-

UK king, Starmer lead VJ Day tributes to WWII veterans, survivors

UK king, Starmer lead VJ Day tributes to WWII veterans, survivors

-

South Korean president vows to build 'military trust' with North

-

Macron vows to punish antisemitic 'hatred' after memorial tree cut down

Macron vows to punish antisemitic 'hatred' after memorial tree cut down

-

Hodgkinson happy to be back on track ahead of Tokyo worlds

-

Deadly monsoon rains lash Pakistan, killing dozens

Deadly monsoon rains lash Pakistan, killing dozens

-

Frank urges 'real' Spurs fans to back Tel after racist abuse

-

Japan's emperor expresses 'deep remorse' 80 years after WWII

Japan's emperor expresses 'deep remorse' 80 years after WWII

-

Chelsea boss Maresca eager to sign new defender as Colwill cover

-

Liverpool target Isak controls his Newcastle future: Howe

Liverpool target Isak controls his Newcastle future: Howe

-

New-look Liverpool kick off Premier League season after spending spree

-

Football and falls as first humanoid robot games launch in China

Football and falls as first humanoid robot games launch in China

-

'Like hell': Indoor heat overwhelms Saudi Arabia's cooks, bakers

-

On VJ day, king pays tribute to UK veterans, warns of war's 'true cost'

On VJ day, king pays tribute to UK veterans, warns of war's 'true cost'

-

Stocks mostly higher before US-Russia summit

-

Bayern's Bundesliga crown up for grabs after rocky summer

Bayern's Bundesliga crown up for grabs after rocky summer

-

Arsenal face revamped Man Utd as new-look Liverpool open Premier League season

-

South Korea president vows to build 'military trust' with North

South Korea president vows to build 'military trust' with North

-

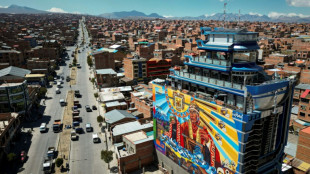

'Never again': Indigenous Bolivians sour on socialism

-

Indonesia's president touts economy, social welfare drive

Indonesia's president touts economy, social welfare drive

-

World plastic pollution treaty talks collapse with no deal

-

Facing US tariffs, India's Modi vows self-reliance

Facing US tariffs, India's Modi vows self-reliance

-

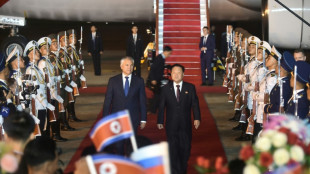

Trump to meet Putin in high-stakes Alaska summit

-

Indian rescuers scour debris after 60 killed in flood

Indian rescuers scour debris after 60 killed in flood

-

Ivory Coast village reburies relatives as rising sea engulfs cemetery

-

Stressed UK teens seek influencers' help for exams success

Stressed UK teens seek influencers' help for exams success

-

National Guard deploys 800 personnel for DC mission, says Pentagon

-

Japan emperor expresses 'deep remorse' 80 years after WWII

Japan emperor expresses 'deep remorse' 80 years after WWII

-

With waters at 32C, Mediterranean tropicalisation shifts into high gear

-

Historic Swedish church being moved as giant mine casts growing shadow

Historic Swedish church being moved as giant mine casts growing shadow

-

Malawi's restless youth challenged to vote in September polls

-

Indonesian roof tilers flex muscles to keep local industry alive

Indonesian roof tilers flex muscles to keep local industry alive

-

World's first humanoid robot games begin in China

-

Scott Barrett returns to lead All Blacks against Argentina

Scott Barrett returns to lead All Blacks against Argentina

-

Five things to know about Nigeria's oil sector

-

New compromise but still no deal at plastic pollution talks

New compromise but still no deal at plastic pollution talks

-

France's Cernousek seizes lead at LPGA Portland Classic

-

Putin-Trump summit: What each side wants

Putin-Trump summit: What each side wants

-

Desperate Myanmar villagers scavenge for food as hunger bites

-

Qualifier Atmane stuns Rune to set up Sinner semi-final in Cincinnati

Qualifier Atmane stuns Rune to set up Sinner semi-final in Cincinnati

-

Hong Kong tycoon Jimmy Lai's security trial delayed over health concerns

-

Asia stocks mixed before US-Russia summit

Asia stocks mixed before US-Russia summit

-

Putin hails North Korean troops as 'heroic' in letter to Kim

-

Fleeing the heat, tourists explore Rome at night, underground

Fleeing the heat, tourists explore Rome at night, underground

-

Online cockfighting thrives in Philippines despite ban and murders

-

Keeping cool with colours -- Vienna museum paints asphalt to fight heat

Keeping cool with colours -- Vienna museum paints asphalt to fight heat

-

Raising the bar: Nepal's emerging cocktail culture

-

El Salvador plans 600 mass trials for suspected gang members

El Salvador plans 600 mass trials for suspected gang members

-

Trump's tariffs drown Brazil's fish industry

-

Hong Kong tycoon Jimmy Lai's collusion trial resumes after delay

Hong Kong tycoon Jimmy Lai's collusion trial resumes after delay

-

Britain's Princess Anne turns 75 with typically minimal fuss

Stocks volatile, oil plunges as trade war cranks higher

Wall Street rose but European and Asian stock markets tumbled along with oil on Wednesday as President Donald Trump's trade war cranked up a notch.

US President Donald Trump's sweeping tariffs against trading partners kicked in, triggering strong retaliation from China which slapped a higher 84-percent levy on US goods.

The EU announced reprisals for steel and aluminium tariffs that entered force last month, targeting more than 20 billion euros ($22 billion) of US products including soybeans, motorcycles and beauty products.

Growing fears of weakened demand sent oil prices to four-year lows, with international benchmark Brent North Sea crude briefly dropping under $60.

Paris and Frankfurt fell more than two percent, as goods from the European Union now face a 20 percent tariff when entering the United States.

London slumped 2.1 percent, with Britain having been hit with a 10 percent levy on Saturday.

Most Asian equities markets fell back into the red -- Tokyo closed down 3.9 percent.

Wall Street's main indices opened mixed but then pushed solidly higher, with Trump urging calm.

"BE COOL! Everything is going to work out well. The USA will be bigger and better than ever before!" Trump posted on his Truth Social network.

But any hopes of a last minute roll-back on tariffs were dashed as the United States earlier hit China -- its major trading partner -- with tariffs now reaching 104 percent.

"The world's largest and second largest economies are now locked in a trade war, and neither nation seems willing to back down," said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

Speculation that Beijing will unveil stimulus measures helped Shanghai and Hong Kong stocks buck the downward trend in Asian equities.

Pharmaceutical firms took a heavy hit after Trump said he would be announcing a major levy on the sector.

Europe's most valuable company, weight-loss drug maker Novo Nordisk, and British pharmaceutical giant AstraZeneca both fell around six percent.

- Bond yields rise -

"Perhaps even more alarmingly, US Treasury markets are also experiencing an incredibly aggressive selloff... adding to the evidence that they're losing their traditional haven status," said Jim Reid, managing director at Deutsche Bank.

The sharp rise in yields on US government bonds triggered similar increases to borrowing costs in the UK and Japan, as expectations for global growth and spending diminished.

"It feels like no asset class has been spared as investors continue to price in a growing probability of a US recession," Reid added.

The rising yields may be an indication that investors need to sell bonds to cover losing positions in equity markets, which have fallen sharply in recent weeks.

"When a few asset classes come under pressure, losses can pile up for investors and traders who are then forced to sell other investments including haven assets like government bonds," said XTB research director Kathleen Brooks.

Foreign exchange markets were similarly rattled on Wednesday -- Beijing has allowed the yuan to weaken to a record low against the dollar, while the South Korean won also hit its weakest since 2009 during the global financial crisis.

The dollar took a knock, while the yen rose more than one percent.

- Key figures around 1400 GMT -

New York - Dow: UP 0.8 percent at 37,950.03 points

New York - S&P 500: UP 1.2 percent at 5,043.39

New York - Nasdaq Composite: UP 2.1 percent at 15,586.93

London - FTSE 100: DOWN 2.1 percent at 7,747.28

Paris - CAC 40: DOWN 2.4 percent at 6,932.91

Frankfurt - DAX: DOWN 2.1 percent at 19,864.30

Tokyo - Nikkei 225: DOWN 3.9 percent at 31,714.03 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 20,264.49 (close)

Shanghai - Composite: UP 1.3 percent at 3,186.81 (close)

Euro/dollar: UP at $1.1041 from $1.0959

Pound/dollar: UP at $1.2780 from $1.2766

Dollar/yen: DOWN at 145.05 yen from 146.23 yen on Tuesday

Euro/pound: UP at 86.39 pence from 85.78 pence

West Texas Intermediate: DOWN 3.7 percent at $57.39 per barrel

Brent North Sea Crude: DOWN 3.7 percent at $60.50 per barrel

burs-rl/lth

K.AbuDahab--SF-PST