-

Justice orders release of migrants deported to Costa Rica by Trump

Justice orders release of migrants deported to Costa Rica by Trump

-

Vietnam tycoon will not face death penalty over $27 bn fraud: lawyer

-

Vietnam abolishes death penalty for spying, anti-state activities

Vietnam abolishes death penalty for spying, anti-state activities

-

Over 80,000 people flee severe flooding in southwest China

-

AI fakes duel over Sara Duterte impeachment in Philippines

AI fakes duel over Sara Duterte impeachment in Philippines

-

UK carbon emissions cut by half since 1990: experts

-

Delap off mark as Chelsea ease into Club World Cup last 16

Delap off mark as Chelsea ease into Club World Cup last 16

-

UK to reintroduce nuclear weapon-capable aircraft under NATO

-

Upstart socialist stuns political veteran in NYC mayoral primary

Upstart socialist stuns political veteran in NYC mayoral primary

-

China's premier warns global trade tensions 'intensifying'

-

Chelsea through to Club World Cup knockouts, Benfica beat Bayern

Chelsea through to Club World Cup knockouts, Benfica beat Bayern

-

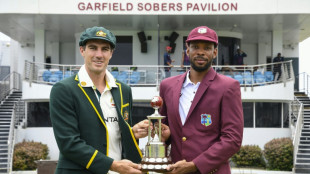

Cummins says Green 'long-term option' as Australia face new-look Windies

-

Chelsea east past Esperance and into Club World Cup last 16

Chelsea east past Esperance and into Club World Cup last 16

-

Stocks rally as Iran-Israel ceasefire holds, oil claws back some losses

-

Trump whirlwind to test NATO summit unity

Trump whirlwind to test NATO summit unity

-

Israel claims victory as US intel says Iran nuclear sites not destroyed

-

Benfica beat Bayern at Club World Cup as Auckland City hold Boca

Benfica beat Bayern at Club World Cup as Auckland City hold Boca

-

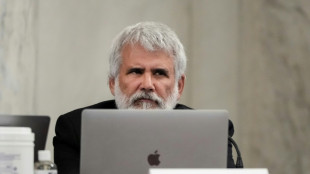

RFK Jr's medical panel to revisit debunked vaccine claims

-

Sean Combs trial: Takeaways from testimony

Sean Combs trial: Takeaways from testimony

-

Messi and Miami relishing reunion with PSG and Enrique

-

At least 10 dead in Colombia landslide

At least 10 dead in Colombia landslide

-

Extreme heat, storms take toll at Club World Cup

-

France's Versailles unveils AI-powered talking statues

France's Versailles unveils AI-powered talking statues

-

Child vaccine coverage faltering, threatening millions: study

-

Club World Cup winners team who handles weather best: Dortmund's Kovac

Club World Cup winners team who handles weather best: Dortmund's Kovac

-

FIFA launch probe into Rudiger racism allegation

-

Trump rattles NATO allies as he descends on summit

Trump rattles NATO allies as he descends on summit

-

Three things we learned from the first Test between England and India

-

Saint Laurent, Vuitton kick off Paris men's fashion week

Saint Laurent, Vuitton kick off Paris men's fashion week

-

Amateurs Auckland City hold Boca Juniors to Club World Cup draw

-

Neymar signs for six more months with Santos with an eye on World cup

Neymar signs for six more months with Santos with an eye on World cup

-

Grok shows 'flaws' in fact-checking Israel-Iran war: study

-

Both sides in Sean Combs trial rest case, closing arguments next

Both sides in Sean Combs trial rest case, closing arguments next

-

Benfica beat Bayern to top group C

-

Trump plays deft hand with Iran-Israel ceasefire but doubts remain

Trump plays deft hand with Iran-Israel ceasefire but doubts remain

-

England knew they could 'blow match apart' says Stokes after India triumph

-

Lyon appeal relegation to Ligue 2 by financial regulator

Lyon appeal relegation to Ligue 2 by financial regulator

-

US intel says strikes did not destroy Iran nuclear program

-

Nearly half the US population face scorching heat wave

Nearly half the US population face scorching heat wave

-

Israel's Netanyahu vows to block Iran 'nuclear weapon' as he declares victory

-

Saint Laurent kicks off Paris men's fashion week

Saint Laurent kicks off Paris men's fashion week

-

Arbitrator finds NFL encouraged teams to cut veteran guarantees: reports

-

India, Poland, Hungary make spaceflight comeback with ISS mission

India, Poland, Hungary make spaceflight comeback with ISS mission

-

Piot, dropped by LIV Golf, to tee off at PGA Detroit event

-

US judge backs using copyrighted books to train AI

US judge backs using copyrighted books to train AI

-

Russian strikes kill 19 in Ukraine region under pressure

-

Raducanu's tears of joy, Krejcikova survives match points at Eastbourne

Raducanu's tears of joy, Krejcikova survives match points at Eastbourne

-

Duplantis dominates at Golden Spike in Czech Republic

-

Prosecutors of Sean Combs rest their case, eyes turn to defense

Prosecutors of Sean Combs rest their case, eyes turn to defense

-

Duckett and Root star as England beat India in thrilling 1st Test

Tech rally helps Hong Kong lead Asian markets higher

Hong Kong resumed its tech-led rally on a healthy day for Asian markets Tuesday as a meeting between President Xi Jinping and China's top business leaders fanned hopes that a years-long crackdown on the private sector is coming to an end.

The Hang Seng Index's gains extended an impressive start to the year, with the emergence of a new chatbot from Chinese startup DeepSeek stoking optimism in the country's AI drive.

The tech revival has also helped offset worries about the impact of US President Donald Trump's hardball foreign policies and decision to impose sweeping tariffs on trade partners.

Among the luminaries meeting Xi in Beijing were Alibaba co-founder Jack Ma, Huawei founder Ren Zhengfei and Wang Chuanfu, CEO of electric-vehicle giant BYD.

Since taking the helm, Xi has strengthened the role of state enterprises in the world's second-largest economy and waged crackdowns on areas of the private sector undergoing "disorderly" expansion.

The drive has hammered some of the country's biggest names in recent years, sending their share prices plummeting.

State news agency Xinhua reported that Xi had "stressed that the difficulties and challenges currently faced by the development of the private economy have generally appeared during the process of reform and development, and industrial transformation".

"They are partial rather than general, temporary rather than long-term, and surmountable rather than unsolvable," Xi said, according to Xinhua.

He added that Beijing was focused on removing obstacles to commerce, promoting fair competition, cracking down on arbitrary fines and protecting business interests.

Monday's gathering provided some much-needed relief to investors and fanned hopes for a sector revival.

"This was seen as a strong signal that his crackdown on the tech sector is over and with forthcoming pro-business policies to help revive the economy," said National Australia Bank head of market economics Tapas Strickland.

Ma's inclusion hinted at the billionaire magnate's potential public rehabilitation after years out of the spotlight following a tangle with regulators.

Shares in Alibaba rose more than four percent Tuesday, and have now piled on more than 50 percent since the turn of the year. There were also healthy gains in other tech firms including Tencent, XD Inc and Netease.

Shanghai, Tokyo, Singapore, Seoul, Taipei, Manila and Jakarta also rose.

The advances came after a strong day in Europe, where Frankfurt hit a new record. Wall Street was closed for a public holiday.

Meanwhile, Federal Reserve governor Christopher Waller suggested the bank could cut interest rates this year if inflation performs as it has in the past, pointing to last year's spike in the winter followed by a quick easing.

"If this wintertime lull in progress is temporary, as it was last year, then further policy easing will be appropriate," he said in prepared remarks due to be delivered on Tuesday in Sydney.

"But until that is clear, I favour holding the policy rate steady."

With prices showing signs of ticking back up in recent months, traders have scaled back their bets on how many reductions officials would make this year.

"The data are not supporting a reduction in the policy rate at this time," Waller said. "But if 2025 plays out like 2024, rate cuts would be appropriate at some point this year."

His remarks come amid fears that Trump's plans to impose tariffs and slash taxes, regulations and immigration will reignite inflation.

- Key figures around 0240 GMT -

Tokyo - Nikkei 225: UP 0.3 percent at 39,296.11 (break)

Hong Kong - Hang Seng Index: UP 1.7 percent at 23,001.87

Shanghai - Composite: UP 0.2 percent at 3,359.80

Euro/dollar: DOWN at $1.0465 from $1.0483 on Monday

Pound/dollar: DOWN at $1.2601 from $1.2613

Dollar/yen: UP at 151.74 from 151.41 yen

Euro/pound: DOWN at 83.06 pence from 83.11 pence

West Texas Intermediate: UP 0.6 percent at $71.19 per barrel

Brent North Sea Crude: DOWN 0.1 percent at $75.13 per barrel

New York - Dow: Closed for a holiday

London - FTSE 100: UP 0.4 percent at 8,768.01 (close)

T.Khatib--SF-PST