-

'Not Test class': Pundits tear into India after England chase 371

'Not Test class': Pundits tear into India after England chase 371

-

Trump whirlwind tests NATO summit unity

-

Justice orders release of migrants deported to Costa Rica by Trump

Justice orders release of migrants deported to Costa Rica by Trump

-

Vietnam tycoon will not face death penalty over $27 bn fraud: lawyer

-

Vietnam abolishes death penalty for spying, anti-state activities

Vietnam abolishes death penalty for spying, anti-state activities

-

Over 80,000 people flee severe flooding in southwest China

-

AI fakes duel over Sara Duterte impeachment in Philippines

AI fakes duel over Sara Duterte impeachment in Philippines

-

UK carbon emissions cut by half since 1990: experts

-

Delap off mark as Chelsea ease into Club World Cup last 16

Delap off mark as Chelsea ease into Club World Cup last 16

-

UK to reintroduce nuclear weapon-capable aircraft under NATO

-

Upstart socialist stuns political veteran in NYC mayoral primary

Upstart socialist stuns political veteran in NYC mayoral primary

-

China's premier warns global trade tensions 'intensifying'

-

Chelsea through to Club World Cup knockouts, Benfica beat Bayern

Chelsea through to Club World Cup knockouts, Benfica beat Bayern

-

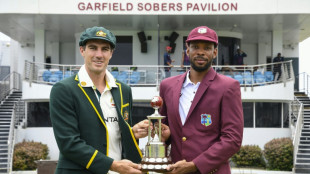

Cummins says Green 'long-term option' as Australia face new-look Windies

-

Chelsea east past Esperance and into Club World Cup last 16

Chelsea east past Esperance and into Club World Cup last 16

-

Stocks rally as Iran-Israel ceasefire holds, oil claws back some losses

-

Trump whirlwind to test NATO summit unity

Trump whirlwind to test NATO summit unity

-

Israel claims victory as US intel says Iran nuclear sites not destroyed

-

Benfica beat Bayern at Club World Cup as Auckland City hold Boca

Benfica beat Bayern at Club World Cup as Auckland City hold Boca

-

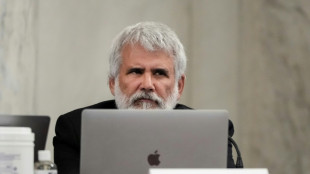

RFK Jr's medical panel to revisit debunked vaccine claims

-

Sean Combs trial: Takeaways from testimony

Sean Combs trial: Takeaways from testimony

-

Messi and Miami relishing reunion with PSG and Enrique

-

At least 10 dead in Colombia landslide

At least 10 dead in Colombia landslide

-

Extreme heat, storms take toll at Club World Cup

-

France's Versailles unveils AI-powered talking statues

France's Versailles unveils AI-powered talking statues

-

Child vaccine coverage faltering, threatening millions: study

-

Club World Cup winners team who handles weather best: Dortmund's Kovac

Club World Cup winners team who handles weather best: Dortmund's Kovac

-

FIFA launch probe into Rudiger racism allegation

-

Trump rattles NATO allies as he descends on summit

Trump rattles NATO allies as he descends on summit

-

Three things we learned from the first Test between England and India

-

Saint Laurent, Vuitton kick off Paris men's fashion week

Saint Laurent, Vuitton kick off Paris men's fashion week

-

Amateurs Auckland City hold Boca Juniors to Club World Cup draw

-

Neymar signs for six more months with Santos with an eye on World cup

Neymar signs for six more months with Santos with an eye on World cup

-

Grok shows 'flaws' in fact-checking Israel-Iran war: study

-

Both sides in Sean Combs trial rest case, closing arguments next

Both sides in Sean Combs trial rest case, closing arguments next

-

Benfica beat Bayern to top group C

-

Trump plays deft hand with Iran-Israel ceasefire but doubts remain

Trump plays deft hand with Iran-Israel ceasefire but doubts remain

-

England knew they could 'blow match apart' says Stokes after India triumph

-

Lyon appeal relegation to Ligue 2 by financial regulator

Lyon appeal relegation to Ligue 2 by financial regulator

-

US intel says strikes did not destroy Iran nuclear program

-

Nearly half the US population face scorching heat wave

Nearly half the US population face scorching heat wave

-

Israel's Netanyahu vows to block Iran 'nuclear weapon' as he declares victory

-

Saint Laurent kicks off Paris men's fashion week

Saint Laurent kicks off Paris men's fashion week

-

Arbitrator finds NFL encouraged teams to cut veteran guarantees: reports

-

India, Poland, Hungary make spaceflight comeback with ISS mission

India, Poland, Hungary make spaceflight comeback with ISS mission

-

Piot, dropped by LIV Golf, to tee off at PGA Detroit event

-

US judge backs using copyrighted books to train AI

US judge backs using copyrighted books to train AI

-

Russian strikes kill 19 in Ukraine region under pressure

-

Raducanu's tears of joy, Krejcikova survives match points at Eastbourne

Raducanu's tears of joy, Krejcikova survives match points at Eastbourne

-

Duplantis dominates at Golden Spike in Czech Republic

Google pays 326 mn euros to settle Italy tax dispute: prosecutor

Tech giant Google has paid 326 million euros to Italy following an investigation into alleged unpaid taxes, Milan prosecutors said Wednesday, as they recommended criminal proceedings be dropped.

Italian authorities had accused Google Ireland Limited of failing to declare and pay taxes on income generated in the country between 2015 and 2019, with the probe focusing particularly on revenues obtained through selling advertising space.

Under an agreement reached with Google, "the company proceeded to payment of... 326 million euros in taxes, fines and interest, to resolve the outstanding matter with the Italian tax authorities", Milan prosecutors said in a statement.

As a result, the prosecutors said they have submitted to a judge a request to dismiss criminal proceedings in the case.

The tech firm did not immediately respond to a request for comment.

The EU has had little success in getting tech companies to pay more taxes in Europe, where they are accused of funnelling profits into low-tax economies like Ireland and Luxembourg.

In one of the most notorious cases, the European Commission in 2016 ordered Apple to pay Ireland more than a decade in back taxes -- 13 billion euros -- after ruling a sweetheart deal with the government was illegal.

But EU judges overturned the decision saying there was no evidence the company had broken the rules, a decision the commission has been trying to reverse ever since.

The commission is also fighting to reverse another court loss, after judges overruled its order for Amazon to repay 250 million euros in back taxes to Luxembourg.

L.AbuAli--SF-PST