyre to three-shot lead at BMW Championship

-

'Ridiculous': How Washington residents view the new troops in town

-

Global plastic pollution treaty talks extended in 'haze' of confusion

Global plastic pollution treaty talks extended in 'haze' of confusion

-

Trump's tariffs have not reduced Panama Canal traffic -- yet

-

YouTube turns to AI to spot children posing as adults

YouTube turns to AI to spot children posing as adults

-

Sky's the limit for Duplantis ahead of 'super-sick' Tokyo worlds

Argentine peso depreciates after exchange controls lifted

Argentina's currency dropped 8.4 percent against the US dollar as markets opened in Buenos Aires Monday, after the partial lifting of exchange controls in place for six years.

The rate settled at 1,190 pesos to the dollar, according to state-owned Banco Nacion, well within the floating band of 1,000 to 1,400 pesos to the dollar set by Argentine authorities Friday.

The Central Bank can intervene to keep the rate within the range.

The peso had traded at 1,097 to the dollar Friday, when Buenos Aires announced it would ease exchange controls after being granted a $20 billion loan from the International Monetary Fund.

The World Bank also announced it would pump $12 billion into Argentina's troubled economy, and the Inter-American Development Bank announced plans for a $10 billion deal in a political boon for libertarian President Javier Milei's aggressive efforts to revive the nation's fortunes.

The injection is crucial for replenishing the meager reserves of the Argentine Central Bank, revive growth and tackle inflation -- a key focus for self-styled "anarcho-capitalist" Milei.

"Today, we are freer," the president told El Observador radio Monday.

"Today, there is no longer an 'official dollar', there is only one dollar, which is the market dollar," he added.

In recent years, the government has strictly controlled the peso and access to dollars, leading to a complex plethora of exchange rates.

The IMF deal also saw a $200-per-month limit on Argentine citizens accessing greenbacks lifted after a weeks-long currency crisis that saw the central bank selling about $2 billion to support the peso.

"Expectations need to be tempered on this first day; we are prepared, but this is going to be a process," central bank board member Santiago Furiase told the LN+ channel Monday.

If the peso reaches the upper limit of the band, it would mean a 30 percent depreciation.

US Treasury Secretary Scott Bessent, meanwhile, was to meet Milei in Buenos Aires Monday to "affirm the United States' full support for Argentina's bold economic reforms," a statement from his office said last week.

- 'Waiting to see' -

On Florida street in downtown Buenos Aires, where black market dollars are traditionally exchanged, there was very little activity Monday, contrary to fears of a rush on the safe-haven greenback.

"Everyone is waiting to see what happens," a trader told AFP.

There are fears that loosening exchange controls could fuel inflation, which has dropped under Milei from 211 percent in 2023 to 118 percent last year.

Furiase sought to downplay the inflationary impact, saying "it will take people some time" to get used to the new regime.

There would be "an initial reaction," he predicted, "but then there will be a trajectory towards the floor of the band."

A downward trend in month-on-month inflation that started last September was broken in March when prices rose 3.7 percent compared to 2.4 percent in February.

To cut back on government spending, Milei has fired tens of thousands of public sector workers, halved the number of government ministries and vetoed inflation-aligned pension increases to curb public spending.

Last year, Argentina recorded its first budget surplus in a decade, but the collateral damage has been a loss of purchasing power, jobs, and consumer spending.

Milei promised that by mid-2026, "the problem of inflation in Argentina will be over."

A.AlHaj--SF-PST