-

Israel claims victory as US intel says Iran nuclear sites not destroyed

Israel claims victory as US intel says Iran nuclear sites not destroyed

-

Benfica beat Bayern at Club World Cup as Auckland City hold Boca

-

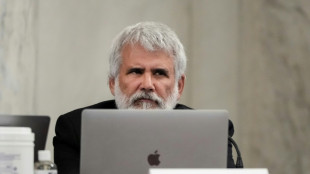

RFK Jr's medical panel to revisit debunked vaccine claims

RFK Jr's medical panel to revisit debunked vaccine claims

-

Sean Combs trial: Takeaways from testimony

-

Messi and Miami relishing reunion with PSG and Enrique

Messi and Miami relishing reunion with PSG and Enrique

-

At least 10 dead in Colombia landslide

-

Extreme heat, storms take toll at Club World Cup

Extreme heat, storms take toll at Club World Cup

-

France's Versailles unveils AI-powered talking statues

-

Child vaccine coverage faltering, threatening millions: study

Child vaccine coverage faltering, threatening millions: study

-

Club World Cup winners team who handles weather best: Dortmund's Kovac

-

FIFA launch probe into Rudiger racism allegation

FIFA launch probe into Rudiger racism allegation

-

Trump rattles NATO allies as he descends on summit

-

Three things we learned from the first Test between England and India

Three things we learned from the first Test between England and India

-

Saint Laurent, Vuitton kick off Paris men's fashion week

-

Amateurs Auckland City hold Boca Juniors to Club World Cup draw

Amateurs Auckland City hold Boca Juniors to Club World Cup draw

-

Neymar signs for six more months with Santos with an eye on World cup

-

Grok shows 'flaws' in fact-checking Israel-Iran war: study

Grok shows 'flaws' in fact-checking Israel-Iran war: study

-

Both sides in Sean Combs trial rest case, closing arguments next

-

Benfica beat Bayern to top group C

Benfica beat Bayern to top group C

-

Trump plays deft hand with Iran-Israel ceasefire but doubts remain

-

England knew they could 'blow match apart' says Stokes after India triumph

England knew they could 'blow match apart' says Stokes after India triumph

-

Lyon appeal relegation to Ligue 2 by financial regulator

-

US intel says strikes did not destroy Iran nuclear program

US intel says strikes did not destroy Iran nuclear program

-

Nearly half the US population face scorching heat wave

-

Israel's Netanyahu vows to block Iran 'nuclear weapon' as he declares victory

Israel's Netanyahu vows to block Iran 'nuclear weapon' as he declares victory

-

Saint Laurent kicks off Paris men's fashion week

-

Arbitrator finds NFL encouraged teams to cut veteran guarantees: reports

Arbitrator finds NFL encouraged teams to cut veteran guarantees: reports

-

India, Poland, Hungary make spaceflight comeback with ISS mission

-

Piot, dropped by LIV Golf, to tee off at PGA Detroit event

Piot, dropped by LIV Golf, to tee off at PGA Detroit event

-

US judge backs using copyrighted books to train AI

-

Russian strikes kill 19 in Ukraine region under pressure

Russian strikes kill 19 in Ukraine region under pressure

-

Raducanu's tears of joy, Krejcikova survives match points at Eastbourne

-

Duplantis dominates at Golden Spike in Czech Republic

Duplantis dominates at Golden Spike in Czech Republic

-

Prosecutors of Sean Combs rest their case, eyes turn to defense

-

Duckett and Root star as England beat India in thrilling 1st Test

Duckett and Root star as England beat India in thrilling 1st Test

-

Thunder celebrate first NBA title with Oklahoma City parade

-

US judge allows using pirated books to train AI

US judge allows using pirated books to train AI

-

Flagg expected to be taken first by Dallas in NBA Draft

-

Iran willing to return to talks as ceasefire with Israel takes hold

Iran willing to return to talks as ceasefire with Israel takes hold

-

Spain moves to strengthen power grid after huge April blackout

-

Haliburton says no regrets after Achilles tendon surgery

Haliburton says no regrets after Achilles tendon surgery

-

Oil slides, stocks rise as Iran-Israel ceasefire holds

-

Krishna, Thakur give India hope after Duckett ton leads England charge

Krishna, Thakur give India hope after Duckett ton leads England charge

-

How Iran's 'telegraphed' strikes on Qatari soil paved way to Israel truce

-

US Fed chair signals no rush for rate cuts despite Trump pressure

US Fed chair signals no rush for rate cuts despite Trump pressure

-

Gaza rescuers say 46 killed as UN slams US-backed aid system

-

The billionaire and the TV anchor: Bezos, Sanchez's whirlwind romance

The billionaire and the TV anchor: Bezos, Sanchez's whirlwind romance

-

Life returns to Tehran, but residents wary ceasefire won't hold

-

The billionaire and the TV anchor: Bezoz, Sanchez's whirlwind romance

The billionaire and the TV anchor: Bezoz, Sanchez's whirlwind romance

-

Fickou to captain youthful France squad for tour of New Zealand

Glencore looks to leave London Stock Exchange as falls into loss

Swiss mining and commodity trading giant Glencore said Wednesday it was considering shifting its stock listing from London after it stumbled into a net loss last year on falling coal prices and writing down the value of assets.

"We are actively considering the right exchange for our shares," Glencore chief executive Gary Nagle said in a call with analysts.

The company chose in 2011 to list on the London Stock Exchange, which was then considered the leading exchange for international mining groups.

"We're not saying that the London Stock Exchange is bad," said Nagle.

"What we're saying is: is there a better stock exchange to trade our securities?" he added, acknowledging that "the US is the leading stock market".

The company's shares were down around seven percent in London.

- Coal business take a lump -

The company earlier Wednesday reported $1.6 billion net loss for 2024 compared to a net profit of nearly $4.3 billion the previous year.

The group took charges to write down the value in its accounts of its coal operations in South Africa, and the Koniambo nickel mine in New Caledonia.

Accounting rules force companies to take such charges to reflect changes in the market value of their operations.

Excluding such exceptional charges, the company said it would have posted a net profit of $3.7 billion.

Nagle said in the statement that "operationally, 2024 was a strong year for Glencore" with its industrial mining operations meeting their performance targets.

Adjusted operational earnings from these operations came in at $10.6 billion, a drop of 20 percent from 2023, which the company said was "primarily driven by lower energy coal prices".

While mining rivals Rio Tinto or Anglo American have pulled out of coal mining, Glencore boosted its involvement in this market by buying Elk Valley Resources (EVR) from Canada's Teck Resources for $7 billion last year.

Glencore's commodities trading business generated adjusted operational earnings of $3.2 billion, an eight percent drop from 2023 due to the "progressive normalisation of energy markets from the severe disruption and extreme volatilities seen in 2022/23".

That disruption and extreme volatility in energy markets driven by Russia's invasion of Ukraine helped Glencore post a record profit of $34.1 billion, allowing it to return $7.1 to shareholders in dividends.

Despite the net loss Glencore plans to distribute $2.2 billion to its shareholders via dividends and share buybacks.

The group said it expects to receive in the coming months $1 billion in cash from the sale of its stake in Canadian grain handling company Viterra to Bunge, plus shares in the US-Swiss agribusiness.

J.AbuHassan--SF-PST