-

New-look Liverpool kick off Premier League season after spending spree

New-look Liverpool kick off Premier League season after spending spree

-

Football and falls as first humanoid robot games launch in China

-

'Like hell': Indoor heat overwhelms Saudi Arabia's cooks, bakers

'Like hell': Indoor heat overwhelms Saudi Arabia's cooks, bakers

-

On VJ day, king pays tribute to UK veterans, warns of war's 'true cost'

-

Stocks mostly higher before US-Russia summit

Stocks mostly higher before US-Russia summit

-

Bayern's Bundesliga crown up for grabs after rocky summer

-

Arsenal face revamped Man Utd as new-look Liverpool open Premier League season

Arsenal face revamped Man Utd as new-look Liverpool open Premier League season

-

South Korea president vows to build 'military trust' with North

-

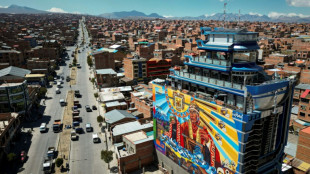

'Never again': Indigenous Bolivians sour on socialism

'Never again': Indigenous Bolivians sour on socialism

-

Indonesia's president touts economy, social welfare drive

-

World plastic pollution treaty talks collapse with no deal

World plastic pollution treaty talks collapse with no deal

-

Facing US tariffs, India's Modi vows self-reliance

-

Trump to meet Putin in high-stakes Alaska summit

Trump to meet Putin in high-stakes Alaska summit

-

Indian rescuers scour debris after 60 killed in flood

-

Ivory Coast village reburies relatives as rising sea engulfs cemetery

Ivory Coast village reburies relatives as rising sea engulfs cemetery

-

Stressed UK teens seek influencers' help for exams success

-

National Guard deploys 800 personnel for DC mission, says Pentagon

National Guard deploys 800 personnel for DC mission, says Pentagon

-

Japan emperor expresses 'deep remorse' 80 years after WWII

-

With waters at 32C, Mediterranean tropicalisation shifts into high gear

With waters at 32C, Mediterranean tropicalisation shifts into high gear

-

Historic Swedish church being moved as giant mine casts growing shadow

-

Malawi's restless youth challenged to vote in September polls

Malawi's restless youth challenged to vote in September polls

-

Indonesian roof tilers flex muscles to keep local industry alive

-

World's first humanoid robot games begin in China

World's first humanoid robot games begin in China

-

Scott Barrett returns to lead All Blacks against Argentina

-

Five things to know about Nigeria's oil sector

Five things to know about Nigeria's oil sector

-

New compromise but still no deal at plastic pollution talks

-

France's Cernousek seizes lead at LPGA Portland Classic

France's Cernousek seizes lead at LPGA Portland Classic

-

Putin-Trump summit: What each side wants

-

Desperate Myanmar villagers scavenge for food as hunger bites

Desperate Myanmar villagers scavenge for food as hunger bites

-

Qualifier Atmane stuns Rune to set up Sinner semi-final in Cincinnati

-

Hong Kong tycoon Jimmy Lai's security trial delayed over health concerns

Hong Kong tycoon Jimmy Lai's security trial delayed over health concerns

-

Asia stocks mixed before US-Russia summit

-

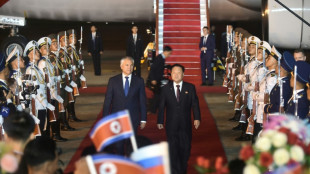

Putin hails North Korean troops as 'heroic' in letter to Kim

Putin hails North Korean troops as 'heroic' in letter to Kim

-

Fleeing the heat, tourists explore Rome at night, underground

-

Online cockfighting thrives in Philippines despite ban and murders

Online cockfighting thrives in Philippines despite ban and murders

-

Keeping cool with colours -- Vienna museum paints asphalt to fight heat

-

Raising the bar: Nepal's emerging cocktail culture

Raising the bar: Nepal's emerging cocktail culture

-

El Salvador plans 600 mass trials for suspected gang members

-

Trump's tariffs drown Brazil's fish industry

Trump's tariffs drown Brazil's fish industry

-

Hong Kong tycoon Jimmy Lai's collusion trial resumes after delay

-

Britain's Princess Anne turns 75 with typically minimal fuss

Britain's Princess Anne turns 75 with typically minimal fuss

-

Japan posts modest growth despite US tariffs

-

Rugby Championship kicks off amid uncertain future

Rugby Championship kicks off amid uncertain future

-

Israeli far-right minister backs contentious West Bank settlement plan

-

Hot putter carries MacIntyre to three-shot lead at BMW Championship

Hot putter carries MacIntyre to three-shot lead at BMW Championship

-

'Ridiculous': How Washington residents view the new troops in town

-

Global plastic pollution treaty talks extended in 'haze' of confusion

Global plastic pollution treaty talks extended in 'haze' of confusion

-

Trump's tariffs have not reduced Panama Canal traffic -- yet

-

YouTube turns to AI to spot children posing as adults

YouTube turns to AI to spot children posing as adults

-

Sky's the limit for Duplantis ahead of 'super-sick' Tokyo worlds

Trump tariff rollercoaster complicates ECB rate call

US President Donald Trump's on-and-off tariffs have clouded the picture for European Central Bank policymakers meeting this week to decide whether to lower eurozone interest rates again.

After five straight cuts that brought the central bank's borrowing costs down from historic highs, the ECB looked open to declaring a pause in its monetary policy easing on Thursday.

But Trump's move to impose sweeping tariffs on the European Union and the rest of the world increased the chances of another reduction in interest rates, according to observers.

Even after the US president last week announced a 90-day pause in the implementation of higher duties on many countries -- leaving just a global baseline 10 percent tariff intact -- the probability seemed higher.

"[T]he situation can change in just a few weeks," said Ulrike Kastens, economist at asset manager DWS.

ECB rate-setters gathering in Frankfurt to discuss their next steps were being "caught up in the new trade policy reality", Kastens said.

The impact of possible US tariffs and any retaliation from the European side had increased the "downside risks" for the eurozone economy in 2025, she said.

"The central bank is likely to counter with a further reduction in the deposit rate."

Speaking in Warsaw Friday after talks with EU finance ministers, ECB chief Christine Lagarde said the central bank was "always ready to use the instruments that it has available" should tariffs threaten financial stability.

- 'Big impact' -

Having peaked at four percent as consumer prices soared in the wake of the coronavirus pandemic and the Russian inflation of Ukraine, the ECB has brought its benchmark deposit rate down to 2.5 percent.

Inflation in the eurozone has settled towards the ECB's two-percent target, coming in at 2.2 percent in March.

Whether tariffs that made certain imports more expensive would reignite inflation in the 20-member currency bloc would be a "key question" for policymakers, Kastens said.

But the impact was more likely to be disinflationary, she ventured, as a drop in global activity brought down oil prices and cheaper goods destined for the US were diverted to Europe.

Capital Economics analyst Andrew Kenningham agreed, saying Trump's tariff announcements would have a "big impact on the world economy" despite the pause.

"The shock to confidence, trade and investment has increased downside risks to activity," said Kenningham.

"As a result the ECB seems certain to cuts interest rates by 25 basis points."

The conditions created by Trump would eventually encourage the ECB to lower its deposit rate below two percent, all the way to 1.75 percent, Kenningham predicted.

- 'Worst nightmare' -

The advent of a potential trade war looked like "Europe's worst economic nightmare just came true", ING bank analyst Carsten Brzeski said, before Trump made his U-turn.

The stay of execution from Washington prompted Brussels to delay its own plans for retaliation, opening the door for negotiations between the United States and the EU.

Whether the temporary reprieve would calm policymakers' fears remained to be seen.

Observers will listen closely to Lagarde's comments following Thursday's rates announcement to try and gauge the mood within the central bank.

After the last meeting in March, the ECB president said there were "risks all over and uncertainty all over", a reference not just to tariffs but an increasingly turbulent global context.

The "extreme" lack of clarity would prompt the bank to stick to its data-dependent, meeting-by-meeting approach for the time being, Kastens said.

"Further interest rate cuts cannot be ruled out in the short term," she said, but the scope was limited by a promised major fiscal boost in Germany, the eurozone's biggest member.

French central bank chief Francois Villeroy de Galhau, who is also an ECB rate-setter, told newspaper Midi Libre earlier this month that the approaching "victory over inflation" would provide a strong anchor of stability.

"This may give us more confidence to lower our interest rates again soon," he said, albeit before the latest twists in the tariff saga.

L.Hussein--SF-PST