-

UK king, Starmer lead VJ Day tributes to WWII veterans, survivors

UK king, Starmer lead VJ Day tributes to WWII veterans, survivors

-

South Korean president vows to build 'military trust' with North

-

Macron vows to punish antisemitic 'hatred' after memorial tree cut down

Macron vows to punish antisemitic 'hatred' after memorial tree cut down

-

Hodgkinson happy to be back on track ahead of Tokyo worlds

-

Deadly monsoon rains lash Pakistan, killing dozens

Deadly monsoon rains lash Pakistan, killing dozens

-

Frank urges 'real' Spurs fans to back Tel after racist abuse

-

Japan's emperor expresses 'deep remorse' 80 years after WWII

Japan's emperor expresses 'deep remorse' 80 years after WWII

-

Chelsea boss Maresca eager to sign new defender as Colwill cover

-

Liverpool target Isak controls his Newcastle future: Howe

Liverpool target Isak controls his Newcastle future: Howe

-

New-look Liverpool kick off Premier League season after spending spree

-

Football and falls as first humanoid robot games launch in China

Football and falls as first humanoid robot games launch in China

-

'Like hell': Indoor heat overwhelms Saudi Arabia's cooks, bakers

-

On VJ day, king pays tribute to UK veterans, warns of war's 'true cost'

On VJ day, king pays tribute to UK veterans, warns of war's 'true cost'

-

Stocks mostly higher before US-Russia summit

-

Bayern's Bundesliga crown up for grabs after rocky summer

Bayern's Bundesliga crown up for grabs after rocky summer

-

Arsenal face revamped Man Utd as new-look Liverpool open Premier League season

-

South Korea president vows to build 'military trust' with North

South Korea president vows to build 'military trust' with North

-

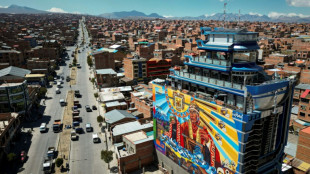

'Never again': Indigenous Bolivians sour on socialism

-

Indonesia's president touts economy, social welfare drive

Indonesia's president touts economy, social welfare drive

-

World plastic pollution treaty talks collapse with no deal

-

Facing US tariffs, India's Modi vows self-reliance

Facing US tariffs, India's Modi vows self-reliance

-

Trump to meet Putin in high-stakes Alaska summit

-

Indian rescuers scour debris after 60 killed in flood

Indian rescuers scour debris after 60 killed in flood

-

Ivory Coast village reburies relatives as rising sea engulfs cemetery

-

Stressed UK teens seek influencers' help for exams success

Stressed UK teens seek influencers' help for exams success

-

National Guard deploys 800 personnel for DC mission, says Pentagon

-

Japan emperor expresses 'deep remorse' 80 years after WWII

Japan emperor expresses 'deep remorse' 80 years after WWII

-

With waters at 32C, Mediterranean tropicalisation shifts into high gear

-

Historic Swedish church being moved as giant mine casts growing shadow

Historic Swedish church being moved as giant mine casts growing shadow

-

Malawi's restless youth challenged to vote in September polls

-

Indonesian roof tilers flex muscles to keep local industry alive

Indonesian roof tilers flex muscles to keep local industry alive

-

World's first humanoid robot games begin in China

-

Scott Barrett returns to lead All Blacks against Argentina

Scott Barrett returns to lead All Blacks against Argentina

-

Five things to know about Nigeria's oil sector

-

New compromise but still no deal at plastic pollution talks

New compromise but still no deal at plastic pollution talks

-

France's Cernousek seizes lead at LPGA Portland Classic

-

Putin-Trump summit: What each side wants

Putin-Trump summit: What each side wants

-

Desperate Myanmar villagers scavenge for food as hunger bites

-

Qualifier Atmane stuns Rune to set up Sinner semi-final in Cincinnati

Qualifier Atmane stuns Rune to set up Sinner semi-final in Cincinnati

-

Hong Kong tycoon Jimmy Lai's security trial delayed over health concerns

-

Asia stocks mixed before US-Russia summit

Asia stocks mixed before US-Russia summit

-

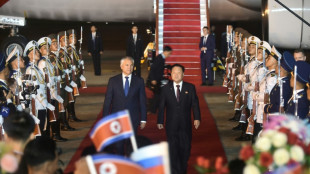

Putin hails North Korean troops as 'heroic' in letter to Kim

-

Fleeing the heat, tourists explore Rome at night, underground

Fleeing the heat, tourists explore Rome at night, underground

-

Online cockfighting thrives in Philippines despite ban and murders

-

Keeping cool with colours -- Vienna museum paints asphalt to fight heat

Keeping cool with colours -- Vienna museum paints asphalt to fight heat

-

Raising the bar: Nepal's emerging cocktail culture

-

El Salvador plans 600 mass trials for suspected gang members

El Salvador plans 600 mass trials for suspected gang members

-

Trump's tariffs drown Brazil's fish industry

-

Hong Kong tycoon Jimmy Lai's collusion trial resumes after delay

Hong Kong tycoon Jimmy Lai's collusion trial resumes after delay

-

Britain's Princess Anne turns 75 with typically minimal fuss

US stocks soar on Trump tariff reversal, oil prices jump

Wall Street stocks rocketed higher Wednesday following President Trump's shock move to pause many new tariffs, lifting an equity market beaten down by days of losses amid rising recession worries.

The catalyst came around 1720 GMT when Trump announced a 90-day pause on the most onerous new tariffs for every country except China, which was targeted with a whopping 125 percent levy.

Within moments of Trump's social media announcement, the Dow index surged ahead around 2,500 points along the way to a nearly eight-percent gain on the session.

The tech-rich Nasdaq won 12.2 percent to notch its best day in 24 years.

Oil prices jumped more than four percent while the dollar also strengthened.

The reversals followed another down day on European bourses reflecting worsening fears of a US recession and global slowdown, in part due to expectations that widespread trade wars would reignite inflation.

Instead of the onerous tariff levels unveiled last week during Trump's "Liberation Day" event, affected US trading partners excluding China would face a 10 percent tariff rate, temporarily reverting to a level that took effect over the weekend. That move had already roiled markets.

Trump singled out the world's second-biggest economy however, saying its tariff rate would be raised to a prohibitive 125 percent "based on the lack of respect that China has shown to the world's markets."

Trump denied that he had backtracked on the tariffs, telling reporters that "you have to be flexible."

"People were jumping a little bit out of line, they were getting yippy, a little bit afraid," Trump said. "Yippy" is a term in sports to describe a loss of nerves.

"When markets are pricing in worst-case scenarios, it doesn't take much good news to turn that opinion around," said Art Hogan of B. Riley Wealth Management.

Hogan added that investors were waiting for any sense of a more reasonable trade process, saying this situation might "be less of a drag on economic activity and earnings."

Sam Stovall, chief investment strategist at CFRA Research, said most of the equity purchases Wednesday likely came from short-term investors looking for quick gains or traders eager to cover positions purchased prior to the shift in fortune.

Investment advisors typically advise clients to avoid trading during periods of great upheaval when even major losses can be reversed if a stockholder's approach is that of a long-term investor.

Retail investors "will want to see whether this story has legs," Stovall said. "Investors and clients have been whipsawed and they don't like it."

- Bond market volatility -

A secondary factor in Wednesday's positive US session was the successful auction of $38 billion in US Treasury notes, said Briefing.com.

Volatility in the US bond market, including a jump in yields over the last week, has rattled investors, prompting talk that US Treasuries could be losing their status as a safe haven asset.

Trump's reversal lifted the entire Dow index with Nvidia the biggest gainer at 18.7 percent. Both Apple and Boeing piled on more than 15 percent, while Disney, Goldman Sachs and Nike were among the names winning more than 10 percent.

Earlier, European bourses suffered another down day as the European Union announced reprisals for steel and aluminum tariffs that entered force last month, targeting more than 20 billion euros ($22 billion) of US products including soybeans, motorcycles and beauty products.

Most Asian equities markets fell back into the red. Tokyo closed down 3.9 percent.

- Key figures around 2030 GMT -

New York - Dow: UP 7.9 percent at 40,608.45 (close)

New York - S&P 500: UP 9.5 percent at 55456.90 (close)

New York - Nasdaq Composite: UP 12.2 percent at 17,124.97 (close)

London - FTSE 100: DOWN 2.9 percent at 7,679.48 (close)

Paris - CAC 40: DOWN 3.3 percent at 6,863.02 (close)

Frankfurt - DAX: DOWN 3.0 percent at 19,670.88 (close)

Tokyo - Nikkei 225: DOWN 3.9 percent at 31,714.03 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 20,264.49 (close)

Shanghai - Composite: UP 1.3 percent at 3,186.81 (close)

Euro/dollar: DOWN at $1.0948 from $1.0958

Pound/dollar: UP at $1.2810 from $1.2765

Dollar/yen: DOWN at 147.82 yen from 146.27 yen on Tuesday

Euro/pound: DOWN at 85.45 pence from 85.84 pence

West Texas Intermediate: UP 4.7 percent at $62.35 per barrel

Brent North Sea Crude: UP 4.2 percent at $65.48 per barrel

burs-jmb/aha

D.AbuRida--SF-PST