-

'How to Train Your Dragon' holds top spot in N.America box office

'How to Train Your Dragon' holds top spot in N.America box office

-

Almeida wins time-trial to take Tour of Switzerland

-

Bublik sees off Medvedev to claim second title on grass in Halle

Bublik sees off Medvedev to claim second title on grass in Halle

-

Feyi-Waboso banned for England tour to Argentina

-

US strikes on Iran: what we know

US strikes on Iran: what we know

-

Alcaraz crowned king of Queen's for second time

-

US says strikes 'devastated' Iran's nuclear program

US says strikes 'devastated' Iran's nuclear program

-

Bublik sees off Medvedev to claim fifth AFP title in Halle

-

Freed Belarus opposition figure urges Trump to help release all prisoners

Freed Belarus opposition figure urges Trump to help release all prisoners

-

Wave of syringe attacks mar France's street music festival

-

US intervention 'devastated' Iran's nuclear programme says Pentagon

US intervention 'devastated' Iran's nuclear programme says Pentagon

-

Marc Marquez completes perfect Mugello weekend with Italian MotoGP triumph

-

Vondrousova warms up for Wimbledon with Berlin title

Vondrousova warms up for Wimbledon with Berlin title

-

India still on top in first Test despite Brook fifty for England

-

Ukraine army chief vows to expand strikes on Russia

Ukraine army chief vows to expand strikes on Russia

-

United behind Iran war effort, Israelis express relief at US bombing

-

Former England fast bowler David Lawrence dead at 61

Former England fast bowler David Lawrence dead at 61

-

At least three impacts in Israel during Iran missile attacks, 23 hurt

-

Trump says US strikes 'obliterated' Iran nuclear sites

Trump says US strikes 'obliterated' Iran nuclear sites

-

Japan's high-tech sunscreens tap into skincare craze

-

Tesla expected to launch long-discussed robotaxi service

Tesla expected to launch long-discussed robotaxi service

-

South Korea counts on shipbuilding to ease US tariff woes

-

Bombing Iran, Trump gambles on force over diplomacy

Bombing Iran, Trump gambles on force over diplomacy

-

Trump says US attack 'obliterated' Iran nuclear sites

-

Itoje to Valetini: five to watch when the Lions face Australia

Itoje to Valetini: five to watch when the Lions face Australia

-

Wallabies confident but wary of wounded British and irish Lions

-

Utopia and fragile democracy at Art Basel fair

Utopia and fragile democracy at Art Basel fair

-

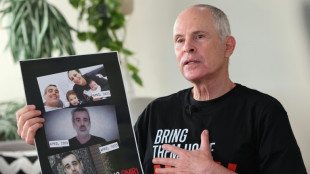

Freed Israeli hostage recounts 484-day nightmare in Gaza

-

River Plate frustrated by Monterrey in 0-0 stalemate

River Plate frustrated by Monterrey in 0-0 stalemate

-

Panama cuts internet, cell phones in restive province

-

Tens of thousands join pro-Palestinian marches across Europe

Tens of thousands join pro-Palestinian marches across Europe

-

Coach Penney unsure of return to Super Rugby champions Crusaders

-

Trump says US 'obliterated' Iran nuclear sites, threatens more

Trump says US 'obliterated' Iran nuclear sites, threatens more

-

Olympic chief Kirsty Coventry's steeliness honed by hard knocks

-

Outgoing IOC president Thomas Bach faced mammoth challenges

Outgoing IOC president Thomas Bach faced mammoth challenges

-

Maro Itoje comes of age with Lions captaincy

-

Trump says US bombs Iran nuclear sites, joining Israeli campaign

Trump says US bombs Iran nuclear sites, joining Israeli campaign

-

In New York, Vermeer show reveals art of the love letter

-

Ex-members of secret US abortion group fear return to dark era

Ex-members of secret US abortion group fear return to dark era

-

Trump says US launched 'very successful' attack on Iran nuclear sites

-

Man City squad must be trimmed: Guardiola

Man City squad must be trimmed: Guardiola

-

Minjee Lee grabs four-shot lead at 'brutal' Women's PGA Championship

-

Olympic balloon rises again in Paris

Olympic balloon rises again in Paris

-

Inter Milan, Dortmund claim first wins at Club World Cup

-

South American teams lay down the gauntlet to Europe at Club World Cup

South American teams lay down the gauntlet to Europe at Club World Cup

-

Fleetwood grabs PGA Travelers lead as top-ranked stars fade

-

'Lucky' Lamothe hat-trick guides Bordeaux-Begles into Top 14 final

'Lucky' Lamothe hat-trick guides Bordeaux-Begles into Top 14 final

-

Lamothe hat-trick guides Bordeaux-Begles into Top 14 final

-

UK PM Starmer says Kneecap should not perform Glastonbury

UK PM Starmer says Kneecap should not perform Glastonbury

-

Inter Milan strike late to beat Urawa Reds at Club World Cup

Gold tops $3,000 for first time on Trump tariff war, stocks rebound

Gold rose above $3,000 for the first time Friday as President Donald Trump's trade wars boosted demand for safe-haven assets, while stock markets bounced on signs US lawmakers would avert a government shutdown.

Major US indices opened higher and remained in positive territory through the day, shrugging off a downcast reading on US consumer sentiment.

European stock markets were also given a lift after Germany moved closer to approving a massive infrastructure and defense spending program.

In Washington, hours before a deadline to push a Republican spending bill through, Senate Democratic leader Chuck Schumer dropped a threat to block it.

The package would keep the government operating through September, but Democrats had come under pressure from supporters to defy the plan, which they say is full of harmful spending cuts.

Stocks gained support from "a burgeoning sense that a government shutdown will be averted after Senator Schumer said he will vote for House-passed continuing resolution," said Patrick O'Hare, analyst at Briefing.com.

A consumer survey by the University of Michigan said expectations for the future "deteriorated," with "many consumers": citing a "high level of uncertainty around policy and other economic factors."

Paris and Frankfurt both rebounded after losses the previous day on US tariff threats.

Germany's likely next chancellor Friedrich Merz said his conservative party had struck a deal with the Greens on boosting defense and infrastructure spending, paving the way for the plan's approval in parliament.

"Germany is poised to pursue essential structural reforms while hoping for an end to the economic downturn," said Jochen Stanzl, an analyst at CMC Markets. "Investor sentiment shifted dramatically today."

- Times of uncertainty -

Gold, a haven in times of uncertainty, rose to as much as $3,004 an ounce before falling back to just under $3,000.

The precious metal was "boosted on increased haven demand amid trade war risks and recent stock market volatility", said Fawad Razaqzada, an analyst at City Index and Forex.com.

In the latest salvo, Trump threatened to impose 200 percent tariffs on wine, champagne and other alcoholic beverages from European Union countries.

Wall Street has been hammered in recent sessions by trade tensions, with the S&P 500 slipping into a technical correction Thursday, having fallen more than 10 percent from a record high it hit just last month.

The broad-based S&P 500 finished at 5,638.94, up 2.1 percent for the day, but down 2.3 percent for the week.

Some analysts warned that Friday's rebound would be short-lived.

"Recent rallies have run into a buzzsaw of selling pressure," said Nathan Peterson, an analyst at Charles Schwab. "Tariff escalations, a potential government shutdown, and persistent growth concerns due to trade policy make it difficult to sustain any kind of a bounce."

In company news, shares in Gucci-owner Kering plunged more than 11 percent in Paris as the group appointed a new creative director for its struggling flagship brand.

Shares in BMW were in the red as the German automaker warned that trade tensions between the United States, Europe and China would cost the company $1 billion this year.

- Key figures around 2040 GMT -

New York - Dow: Up 1.7 percent at 41,488.19 (close

New York - S&P 500: UP 2.1 percent at 5,638.94 (close)

New York - Nasdaq Composite: UP 2.6 percent at 17,754.09 (close)

London - FTSE 100: UP 1.1 percent at 8,632.33 (close)

Paris - CAC 40: UP 1.1 percent at 8,028.28 (close)

Frankfurt - DAX: UP 1.9 percent at 22,986.82 (close)

Tokyo - Nikkei 225: UP 0.7 percent at 37,053.10 (close)

Hong Kong - Hang Seng Index: UP 2.1 percent at 23,959.98 (close)

Shanghai - Composite: UP 1.8 percent at 3,419.56 (close)

Euro/dollar: UP at $1.0884 from $1.0852 on Thursday

Pound/dollar: DOWN at $1.2936 from $1.2952

Dollar/yen: UP at 148.62 yen from 147.81 yen

Euro/pound: UP at 84.14 pence from 83.79 pence

Brent North Sea Crude: UP 1.0 percent at $70.58 per barrel

West Texas Intermediate: UP 1.0 percent at $67.18 per barrel

Z.Ramadan--SF-PST