-

UK king, Starmer lead VJ Day tributes to WWII veterans, survivors

UK king, Starmer lead VJ Day tributes to WWII veterans, survivors

-

South Korean president vows to build 'military trust' with North

-

Macron vows to punish antisemitic 'hatred' after memorial tree cut down

Macron vows to punish antisemitic 'hatred' after memorial tree cut down

-

Hodgkinson happy to be back on track ahead of Tokyo worlds

-

Deadly monsoon rains lash Pakistan, killing dozens

Deadly monsoon rains lash Pakistan, killing dozens

-

Frank urges 'real' Spurs fans to back Tel after racist abuse

-

Japan's emperor expresses 'deep remorse' 80 years after WWII

Japan's emperor expresses 'deep remorse' 80 years after WWII

-

Chelsea boss Maresca eager to sign new defender as Colwill cover

-

Liverpool target Isak controls his Newcastle future: Howe

Liverpool target Isak controls his Newcastle future: Howe

-

New-look Liverpool kick off Premier League season after spending spree

-

Football and falls as first humanoid robot games launch in China

Football and falls as first humanoid robot games launch in China

-

'Like hell': Indoor heat overwhelms Saudi Arabia's cooks, bakers

-

On VJ day, king pays tribute to UK veterans, warns of war's 'true cost'

On VJ day, king pays tribute to UK veterans, warns of war's 'true cost'

-

Stocks mostly higher before US-Russia summit

-

Bayern's Bundesliga crown up for grabs after rocky summer

Bayern's Bundesliga crown up for grabs after rocky summer

-

Arsenal face revamped Man Utd as new-look Liverpool open Premier League season

-

South Korea president vows to build 'military trust' with North

South Korea president vows to build 'military trust' with North

-

'Never again': Indigenous Bolivians sour on socialism

-

Indonesia's president touts economy, social welfare drive

Indonesia's president touts economy, social welfare drive

-

World plastic pollution treaty talks collapse with no deal

-

Facing US tariffs, India's Modi vows self-reliance

Facing US tariffs, India's Modi vows self-reliance

-

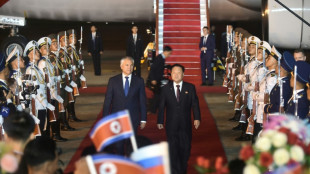

Trump to meet Putin in high-stakes Alaska summit

-

Indian rescuers scour debris after 60 killed in flood

Indian rescuers scour debris after 60 killed in flood

-

Ivory Coast village reburies relatives as rising sea engulfs cemetery

-

Stressed UK teens seek influencers' help for exams success

Stressed UK teens seek influencers' help for exams success

-

National Guard deploys 800 personnel for DC mission, says Pentagon

-

Japan emperor expresses 'deep remorse' 80 years after WWII

Japan emperor expresses 'deep remorse' 80 years after WWII

-

With waters at 32C, Mediterranean tropicalisation shifts into high gear

-

Historic Swedish church being moved as giant mine casts growing shadow

Historic Swedish church being moved as giant mine casts growing shadow

-

Malawi's restless youth challenged to vote in September polls

-

Indonesian roof tilers flex muscles to keep local industry alive

Indonesian roof tilers flex muscles to keep local industry alive

-

World's first humanoid robot games begin in China

-

Scott Barrett returns to lead All Blacks against Argentina

Scott Barrett returns to lead All Blacks against Argentina

-

Five things to know about Nigeria's oil sector

-

New compromise but still no deal at plastic pollution talks

New compromise but still no deal at plastic pollution talks

-

France's Cernousek seizes lead at LPGA Portland Classic

-

Putin-Trump summit: What each side wants

Putin-Trump summit: What each side wants

-

Desperate Myanmar villagers scavenge for food as hunger bites

-

Qualifier Atmane stuns Rune to set up Sinner semi-final in Cincinnati

Qualifier Atmane stuns Rune to set up Sinner semi-final in Cincinnati

-

Hong Kong tycoon Jimmy Lai's security trial delayed over health concerns

-

Asia stocks mixed before US-Russia summit

Asia stocks mixed before US-Russia summit

-

Putin hails North Korean troops as 'heroic' in letter to Kim

-

Fleeing the heat, tourists explore Rome at night, underground

Fleeing the heat, tourists explore Rome at night, underground

-

Online cockfighting thrives in Philippines despite ban and murders

-

Keeping cool with colours -- Vienna museum paints asphalt to fight heat

Keeping cool with colours -- Vienna museum paints asphalt to fight heat

-

Raising the bar: Nepal's emerging cocktail culture

-

El Salvador plans 600 mass trials for suspected gang members

El Salvador plans 600 mass trials for suspected gang members

-

Trump's tariffs drown Brazil's fish industry

-

Hong Kong tycoon Jimmy Lai's collusion trial resumes after delay

Hong Kong tycoon Jimmy Lai's collusion trial resumes after delay

-

Britain's Princess Anne turns 75 with typically minimal fuss

Stocks zoom higher as Trump delays painful tariffs

Stocks rocketed Thursday as a relief rally spread through markets after Donald Trump paused crippling tariffs on US partners, with Chinese investors even brushing off his decision to ramp up duties on Beijing to 125 percent.

The across-the-board gains tracked a blistering performance on Wall Street as the US president said he would delay for 90 days measures announced last week that set off a firestorm on trading floors and sparked global recession fears.

Trump said he would keep in place a basic levy of 10 percent on dozens of countries but upped the ante in his brutal trade war with superpower rival China by hitting it even harder after it retaliated.

China's own 84 percent retaliatory measures kicked in at 0401 GMT Thursday, later saying that the United States "goes against the whole world" with the measures and called on Washington to "meet halfway".

Trump made the decision to delay because investors were "jumping a little bit out of line", he said, after markets collapsed and US Treasuries -- considered the safest option in times of crisis -- showed signs of cracking.

People "were getting yippy, a little bit afraid", he added, referring to a term in sports to describe a loss of nerves.

The extra tariffs on Beijing, however, were "based on the lack of respect that China has shown to the world's markets", Trump said.

The president denied he had made a U-turn, telling reporters that "you have to be flexible".

And his top trade advisor Peter Navarro said: "This will go down in American history as the greatest trade negotiating day we have ever had.

"We're in a beautiful position for the next 90 days, we've got over 75 countries that are going to come in and negotiate with us and what they're going to have to do, without fail, is they're going to have to lower their non-tariff barriers."

Trump's shock announcement on his Truth Social network sparked a buying frenzy as Asian and European investors chased beaten-down stocks.

"Asia markets are flipping the switch -- from fear to euphoria -- as Trump throws a 90-day lifeline, pausing the reciprocal tariff barrage," said Stephen Innes at SPI Asset Management.

"We just witnessed one of the all-time bouncebacks -- and now, we look for Asia investors, much like their North American counterparts, to step in and buy the 'yips'."

Tokyo's Nikkei surged more than nine percent, while Taipei's 9.3 percent gain was its best rise on record -- after Monday's 9.7 percent drop represented its worst fall.

- 'Fear to euphoria' -

Hong Kong rallied more than two percent -- a third day of gains after collapsing more than 13 percent on Monday in its worst day since 1997 during the Asian financial crisis. Shanghai gained more than one percent.

The two markets have been given extra support by optimism that China will unveil fresh stimulus to support its economy.

Seoul, Singapore, Jakarta, Sydney, Saigon and Bangkok climbed between four and 6.6 percent. Manila and Wellington were also well in the positive territory.

In early trade, Paris and Frankfurt cruised more than six percent higher and London rallied more than four percent.

Tech firms were the standout performers, with Sony, Sharp, Panasonic and SoftBank chalking up double-digit gains, while airlines, car makers and casinos also enjoyed strong buying.

Gold surged almost three percent around $3,120 -- around $50 short of its record touched last month -- thanks to the weaker dollar and as the uncertainty saw investors rush into the safe haven.

Chihiro Ota, at SMBC Nikko Securities, said: "What happens now? If the US takes hardline stance (in negotiations), then the market would be disappointed. If it turns out that they can engage in talks, then it may create a room for (an upswing)."

US Treasury yields also edged down, after a successful auction of $38 billion in notes, said Briefing.com.

That eased pressure on the bond market, which had fanned worries investors were losing confidence in the United States.

However, observers warn the China-US standoff could mark a step towards a disengagement between the world's top two economies.

"The escalation of the trade war between the US and China suggests that a full trade decoupling is increasingly likely," said Mali Chivakul, emerging markets economist at J. Safra Sarasin bank.

"Even if we may see a de-escalation later, a decoupling could still be the result."

Trump's trade war is also causing a headache for the Federal Reserve as it weighs cutting interest rates to protect the economy or holding them to ward off the inflation many say tariffs will fuel.

Minutes from its March meeting, released Wednesday, showed members felt they "may face difficult trade-offs if inflation proved to be more persistent while the outlook for growth and employment weakened".

Oil prices dropped after bouncing more than four percent Wednesday, though they remain under pressure amid concerns about the global economy and its impact on demand.

- Key figures around 0810 GMT -

Tokyo - Nikkei 225: 9.1 percent at 34,609.00 (close)

Hong Kong - Hang Seng Index: UP 2.1 percent at 20,681.78 (close)

Shanghai - Composite: UP 1.2 percent at 3,223.64 (close)

London - FTSE 100: UP 4.7 percent at 8,042.33

Dollar/yen: DOWN at 146.50 yen from 147.82 yen on Wednesday

Euro/dollar: UP at $1.1012 from $1.0948

Pound/dollar: UP at $1.2870 from $1.2810

Euro/pound: UP at 85.55 pence from 85.45 pence

West Texas Intermediate: DOWN 2.0 percent at $61.11 per barrel

Brent North Sea Crude: DOWN 2.1 percent at $64.12 per barrel

New York - Dow: UP 7.9 percent at 40,608.45 (close)

M.AbuKhalil--SF-PST