-

Bethell to become England's youngest cricket captain against Ireland

Bethell to become England's youngest cricket captain against Ireland

-

Marc Marquez seeks elusive first win in Austria

-

Trump, Putin head for high-stakes Alaska summit

Trump, Putin head for high-stakes Alaska summit

-

Brazil court to rule from Sept 2 in Bolsonaro coup trial

-

Deadline looms to avert Air Canada strike

Deadline looms to avert Air Canada strike

-

Spain on heat alert and 'very high to extreme' fire risk

-

Taliban mark fourth year in power in Afghanistan

Taliban mark fourth year in power in Afghanistan

-

Grand Slam Track won't happen in 2026 till athletes paid for 2025

-

Man City boss Guardiola wants to keep Tottenham target Savinho

Man City boss Guardiola wants to keep Tottenham target Savinho

-

No Grand Slam Track in 2026 till athletes paid for 2025: Johnson

-

Macron decries antisemitic 'hatred' after memorial tree cut down

Macron decries antisemitic 'hatred' after memorial tree cut down

-

'Doomsday' monsoon rains lash Pakistan, killing almost 200 people

-

Arteta hits back at criticism of Arsenal captain Odegaard

Arteta hits back at criticism of Arsenal captain Odegaard

-

Leeds sign former Everton striker Calvert-Lewin

-

'Obsessed' Sesko will star for Man Utd says Amorim

'Obsessed' Sesko will star for Man Utd says Amorim

-

Deadly monsoon rains lash Pakistan, killing nearly 170

-

Lyles hints at hitting Olympic form before Thompson re-match

Lyles hints at hitting Olympic form before Thompson re-match

-

Italian authorities try to identify Lampedusa capsize victims

-

UK king, Starmer lead VJ Day tributes to WWII veterans, survivors

UK king, Starmer lead VJ Day tributes to WWII veterans, survivors

-

South Korean president vows to build 'military trust' with North

-

Macron vows to punish antisemitic 'hatred' after memorial tree cut down

Macron vows to punish antisemitic 'hatred' after memorial tree cut down

-

Hodgkinson happy to be back on track ahead of Tokyo worlds

-

Deadly monsoon rains lash Pakistan, killing dozens

Deadly monsoon rains lash Pakistan, killing dozens

-

Frank urges 'real' Spurs fans to back Tel after racist abuse

-

Japan's emperor expresses 'deep remorse' 80 years after WWII

Japan's emperor expresses 'deep remorse' 80 years after WWII

-

Chelsea boss Maresca eager to sign new defender as Colwill cover

-

Liverpool target Isak controls his Newcastle future: Howe

Liverpool target Isak controls his Newcastle future: Howe

-

New-look Liverpool kick off Premier League season after spending spree

-

Football and falls as first humanoid robot games launch in China

Football and falls as first humanoid robot games launch in China

-

'Like hell': Indoor heat overwhelms Saudi Arabia's cooks, bakers

-

On VJ day, king pays tribute to UK veterans, warns of war's 'true cost'

On VJ day, king pays tribute to UK veterans, warns of war's 'true cost'

-

Stocks mostly higher before US-Russia summit

-

Bayern's Bundesliga crown up for grabs after rocky summer

Bayern's Bundesliga crown up for grabs after rocky summer

-

Arsenal face revamped Man Utd as new-look Liverpool open Premier League season

-

South Korea president vows to build 'military trust' with North

South Korea president vows to build 'military trust' with North

-

'Never again': Indigenous Bolivians sour on socialism

-

Indonesia's president touts economy, social welfare drive

Indonesia's president touts economy, social welfare drive

-

World plastic pollution treaty talks collapse with no deal

-

Facing US tariffs, India's Modi vows self-reliance

Facing US tariffs, India's Modi vows self-reliance

-

Trump to meet Putin in high-stakes Alaska summit

-

Indian rescuers scour debris after 60 killed in flood

Indian rescuers scour debris after 60 killed in flood

-

Ivory Coast village reburies relatives as rising sea engulfs cemetery

-

Stressed UK teens seek influencers' help for exams success

Stressed UK teens seek influencers' help for exams success

-

National Guard deploys 800 personnel for DC mission, says Pentagon

-

Japan emperor expresses 'deep remorse' 80 years after WWII

Japan emperor expresses 'deep remorse' 80 years after WWII

-

With waters at 32C, Mediterranean tropicalisation shifts into high gear

-

Historic Swedish church being moved as giant mine casts growing shadow

Historic Swedish church being moved as giant mine casts growing shadow

-

Malawi's restless youth challenged to vote in September polls

-

Indonesian roof tilers flex muscles to keep local industry alive

Indonesian roof tilers flex muscles to keep local industry alive

-

World's first humanoid robot games begin in China

| CMSD | 0.28% | 23.3555 | $ | |

| RBGPF | 0% | 73.08 | $ | |

| BCC | -0.08% | 86.55 | $ | |

| SCS | -0.68% | 16.09 | $ | |

| NGG | -0.13% | 71.465 | $ | |

| RELX | 0.5% | 47.93 | $ | |

| BCE | 1.03% | 25.635 | $ | |

| RIO | 0.44% | 61.31 | $ | |

| RYCEF | -2.19% | 14.63 | $ | |

| BTI | -0.45% | 57.16 | $ | |

| VOD | 0.3% | 11.675 | $ | |

| BP | 1.28% | 34.585 | $ | |

| AZN | 0.68% | 79.005 | $ | |

| GSK | 0.41% | 38.96 | $ | |

| JRI | 0.4% | 13.33 | $ | |

| CMSC | 0.19% | 23.135 | $ |

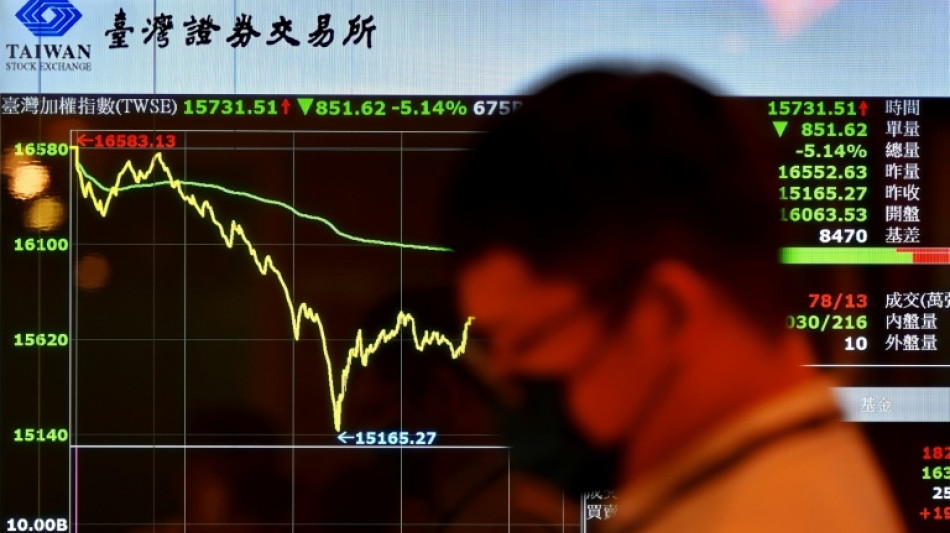

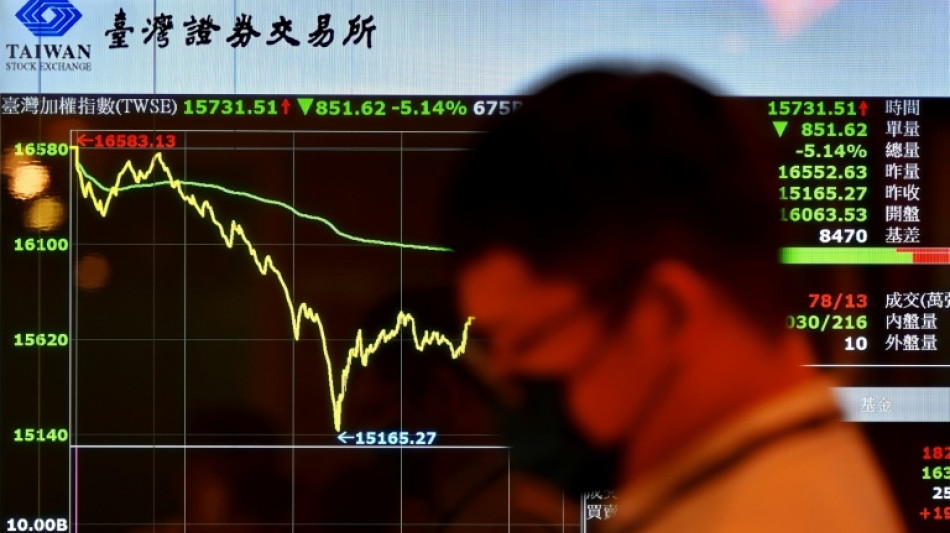

Equities savaged as China retaliation to Trump tariffs fans trade war

Asian markets collapsed Monday after China hammered the United States with its own hefty tariffs, ramping up a trade war that many fear could spark a recession.

Trading floors were overcome by a wave of selling as investors fled to the hills on the worst day for equities since the pandemic, with Hong Kong shedding more than 10 percent, Tokyo diving eight percent and Taipei more than nine percent.

Futures for Wall Street's markets were also taking another hammering, while concerns about the impact on demand also saw commodities slump.

Donald Trump sparked a market meltdown last week when he unveiled sweeping tariffs against US trading partners for what he says was years of being ripped off and claiming that governments were lining up to cut deals with Washington.

But after Asian markets closed on Friday, China said it would impose retaliatory levies of 34 percent on all US goods from April 10.

It also imposed export controls on seven rare earth elements, including gadolinium -- commonly used in MRIs -- and yttrium, utilised in consumer electronics.

Hopes that the US president would rethink his policy in light of the turmoil were dashed Sunday when he said he would not make a deal with other countries unless trade deficits were solved.

He denied that he was intentionally engineering a selloff and insisted he could not foresee market reactions.

"Sometimes you have to take medicine to fix something," he said of the ructions that have wiped trillions of dollars off company valuations.

-- No sector spared --

The selling in Asia was across the board, with no sector unharmed by the savage selling -- tech firms, car makers, banks, casinos and energy firms all felt the pain as investors abandoned riskier assets.

Among the biggest losers, Chinese ecommerce titans Alibaba and JD.com tanked more than 11 percent, while Japanese tech investment giant SoftBank dived more than 10 percent.

Shanghai shed more than five percent and Singapore more than six percent, while Seoul gave up more than five percent triggering a so-called sidecar mechanism -- for the first time in eight months -- that briefly halted some trading.

Concerns about demand saw oil prices sink more than three percent Monday, having dropped around seven percent Friday. Both main contracts are now sitting at their lowest levels since 2021. Copper -- a vital component for energy storage, electric vehicles, solar panels and wind turbines -- also extended losses.

"The market is in free-fall mode again, punching through floors," said Stephen Innes at SPI Asset Management. "Trump’s team isn't blinking. The tariffs are being treated as a victory lap, not a bargaining chip."

The losses followed another day of carnage on Wall Street on Friday, where all three main indexes fell almost six percent.

That came after Federal Reserve boss Jerome Powell said US tariffs will likely cause inflation to rise and growth to slow and warned of an "elevated" risk of higher unemployment.

The measures by Trump are likely to give US central bankers a headache as they try to balance the need for interest rate cuts to support the economy with the need to keep a lid on prices.

His comments came after Trump had insisted "my policies will never change" and urged the Fed to cut rates.

"Powell's hands are tied," said Innes. "He’s acknowledged the obvious -- that tariffs are inflationary and recessionary -- but he's not signalling a rescue.

"And that's the problem. This time, the Fed's inflation mandate is forcing it to keep the safety net rolled up while asset prices get torched."

Tim Waterer, chief market analyst at KCM Trade, said: "Traders are nervously watching the two biggest economies going toe to toe on tariffs and are fearing that both could receive knockout blows from a prolonged economic fight.

"Neither the US nor China are backing down when it comes to slapping new tariffs on each other and in this escalatory environment it's not surprising to see that risk assets are being avoided like the plague."

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: DOWN 6.5 percent at 31,591.84

Hong Kong - Hang Seng Index: DOWN 9.3 percent at 20,725.20

Shanghai - Composite: DOWN 6.1 percent at 3,138.32

West Texas Intermediate: DOWN 2.2 percent at $60.66 per barrel

Brent North Sea Crude: DOWN 2.2 percent at $64.14 per barrel

Dollar/yen: DOWN at 146.04 yen from 146.98 yen on Friday

Euro/dollar: UP at $1.0964 from $1.0962

Pound/dollar: UP at $1.2908 from $1.2893

Euro/pound: DOWN at 84.94 pence from 85.01 pence

New York - Dow: DOWN 5.5 percent at 38,314.86 (close)

London - FTSE 100: DOWN 5.0 percent at 8,054.98 (close)

L.AbuTayeh--SF-PST