-

Deadly monsoon rains lash Pakistan, killing dozens

Deadly monsoon rains lash Pakistan, killing dozens

-

Frank urges 'real' Spurs fans to back Tel after racist abuse

-

Japan's emperor expresses 'deep remorse' 80 years after WWII

Japan's emperor expresses 'deep remorse' 80 years after WWII

-

Chelsea boss Maresca eager to sign new defender as Colwill cover

-

Liverpool target Isak controls his Newcastle future: Howe

Liverpool target Isak controls his Newcastle future: Howe

-

New-look Liverpool kick off Premier League season after spending spree

-

Football and falls as first humanoid robot games launch in China

Football and falls as first humanoid robot games launch in China

-

'Like hell': Indoor heat overwhelms Saudi Arabia's cooks, bakers

-

On VJ day, king pays tribute to UK veterans, warns of war's 'true cost'

On VJ day, king pays tribute to UK veterans, warns of war's 'true cost'

-

Stocks mostly higher before US-Russia summit

-

Bayern's Bundesliga crown up for grabs after rocky summer

Bayern's Bundesliga crown up for grabs after rocky summer

-

Arsenal face revamped Man Utd as new-look Liverpool open Premier League season

-

South Korea president vows to build 'military trust' with North

South Korea president vows to build 'military trust' with North

-

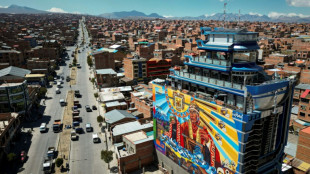

'Never again': Indigenous Bolivians sour on socialism

-

Indonesia's president touts economy, social welfare drive

Indonesia's president touts economy, social welfare drive

-

World plastic pollution treaty talks collapse with no deal

-

Facing US tariffs, India's Modi vows self-reliance

Facing US tariffs, India's Modi vows self-reliance

-

Trump to meet Putin in high-stakes Alaska summit

-

Indian rescuers scour debris after 60 killed in flood

Indian rescuers scour debris after 60 killed in flood

-

Ivory Coast village reburies relatives as rising sea engulfs cemetery

-

Stressed UK teens seek influencers' help for exams success

Stressed UK teens seek influencers' help for exams success

-

National Guard deploys 800 personnel for DC mission, says Pentagon

-

Japan emperor expresses 'deep remorse' 80 years after WWII

Japan emperor expresses 'deep remorse' 80 years after WWII

-

With waters at 32C, Mediterranean tropicalisation shifts into high gear

-

Historic Swedish church being moved as giant mine casts growing shadow

Historic Swedish church being moved as giant mine casts growing shadow

-

Malawi's restless youth challenged to vote in September polls

-

Indonesian roof tilers flex muscles to keep local industry alive

Indonesian roof tilers flex muscles to keep local industry alive

-

World's first humanoid robot games begin in China

-

Scott Barrett returns to lead All Blacks against Argentina

Scott Barrett returns to lead All Blacks against Argentina

-

Five things to know about Nigeria's oil sector

-

New compromise but still no deal at plastic pollution talks

New compromise but still no deal at plastic pollution talks

-

France's Cernousek seizes lead at LPGA Portland Classic

-

Putin-Trump summit: What each side wants

Putin-Trump summit: What each side wants

-

Desperate Myanmar villagers scavenge for food as hunger bites

-

Qualifier Atmane stuns Rune to set up Sinner semi-final in Cincinnati

Qualifier Atmane stuns Rune to set up Sinner semi-final in Cincinnati

-

Hong Kong tycoon Jimmy Lai's security trial delayed over health concerns

-

Asia stocks mixed before US-Russia summit

Asia stocks mixed before US-Russia summit

-

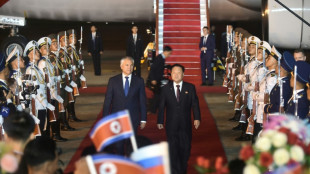

Putin hails North Korean troops as 'heroic' in letter to Kim

-

Fleeing the heat, tourists explore Rome at night, underground

Fleeing the heat, tourists explore Rome at night, underground

-

Online cockfighting thrives in Philippines despite ban and murders

-

Keeping cool with colours -- Vienna museum paints asphalt to fight heat

Keeping cool with colours -- Vienna museum paints asphalt to fight heat

-

Raising the bar: Nepal's emerging cocktail culture

-

El Salvador plans 600 mass trials for suspected gang members

El Salvador plans 600 mass trials for suspected gang members

-

Trump's tariffs drown Brazil's fish industry

-

Hong Kong tycoon Jimmy Lai's collusion trial resumes after delay

Hong Kong tycoon Jimmy Lai's collusion trial resumes after delay

-

Britain's Princess Anne turns 75 with typically minimal fuss

-

Japan posts modest growth despite US tariffs

Japan posts modest growth despite US tariffs

-

Rugby Championship kicks off amid uncertain future

-

Israeli far-right minister backs contentious West Bank settlement plan

Israeli far-right minister backs contentious West Bank settlement plan

-

Hot putter carries MacIntyre to three-shot lead at BMW Championship

JPMorgan Chase sees 'considerable turbulence' facing economy as profits rise

JPMorgan Chase CEO Jamie Dimon said Friday that US Treasury bonds remained a safe place in an unpredictable world as he warned of "considerable turbulence" facing the economy.

The big US bank reported higher quarterly profits in results overshadowed by upheaval in financial markets as equity markets have churned amid gyrations in the US Treasury market and a falling US dollar.

US bond yields were up again early Friday, indicating weaker demand for US Treasuries, long considered a safe haven asset.

Dimon rejected the notion that US Treasuries were no longer a haven, but acknowledged an impact from recent market volatility.

"It does change the nature a little bit from the certainty point of view," Dimon said in a conference call with reporters.

"But it doesn't take away the fact that if you're going to invest your money in something, America is still a pretty, pretty good place in this turbulent world."

The volatility in the Treasury market has been accompanied by a drop in the US dollar that analysts attribute to a weakening US economic outlook and to questions about President Trump's fluctuating trade policy.

Dimon's comments came as the giant US bank reported first-quarter profits of $14.6 billion, up nine percent from the year-ago level in results that topped analyst expectations.

Revenues were $45.3 billion, up eight percent.

The lender had a steady performance across businesses, with the biggest profits coming from its corporate and investment bank.

Equity markets revenues soared 48 percent as the bank pointed to an especially strong performance in derivatives "amid elevated levels of volatility," JPMorgan said in a press release.

The bank also scored higher revenues in trades connected to interest rates and commodities.

Bank officials said they had not seen signs of a steep change in consumer behavior due to tariffs. But they said there had been some move by consumers to "pull forward" spending on some items ahead of tariffs.

- Becoming more cautious -

Dimon reported hearing "anecdotal" evidence that companies are becoming more reticent about deals.

Dimon is hearing that people "are being very cautious about investment," he said. "What you see in the actual data coming forward, I don't know."

Dimon in recent days has warned of an increased risk of recession due to Trump's aggressive trade policy, with China responding to Trump's latest tariff hike with an escalation of its own.

In an earnings press release, Dimon described the economy as "facing considerable turbulence (including geopolitics), with the potential positives of tax reform and deregulation and the potential negatives of tariffs and 'trade wars,' ongoing sticky inflation, high fiscal deficits and still rather high asset prices and volatility." Dimon said.

JPMorgan set aside additional reserves of $973 million in case of loan defaults, a sign that it is preparing for a potentially weaker economy. Overall provisions rose 75 percent from the year-ago level.

The additional reserves reflect that JPMorgan has adjusted its economic scenario "to add a little bit of downside risk and increase the uncertainty," said Chief Financial Officer Jeremy Barnum.

Shares jumped 3.2 percent in early trading.

L.AbuTayeh--SF-PST