-

New-look Liverpool kick off Premier League season after spending spree

New-look Liverpool kick off Premier League season after spending spree

-

Football and falls as first humanoid robot games launch in China

-

'Like hell': Indoor heat overwhelms Saudi Arabia's cooks, bakers

'Like hell': Indoor heat overwhelms Saudi Arabia's cooks, bakers

-

On VJ day, king pays tribute to UK veterans, warns of war's 'true cost'

-

Stocks mostly higher before US-Russia summit

Stocks mostly higher before US-Russia summit

-

Bayern's Bundesliga crown up for grabs after rocky summer

-

Arsenal face revamped Man Utd as new-look Liverpool open Premier League season

Arsenal face revamped Man Utd as new-look Liverpool open Premier League season

-

South Korea president vows to build 'military trust' with North

-

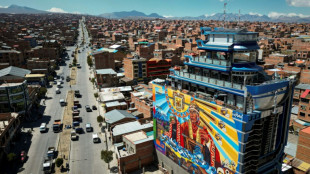

'Never again': Indigenous Bolivians sour on socialism

'Never again': Indigenous Bolivians sour on socialism

-

Indonesia's president touts economy, social welfare drive

-

World plastic pollution treaty talks collapse with no deal

World plastic pollution treaty talks collapse with no deal

-

Facing US tariffs, India's Modi vows self-reliance

-

Trump to meet Putin in high-stakes Alaska summit

Trump to meet Putin in high-stakes Alaska summit

-

Indian rescuers scour debris after 60 killed in flood

-

Ivory Coast village reburies relatives as rising sea engulfs cemetery

Ivory Coast village reburies relatives as rising sea engulfs cemetery

-

Stressed UK teens seek influencers' help for exams success

-

National Guard deploys 800 personnel for DC mission, says Pentagon

National Guard deploys 800 personnel for DC mission, says Pentagon

-

Japan emperor expresses 'deep remorse' 80 years after WWII

-

With waters at 32C, Mediterranean tropicalisation shifts into high gear

With waters at 32C, Mediterranean tropicalisation shifts into high gear

-

Historic Swedish church being moved as giant mine casts growing shadow

-

Malawi's restless youth challenged to vote in September polls

Malawi's restless youth challenged to vote in September polls

-

Indonesian roof tilers flex muscles to keep local industry alive

-

World's first humanoid robot games begin in China

World's first humanoid robot games begin in China

-

Scott Barrett returns to lead All Blacks against Argentina

-

Five things to know about Nigeria's oil sector

Five things to know about Nigeria's oil sector

-

New compromise but still no deal at plastic pollution talks

-

France's Cernousek seizes lead at LPGA Portland Classic

France's Cernousek seizes lead at LPGA Portland Classic

-

Putin-Trump summit: What each side wants

-

Desperate Myanmar villagers scavenge for food as hunger bites

Desperate Myanmar villagers scavenge for food as hunger bites

-

Qualifier Atmane stuns Rune to set up Sinner semi-final in Cincinnati

-

Hong Kong tycoon Jimmy Lai's security trial delayed over health concerns

Hong Kong tycoon Jimmy Lai's security trial delayed over health concerns

-

Asia stocks mixed before US-Russia summit

-

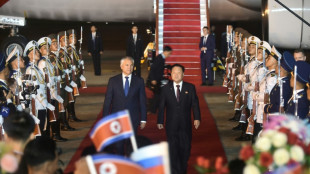

Putin hails North Korean troops as 'heroic' in letter to Kim

Putin hails North Korean troops as 'heroic' in letter to Kim

-

Fleeing the heat, tourists explore Rome at night, underground

-

Online cockfighting thrives in Philippines despite ban and murders

Online cockfighting thrives in Philippines despite ban and murders

-

Keeping cool with colours -- Vienna museum paints asphalt to fight heat

-

Raising the bar: Nepal's emerging cocktail culture

Raising the bar: Nepal's emerging cocktail culture

-

El Salvador plans 600 mass trials for suspected gang members

-

Trump's tariffs drown Brazil's fish industry

Trump's tariffs drown Brazil's fish industry

-

Hong Kong tycoon Jimmy Lai's collusion trial resumes after delay

-

Britain's Princess Anne turns 75 with typically minimal fuss

Britain's Princess Anne turns 75 with typically minimal fuss

-

Japan posts modest growth despite US tariffs

-

Rugby Championship kicks off amid uncertain future

Rugby Championship kicks off amid uncertain future

-

Israeli far-right minister backs contentious West Bank settlement plan

-

Hot putter carries MacIntyre to three-shot lead at BMW Championship

Hot putter carries MacIntyre to three-shot lead at BMW Championship

-

'Ridiculous': How Washington residents view the new troops in town

-

Global plastic pollution treaty talks extended in 'haze' of confusion

Global plastic pollution treaty talks extended in 'haze' of confusion

-

Trump's tariffs have not reduced Panama Canal traffic -- yet

-

YouTube turns to AI to spot children posing as adults

YouTube turns to AI to spot children posing as adults

-

Sky's the limit for Duplantis ahead of 'super-sick' Tokyo worlds

Stocks rise on new tariff twist

Stock markets rose, gold hit another record high and the dollar regained some ground Monday as investors grappled with the latest twists and turns in US President Donald Trump's trade war.

Wall Street opened higher, following sharp rises in Asia and Europe, after Trump appeared to dial down his trade war as smartphones, laptops, semiconductors and other electronics -- all key Chinese-made products -- were given a reprieve from US tariffs on Friday.

"Washington's partial retreat from its hard-line tariff regime -- specifically the temporary exemption of a raft of tech goods from punitive import levies -- has momentarily eased fears of an all-out trade war," said Fawad Razaqzada, analyst at City Index and Forex.com.

But suggestions by Trump over the weekend that the exemptions would be temporary added to market uncertainty, following volatility on trading floors last week over the US leader's erratic trade agenda.

Trump said Sunday that the exemptions had been misconstrued and that no country would get "off the hook" in his trade war -- especially China.

As his team pursued fresh tariffs against many items on the list, including on semiconductors "over the next week", Trump said electronics were only moved to a different tariff "bucket".

"The comment has only added to confusion and reinforced the idea that the exemptions are not permanent, keeping uncertainty elevated as the new week begins," said David Morrison, analyst at financial services platform Trade Nation.

"The US dollar remained under pressure, with ongoing trade tensions denting its appeal," Morrison said.

The dollar, however, pared back some losses against the euro and other major currencies.

US Treasuries also recovered somewhat following a selloff last week that called into question the reliability of US government bonds as a haven investment.

There has been speculation that China contributed to the turmoil in the US bond market by selling Treasury holdings.

Gold, a go-to asset of safety in times of turmoil, hit a new peak of $3,245.75 an ounce Monday before paring back gains.

"Unless a broader (US-China) trade accord is struck soon, the stalemate could continue to hold back risk appetite," Razaqzada said.

"While this softening of tone (on tariffs) may appear constructive on the surface, it doesn't meaningfully shift the dial unless accompanied by substantive progress in US-China trade relations," he said.

- Key figures around 1340 GMT -

New York - Dow: UP 1.0 percent at 40,627.10 points

New York - S&P 500: UP 1.4 percent at 5,438.56

New York - Nasdaq: UP 1.7 percent at 17,015.38

London - FTSE 100: UP 1.8 percent at 8,110.28

Paris - CAC 40: UP 2.4 percent at 7,273.35

Frankfurt - DAX: UP 2.7 percent at 20,921.58

Tokyo - Nikkei 225: UP 1.2 percent at 33,982.36 (close)

Hong Kong - Hang Seng Index: UP 2.4 percent at 21,417.40 (close)

Shanghai - Composite: UP 0.8 percent at 3,262.81 (close)

Euro/dollar: DOWN at $1.1324 from $1.1359 on Friday

Dollar/yen: UP at 143.70 yen from 143.49 yen

Pound/dollar: UP at $1.3157 from $1.3088

Euro/pound: DOWN at 86.14 pence from 86.80 pence

Brent North Sea Crude: UP 0.7 percent at $65.20 per barrel

West Texas Intermediate: UP 0.6 percent at $61.87 per barrel

B.Mahmoud--SF-PST