-

Deadly monsoon rains lash Pakistan, killing dozens

Deadly monsoon rains lash Pakistan, killing dozens

-

Frank urges 'real' Spurs fans to back Tel after racist abuse

-

Japan's emperor expresses 'deep remorse' 80 years after WWII

Japan's emperor expresses 'deep remorse' 80 years after WWII

-

Chelsea boss Maresca eager to sign new defender as Colwill cover

-

Liverpool target Isak controls his Newcastle future: Howe

Liverpool target Isak controls his Newcastle future: Howe

-

New-look Liverpool kick off Premier League season after spending spree

-

Football and falls as first humanoid robot games launch in China

Football and falls as first humanoid robot games launch in China

-

'Like hell': Indoor heat overwhelms Saudi Arabia's cooks, bakers

-

On VJ day, king pays tribute to UK veterans, warns of war's 'true cost'

On VJ day, king pays tribute to UK veterans, warns of war's 'true cost'

-

Stocks mostly higher before US-Russia summit

-

Bayern's Bundesliga crown up for grabs after rocky summer

Bayern's Bundesliga crown up for grabs after rocky summer

-

Arsenal face revamped Man Utd as new-look Liverpool open Premier League season

-

South Korea president vows to build 'military trust' with North

South Korea president vows to build 'military trust' with North

-

'Never again': Indigenous Bolivians sour on socialism

-

Indonesia's president touts economy, social welfare drive

Indonesia's president touts economy, social welfare drive

-

World plastic pollution treaty talks collapse with no deal

-

Facing US tariffs, India's Modi vows self-reliance

Facing US tariffs, India's Modi vows self-reliance

-

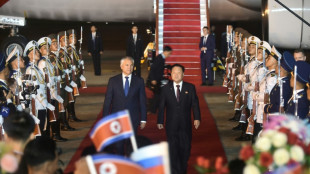

Trump to meet Putin in high-stakes Alaska summit

-

Indian rescuers scour debris after 60 killed in flood

Indian rescuers scour debris after 60 killed in flood

-

Ivory Coast village reburies relatives as rising sea engulfs cemetery

-

Stressed UK teens seek influencers' help for exams success

Stressed UK teens seek influencers' help for exams success

-

National Guard deploys 800 personnel for DC mission, says Pentagon

-

Japan emperor expresses 'deep remorse' 80 years after WWII

Japan emperor expresses 'deep remorse' 80 years after WWII

-

With waters at 32C, Mediterranean tropicalisation shifts into high gear

-

Historic Swedish church being moved as giant mine casts growing shadow

Historic Swedish church being moved as giant mine casts growing shadow

-

Malawi's restless youth challenged to vote in September polls

-

Indonesian roof tilers flex muscles to keep local industry alive

Indonesian roof tilers flex muscles to keep local industry alive

-

World's first humanoid robot games begin in China

-

Scott Barrett returns to lead All Blacks against Argentina

Scott Barrett returns to lead All Blacks against Argentina

-

Five things to know about Nigeria's oil sector

-

New compromise but still no deal at plastic pollution talks

New compromise but still no deal at plastic pollution talks

-

France's Cernousek seizes lead at LPGA Portland Classic

-

Putin-Trump summit: What each side wants

Putin-Trump summit: What each side wants

-

Desperate Myanmar villagers scavenge for food as hunger bites

-

Qualifier Atmane stuns Rune to set up Sinner semi-final in Cincinnati

Qualifier Atmane stuns Rune to set up Sinner semi-final in Cincinnati

-

Hong Kong tycoon Jimmy Lai's security trial delayed over health concerns

-

Asia stocks mixed before US-Russia summit

Asia stocks mixed before US-Russia summit

-

Putin hails North Korean troops as 'heroic' in letter to Kim

-

Fleeing the heat, tourists explore Rome at night, underground

Fleeing the heat, tourists explore Rome at night, underground

-

Online cockfighting thrives in Philippines despite ban and murders

-

Keeping cool with colours -- Vienna museum paints asphalt to fight heat

Keeping cool with colours -- Vienna museum paints asphalt to fight heat

-

Raising the bar: Nepal's emerging cocktail culture

-

El Salvador plans 600 mass trials for suspected gang members

El Salvador plans 600 mass trials for suspected gang members

-

Trump's tariffs drown Brazil's fish industry

-

Hong Kong tycoon Jimmy Lai's collusion trial resumes after delay

Hong Kong tycoon Jimmy Lai's collusion trial resumes after delay

-

Britain's Princess Anne turns 75 with typically minimal fuss

-

Japan posts modest growth despite US tariffs

Japan posts modest growth despite US tariffs

-

Rugby Championship kicks off amid uncertain future

-

Israeli far-right minister backs contentious West Bank settlement plan

Israeli far-right minister backs contentious West Bank settlement plan

-

Hot putter carries MacIntyre to three-shot lead at BMW Championship

Trump's trade whiplash sends dollar into tailspin

The mighty dollar is sliding sharply as President Donald Trump's turbulent trade agenda has battered US credibility in global markets and fanned fears of a self-inflicted economic downturn.

The US currency fell by another two percent on Friday to hit a three-year low against the euro to $1.14, before paring back some losses.

A weaker dollar could drive inflation in the United States by making imports more expensive, squeeze the profit margins of companies and make US markets less attractive to foreign investors.

It has been a sharp reversal of fortune for the greenback, which had soared in the wake of Trump's November election victory.

Back then, there was talk that the dollar's ascent could bring the euro down to parity with the US currency as investors welcomed Trump's plans for tax cuts and smaller government.

"The US was really at its peak," recalled Adam Button of ForexLive. "Now it's slipping in dramatic fashion."

The euros has gained almost 10 percent against the dollar since Trump returned to the White House on January 20, when the currencies stood near parity at $1.04.

It was rocked in recent days by Trump's stop-start tariffs announcements: The US leader announced universal duties last week, only to implement but quickly remove some of the harshest ones this week.

"We don't have a lot of trade wars to look back on, especially in the last 90 years," Button said. "So modern markets have never dealt with this kind of shock."

- 'Damage done' -

George Saravelos, global head of foreign exchange research at Deutsche Bank, said that despite Trump's tariffs U-turn, "the damage to the USD (dollar) has been done".

"The market is re-assessing the structural attractiveness of the dollar as the world's global reserve currency and is undergoing a process of rapid de-dollarization," Saravelos said in a note to clients.

While Trump froze higher tariffs on scores of countries this week, he left a 10 percent universal duty that went into effect last week in place.

At the same time, he escalated a trade war with China, applying a 145 percent levy on goods from the world's second biggest economy, which retaliated on Friday with a 125 percent levy on US goods.

Some other Trump tariffs have also had staying power, such as sectoral levies on auto imports, steel and aluminium.

"Global recession is now our baseline forecast as higher tariffs and retaliatory measures take hold," said a JPMorgan Chase research note released Monday.

- Still strong -

Amid the unrest in financial markets, investors have turned to other assets such as gold and the Swiss franc, which have soared higher.

The movement against the dollar is "a bit of a momentum trade and a bit of an acknowledgement that the tone of US exceptionalism is being peeled back," said Briefing.com analyst Patrick O'Hare.

"You have foreign investors who are losing confidence in their US investments because of the policy volatility," O'Hare added.

Market watchers say it is too early to say whether the recent decline in the greenback portends any deeper shift.

The long-term health of the dollar is an evergreen topic of debate, and the currency has endured earlier moments of doubt.

O'Hare noted that the dollar is still "relatively strong" compared with its trading level at other times, including during the 2008 financial crisis.

X.AbuJaber--SF-PST