-

Italian sculptor Arnaldo Pomodoro dies aged nearly 99

Italian sculptor Arnaldo Pomodoro dies aged nearly 99

-

Rahul and Pant build India lead against England

-

UK probes maternity services after scandals

UK probes maternity services after scandals

-

Asian countries most vulnerable to Strait of Hormuz blockade

-

Anger as Kanye West to perform in Slovakia after Hitler song

Anger as Kanye West to perform in Slovakia after Hitler song

-

Israel targets Iran Guards, Tehran prison in fresh wave of strikes

-

Star-packed, Covid-shaped 'Death Stranding 2' drops this week

Star-packed, Covid-shaped 'Death Stranding 2' drops this week

-

IOC is in 'best of hands', says Bach as he hands over to Coventry

-

Oil prices seesaw as investors await Iran response to US strikes

Oil prices seesaw as investors await Iran response to US strikes

-

Beijing issues weather warning for hottest days of year

-

Tehran hit by Israeli attacks, vows response to US strikes

Tehran hit by Israeli attacks, vows response to US strikes

-

New CEO of Jeep owner Stellantis starts with leadership shake-up

-

Russian drone and missile barrage kills eight in Kyiv

Russian drone and missile barrage kills eight in Kyiv

-

Oil dips, dollar firms after US strikes in Iran

-

Paris Olympics and Paralympics cost taxpayer nearly 6 bn euros: state body

Paris Olympics and Paralympics cost taxpayer nearly 6 bn euros: state body

-

Eurozone business activity almost flat again in June

-

In Norway's Arctic, meteorologists have a first-row seat to climate change

In Norway's Arctic, meteorologists have a first-row seat to climate change

-

Iran vows retaliation for US strikes as Israel keeps up attacks

-

Russian drone and missile barrage on Kyiv kills seven

Russian drone and missile barrage on Kyiv kills seven

-

Oil rises, dollar firms after US strikes in Iran

-

'Noble to attend': Budapest prepares for 'banned' Pride march

'Noble to attend': Budapest prepares for 'banned' Pride march

-

Art market banking on new generation of collectors

-

Turning 80, UN faces fresh storm of doubts

Turning 80, UN faces fresh storm of doubts

-

'A great start': NBA crown just the beginning for Shai

-

Man City hit six to reach Club World Cup last 16, Real Madrid win with 10 men

Man City hit six to reach Club World Cup last 16, Real Madrid win with 10 men

-

Iran vows retaliation after US strikes on nuclear sites

-

'Massive' Russian attack on Kyiv kills at least five: Ukraine

'Massive' Russian attack on Kyiv kills at least five: Ukraine

-

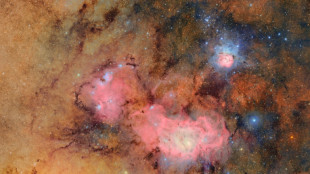

Groundbreaking Vera Rubin Observatory reveals first images

-

Thunder beat Pacers in game seven, cap stunning season with NBA crown

Thunder beat Pacers in game seven, cap stunning season with NBA crown

-

Pacers 'hearts dropped' after Haliburton injury: Carlisle

-

Ukraine says 'massive' Russian attack on Kyiv

Ukraine says 'massive' Russian attack on Kyiv

-

Thunder's Gilgeous-Alexander named NBA Finals MVP

-

Thunder beat injury-hit Pacers in game seven to win NBA title

Thunder beat injury-hit Pacers in game seven to win NBA title

-

Oil prices spike after US strikes on Iran

-

Man City demolish Al Ain to reach Club World Cup last 16

Man City demolish Al Ain to reach Club World Cup last 16

-

Thunder beat Pacers to clinch first NBA Finals crown

-

Bone collectors: searching for WWII remains in Okinawa

Bone collectors: searching for WWII remains in Okinawa

-

Madrid coach Alonso says Rudiger complained of racist insult in Club World Cup win

-

Girls shouldn't shout?: Women break the mould at French metal festival

Girls shouldn't shout?: Women break the mould at French metal festival

-

Indian activists seek to save child brides

-

Jonathan Anderson set for Dior debut at Paris Fashion Week

Jonathan Anderson set for Dior debut at Paris Fashion Week

-

Ukraine says 'massive' Russian drone attack on Kyiv

-

Oasis: from clash to cash

Oasis: from clash to cash

-

Toxic threat from 'forever chemicals' sparks resistance in Georgia towns

-

All Blacks name five debutants in squad for France Tests

All Blacks name five debutants in squad for France Tests

-

Pacers' Haliburton hurt early in game seven against Thunder

-

Suicide attack on Damascus church kills at least 22

Suicide attack on Damascus church kills at least 22

-

French police probe fake Disneyland 'marriage' with nine-year-old

-

ZeptoMetrix Launches H5N1 Control With Phage-Like Particle (PLP) Technology

ZeptoMetrix Launches H5N1 Control With Phage-Like Particle (PLP) Technology

-

Ohtani bags strikeouts, home run as Dodgers rout Nats

Debate over rates pause mounts as ECB set to cut again

Massive German spending pledges and uncertainty caused by US trade policy are fuelling expectations the European Central Bank could on Thursday signal that a pause in interest rate cuts is in sight, analysts said.

The ECB is widely expected to make its sixth cut since June last year, with its focus having shifted recently from tackling inflation to boosting the beleaguered eurozone.

The expected quarter percentage point reduction would bring the bank's benchmark deposit rate to 2.5 percent.

The rate reached a record of four percent in late 2023 after the ECB launched an furious hiking cycle to tame energy and food costs that surged in the wake of Russia's invasion of Ukraine.

But investors will be keeping an eye out for signals from ECB President Christine Lagarde that a pause might be on the horizon, after some officials said it was time to start discussing the matter.

Uncertainty about the fallout from potential US tariffs -- President Donald Trump has threatened a 25-percent duty on all EU goods -- was already clouding the outlook and potentially pushing rate-setters towards hitting pause.

Now plans announced Tuesday by Germany's likely next chancellor Friedrich Merz to spend several hundred billion euros more on defence and infrastructure in the coming years could impact policymakers' considerations, analysts said.

The dramatic move was driven by fears that long-standing US security guarantees for Europe will be weakened under President Donald Trump amid a rush to end the war in Ukraine.

The spending surge has the potential to stoke inflation that would discourage further cuts to borrowing costs, while also supporting eurozone growth.

Investors had already lowered their expectations of a cut at the ECB's next meeting in April following Merz's announcement, said Kathleen Brooks, research director at trading platform XTB.

If bank officials "think that higher spending on German infrastructure and defence will be inflationary, then we could see expectations of ECB rate cuts get scaled back," she said.

- Growing uncertainty -

Even before the German announcement, policymakers at the central bank for the 20 countries that use the euro were already asking how much further it should continue on the path to lower interest rates.

Isabel Schnabel, an influential member of the ECB's board, told The Financial Times last month that policymakers were getting "closer to the point where we may have to pause or halt our rate cuts".

"We can no longer say with confidence that our monetary policy is still restrictive," she said.

Eurozone inflation has also proved stickier than some had hoped.

It edged down slightly in February to 2.4 percent after several months of increases, but remains above the ECB's two-percent target.

Officials have nevertheless remained confident it will settle around the benchmark later this year.

In the United States, where the economy is in more robust health than in the eurozone, the Federal Reserve paused rate cuts recently after inflation rose and amid uncertainty about the future direction of Trump's policy.

Lagarde has so far sought to avoid tipping the ECB's hand and could stick with her mantra of making decisions "meeting-by-meeting" in her remarks after the rates announcement, observers said.

"Global uncertainties have increased significantly in recent weeks," said Felix Schmidt, an economist from Berenberg bank, pointing to Trump's tariff threats.

Given this "Lagarde will refrain from giving any clear forward guidance and will try to maintain maximum flexibility," he added.

The ECB will also publish updated economic forecasts on Thursday.

While inflation predictions are expected to remain stable, the central bank might further lower its growth projections for the coming years, according to economists.

The eurozone has eked out meagre growth in the past two years amid a poor performance in its biggest economies, Germany and France, leaving the single currency area lagging behind the United States and China.

L.AbuAli--SF-PST