-

Italian sculptor Arnaldo Pomodoro dies aged nearly 99

Italian sculptor Arnaldo Pomodoro dies aged nearly 99

-

Rahul and Pant build India lead against England

-

UK probes maternity services after scandals

UK probes maternity services after scandals

-

Asian countries most vulnerable to Strait of Hormuz blockade

-

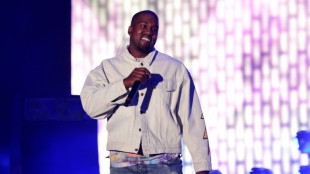

Anger as Kanye West to perform in Slovakia after Hitler song

Anger as Kanye West to perform in Slovakia after Hitler song

-

Israel targets Iran Guards, Tehran prison in fresh wave of strikes

-

Star-packed, Covid-shaped 'Death Stranding 2' drops this week

Star-packed, Covid-shaped 'Death Stranding 2' drops this week

-

IOC is in 'best of hands', says Bach as he hands over to Coventry

-

Oil prices seesaw as investors await Iran response to US strikes

Oil prices seesaw as investors await Iran response to US strikes

-

Beijing issues weather warning for hottest days of year

-

Tehran hit by Israeli attacks, vows response to US strikes

Tehran hit by Israeli attacks, vows response to US strikes

-

New CEO of Jeep owner Stellantis starts with leadership shake-up

-

Russian drone and missile barrage kills eight in Kyiv

Russian drone and missile barrage kills eight in Kyiv

-

Oil dips, dollar firms after US strikes in Iran

-

Paris Olympics and Paralympics cost taxpayer nearly 6 bn euros: state body

Paris Olympics and Paralympics cost taxpayer nearly 6 bn euros: state body

-

Eurozone business activity almost flat again in June

-

In Norway's Arctic, meteorologists have a first-row seat to climate change

In Norway's Arctic, meteorologists have a first-row seat to climate change

-

Iran vows retaliation for US strikes as Israel keeps up attacks

-

Russian drone and missile barrage on Kyiv kills seven

Russian drone and missile barrage on Kyiv kills seven

-

Oil rises, dollar firms after US strikes in Iran

-

'Noble to attend': Budapest prepares for 'banned' Pride march

'Noble to attend': Budapest prepares for 'banned' Pride march

-

Art market banking on new generation of collectors

-

Turning 80, UN faces fresh storm of doubts

Turning 80, UN faces fresh storm of doubts

-

'A great start': NBA crown just the beginning for Shai

-

Man City hit six to reach Club World Cup last 16, Real Madrid win with 10 men

Man City hit six to reach Club World Cup last 16, Real Madrid win with 10 men

-

Iran vows retaliation after US strikes on nuclear sites

-

'Massive' Russian attack on Kyiv kills at least five: Ukraine

'Massive' Russian attack on Kyiv kills at least five: Ukraine

-

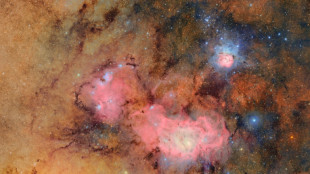

Groundbreaking Vera Rubin Observatory reveals first images

-

Thunder beat Pacers in game seven, cap stunning season with NBA crown

Thunder beat Pacers in game seven, cap stunning season with NBA crown

-

Pacers 'hearts dropped' after Haliburton injury: Carlisle

-

Ukraine says 'massive' Russian attack on Kyiv

Ukraine says 'massive' Russian attack on Kyiv

-

Thunder's Gilgeous-Alexander named NBA Finals MVP

-

Thunder beat injury-hit Pacers in game seven to win NBA title

Thunder beat injury-hit Pacers in game seven to win NBA title

-

Oil prices spike after US strikes on Iran

-

Man City demolish Al Ain to reach Club World Cup last 16

Man City demolish Al Ain to reach Club World Cup last 16

-

Thunder beat Pacers to clinch first NBA Finals crown

-

Bone collectors: searching for WWII remains in Okinawa

Bone collectors: searching for WWII remains in Okinawa

-

Madrid coach Alonso says Rudiger complained of racist insult in Club World Cup win

-

Girls shouldn't shout?: Women break the mould at French metal festival

Girls shouldn't shout?: Women break the mould at French metal festival

-

Indian activists seek to save child brides

-

Jonathan Anderson set for Dior debut at Paris Fashion Week

Jonathan Anderson set for Dior debut at Paris Fashion Week

-

Ukraine says 'massive' Russian drone attack on Kyiv

-

Oasis: from clash to cash

Oasis: from clash to cash

-

Toxic threat from 'forever chemicals' sparks resistance in Georgia towns

-

All Blacks name five debutants in squad for France Tests

All Blacks name five debutants in squad for France Tests

-

Pacers' Haliburton hurt early in game seven against Thunder

-

Suicide attack on Damascus church kills at least 22

Suicide attack on Damascus church kills at least 22

-

French police probe fake Disneyland 'marriage' with nine-year-old

-

ZeptoMetrix Launches H5N1 Control With Phage-Like Particle (PLP) Technology

ZeptoMetrix Launches H5N1 Control With Phage-Like Particle (PLP) Technology

-

Ohtani bags strikeouts, home run as Dodgers rout Nats

Stocks rally on tariff relief hopes, German spending plan

Stock markets rallied Wednesday, buoyed by Germany's plan to massively boost spending on defence, signals that US President Donald Trump could ease huge tariffs and China's economic targets.

Frankfurt surged 3.5 percent in midday deals and German bond yields rose after the likely next chancellor, Friedrich Merz, announced the spending plans in the hope of also reviving Europe's biggest economy.

European defence and manufacturing stocks also jumped while the euro rose sharply against the dollar.

The Paris stock exchange gained 2.1 percent while Milan was up 2.2 percent. London advanced 0.5 percent.

"This is huge," Kathleen Brooks, research director at XTB trading platform said in reaction to the news out of Germany.

"For years, economists have said that Germany needed to change its spending rules to get out of the economic hole. It's taken a Conservative chancellor-in-waiting to pull the trigger," she added.

Investors also reacted to comments from US Commerce Secretary Howard Lutnick, who said that he thought Trump would "work something out" with regards to Canada and Mexico, whose goods were hit with 25 percent levies.

"Markets would take even the slightest rollback from Trump as a positive sign, helping to settle nerves following concerns about a full-blown trade war," said Russ Mould, investment director at investment platform AJ Bell.

Global stocks tumbled Tuesday after US tariffs on China, Mexico and Canada took effect and the three countries retaliated, while fears grew that Europe could be Trump's next target.

- Chinese economy -

Over in Asia, investors welcomed China's economic targets for the coming year and the prospect of tariff relief, with Hong Kong closing up almost three percent.

China set an annual growth target of around five percent and vowed to make domestic demand its main economic driver, as lawmakers attended the annual meeting of the National People's Congress.

Beijing also announced a rare hike in fiscal funding, allowing its budget deficit to reach four percent of its GDP this year.

It comes alongside a pledge to create 12 million new jobs in China's cities and a push for two percent inflation this year.

The world's second-largest economy is also planning to increase defence spending by 7.2 percent, the same as last year.

But observers have tempered expectations for an expected stimulus given that China is facing strong economic headwinds, especially in light of US tariffs.

These include a persistent property sector debt crisis, stubbornly low consumer demand and stuttering employment for young people.

"We remain sceptical that it will be sufficient to prevent growth from slowing this year, said Julian Evans-Pritchard, China analyst at Capital Economics.

"Especially given the headwinds on the external front and the lack of a more pronounced shift in government spending towards support consumption."

Elsewhere Wednesday, the share price of Hong Kong firm CK Hutchison soared more than 20 percent after the company agreed to sell its lucrative Panama Canal ports to a US-led consortium under fierce pressure from Trump.

- Key figures around 1100 GMT -

London - FTSE 100: UP 0.6 percent at 8,807.74 points

Paris - CAC 40: UP 2.1 percent at 8,214.04

Frankfurt - DAX: UP 3.5 percent at 23,097.07

Tokyo - Nikkei 225: UP 0.2 percent at 37,418.24 (close)

Hong Kong - Hang Seng Index: UP 2.8 percent at 23,594.21 (close)

Shanghai - Composite: UP 0.5 percent at 3,341.96 (close)

New York - Dow: DOWN 1.6 percent at 42,520.99 (close)

Euro/dollar: UP at 1.0692 from 1.0485 on Tuesday

Pound/dollar: UP at $1.2825 from $1.2694

Dollar/yen: UP 149.44 from 149.32 yen

Euro/pound: UP at 83.36 pence from 82.60 pence

West Texas Intermediate: DOWN 1.7 percent at $67.12 per barrel

Brent North Sea Crude: DOWN 1.2 percent at $70.20 per barrel

O.Salim--SF-PST