-

Almeida wins time-trial to take Tour of Switzerland

Almeida wins time-trial to take Tour of Switzerland

-

Bublik sees off Medvedev to claim second title on grass in Halle

-

Feyi-Waboso banned for England tour to Argentina

Feyi-Waboso banned for England tour to Argentina

-

US strikes on Iran: what we know

-

Alcaraz crowned king of Queen's for second time

Alcaraz crowned king of Queen's for second time

-

US says strikes 'devastated' Iran's nuclear program

-

Bublik sees off Medvedev to claim fifth AFP title in Halle

Bublik sees off Medvedev to claim fifth AFP title in Halle

-

Freed Belarus opposition figure urges Trump to help release all prisoners

-

Wave of syringe attacks mar France's street music festival

Wave of syringe attacks mar France's street music festival

-

US intervention 'devastated' Iran's nuclear programme says Pentagon

-

Marc Marquez completes perfect Mugello weekend with Italian MotoGP triumph

Marc Marquez completes perfect Mugello weekend with Italian MotoGP triumph

-

Vondrousova warms up for Wimbledon with Berlin title

-

India still on top in first Test despite Brook fifty for England

India still on top in first Test despite Brook fifty for England

-

Ukraine army chief vows to expand strikes on Russia

-

United behind Iran war effort, Israelis express relief at US bombing

United behind Iran war effort, Israelis express relief at US bombing

-

Former England fast bowler David Lawrence dead at 61

-

At least three impacts in Israel during Iran missile attacks, 23 hurt

At least three impacts in Israel during Iran missile attacks, 23 hurt

-

Trump says US strikes 'obliterated' Iran nuclear sites

-

Japan's high-tech sunscreens tap into skincare craze

Japan's high-tech sunscreens tap into skincare craze

-

Tesla expected to launch long-discussed robotaxi service

-

South Korea counts on shipbuilding to ease US tariff woes

South Korea counts on shipbuilding to ease US tariff woes

-

Bombing Iran, Trump gambles on force over diplomacy

-

Trump says US attack 'obliterated' Iran nuclear sites

Trump says US attack 'obliterated' Iran nuclear sites

-

Itoje to Valetini: five to watch when the Lions face Australia

-

Wallabies confident but wary of wounded British and irish Lions

Wallabies confident but wary of wounded British and irish Lions

-

Utopia and fragile democracy at Art Basel fair

-

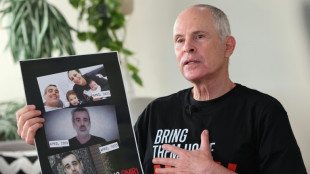

Freed Israeli hostage recounts 484-day nightmare in Gaza

Freed Israeli hostage recounts 484-day nightmare in Gaza

-

River Plate frustrated by Monterrey in 0-0 stalemate

-

Panama cuts internet, cell phones in restive province

Panama cuts internet, cell phones in restive province

-

Tens of thousands join pro-Palestinian marches across Europe

-

Coach Penney unsure of return to Super Rugby champions Crusaders

Coach Penney unsure of return to Super Rugby champions Crusaders

-

Trump says US 'obliterated' Iran nuclear sites, threatens more

-

Olympic chief Kirsty Coventry's steeliness honed by hard knocks

Olympic chief Kirsty Coventry's steeliness honed by hard knocks

-

Outgoing IOC president Thomas Bach faced mammoth challenges

-

Maro Itoje comes of age with Lions captaincy

Maro Itoje comes of age with Lions captaincy

-

Trump says US bombs Iran nuclear sites, joining Israeli campaign

-

In New York, Vermeer show reveals art of the love letter

In New York, Vermeer show reveals art of the love letter

-

Ex-members of secret US abortion group fear return to dark era

-

Trump says US launched 'very successful' attack on Iran nuclear sites

Trump says US launched 'very successful' attack on Iran nuclear sites

-

Man City squad must be trimmed: Guardiola

-

Minjee Lee grabs four-shot lead at 'brutal' Women's PGA Championship

Minjee Lee grabs four-shot lead at 'brutal' Women's PGA Championship

-

Olympic balloon rises again in Paris

-

Inter Milan, Dortmund claim first wins at Club World Cup

Inter Milan, Dortmund claim first wins at Club World Cup

-

South American teams lay down the gauntlet to Europe at Club World Cup

-

Fleetwood grabs PGA Travelers lead as top-ranked stars fade

Fleetwood grabs PGA Travelers lead as top-ranked stars fade

-

'Lucky' Lamothe hat-trick guides Bordeaux-Begles into Top 14 final

-

Lamothe hat-trick guides Bordeaux-Begles into Top 14 final

Lamothe hat-trick guides Bordeaux-Begles into Top 14 final

-

UK PM Starmer says Kneecap should not perform Glastonbury

-

Inter Milan strike late to beat Urawa Reds at Club World Cup

Inter Milan strike late to beat Urawa Reds at Club World Cup

-

Dortmund stars hide from sun at Club World Cup 'sauna'

US Fed likely to keep rates steady as Trump uncertainty flares

The US Federal Reserve is widely expected to keep interest rates unchanged at its policy meeting this week, treading carefully amid uncertainty over President Donald Trump's economic policies, which include spending cuts and sweeping tariffs.

Since January, Trump has imposed levies on major trading partners Canada, Mexico and China, and on steel and aluminum imports, roiling financial markets and fanning fears that his plans could tip the world's biggest economy into a recession.

The Trump administration has also embarked on unprecedented cost-cutting efforts that target staff and spending, while the president has promised tax reductions and deregulation down the road.

But Fed Chair Jerome Powell emphasized this month that it is the "net effect" of policy changes that will matter for both the economy and monetary policy.

Analysts widely expect the central bank to hold the benchmark lending rate steady at 4.25 percent to 4.50 percent, after similarly doing so in January.

"Recent Fed commentary has reinforced a wait-and-see approach, with officials signaling little urgency to adjust policy as they assess the economic impact of recent policy shifts," said EY chief economist Gregory Daco.

Powell himself has said that policymakers are focused on separating signal from noise as the outlook evolves.

"We do not need to be in a hurry, and we are well positioned to wait for greater clarity," the Fed chief added in a recent speech in New York.

- 'No pressing need' -

Economist Michael Pearce at Oxford Economics said he expects the Fed will not want to "overreact" to early signs that inflation may pick up, or to indications that the economy is weakening more quickly than anticipated.

The Fed has previously kept rates elevated to tamp down inflation. Cutting rates, conversely, typically stimulates economic activity, providing a boost to growth.

"It's a bit of a dilemma for the Fed," Pearce said, as there could be conflicting signals.

ING analysts expect the Fed to signal its base case remains two 25 basis point cuts this year, noting "there is no pressing need for additional rate cuts given that unemployment is low and inflation is still tracking hot."

In February, government data showed that the unemployment rate was a relatively low 4.1 percent, with the labor market remaining stable.

The consumer price index -- a gauge of inflation -- came in at 2.8 percent for February as well, cooler than expected but still some distance from officials' two percent target.

This boosts expectations that the Fed would proceed cautiously as it seeks to lower inflation sustainably.

Inflation is "likely to remain above target through the rest of the year given the impetus from tariffs," ING analysts expect.

They warned in a recent note that the use of levies could "escalate significantly" as Trump seeks to bring manufacturing back to US shores, potentially triggering price hikes.

- 'Volatility' -

Pearce of Oxford Economics expects that the economy is strong enough to weather a downturn from tariffs -- meaning the Fed will unlikely be forced to respond to weakening conditions.

But there remains a risk that more weakness comes through, he said, and that the Fed "will react to a growth scare and loosen policy sooner."

Daco of EY said Powell "will have to tap dance around policy uncertainty and its cousin market volatility" in a press conference after the Fed's rate decision is announced Wednesday.

Private sector activity is slowing as policy uncertainty remains elevated, while stocks have pulled back notably, he said.

GDP growth is also likely to stall in the first quarter in part due to weaker consumer spending.

"Powell may find it difficult to reaffirm that the economy is 'holding up just fine,' and that it 'doesn't need us to do anything,'" Daco added in a note.

Looking ahead, he warned that the Fed's policy stance could shift rapidly with economic conditions.

"A reactionary monetary policy stance means policy direction could rapidly turn more dovish on weaker economic and labor market data, just like it could turn hawkish with hotter inflation readings," he said.

U.Shaheen--SF-PST