-

Oil rebounds as markets track Iran-Israel ceasefire

Oil rebounds as markets track Iran-Israel ceasefire

-

Cable theft in north France disrupts Eurostar traffic

-

Cambodians at quiet Thai border plead for peace

Cambodians at quiet Thai border plead for peace

-

Trump plays nice as NATO eyes 'historic' spending hike

-

Barcelona announce Camp Nou return for August 10

Barcelona announce Camp Nou return for August 10

-

Trump insists Iran nuclear programme set back 'decades'

-

Armenia PM says foiled 'sinister' coup plot by senior cleric

Armenia PM says foiled 'sinister' coup plot by senior cleric

-

Turkey breathes easier as Iran-Israel truce eases fallout risk

-

Tesla sales skid in Europe in May despite EV rebound

Tesla sales skid in Europe in May despite EV rebound

-

'Not Test class': Pundits tear into India after England chase 371

-

Trump whirlwind tests NATO summit unity

Trump whirlwind tests NATO summit unity

-

Justice orders release of migrants deported to Costa Rica by Trump

-

Vietnam tycoon will not face death penalty over $27 bn fraud: lawyer

Vietnam tycoon will not face death penalty over $27 bn fraud: lawyer

-

Vietnam abolishes death penalty for spying, anti-state activities

-

Over 80,000 people flee severe flooding in southwest China

Over 80,000 people flee severe flooding in southwest China

-

AI fakes duel over Sara Duterte impeachment in Philippines

-

UK carbon emissions cut by half since 1990: experts

UK carbon emissions cut by half since 1990: experts

-

Delap off mark as Chelsea ease into Club World Cup last 16

-

UK to reintroduce nuclear weapon-capable aircraft under NATO

UK to reintroduce nuclear weapon-capable aircraft under NATO

-

Upstart socialist stuns political veteran in NYC mayoral primary

-

China's premier warns global trade tensions 'intensifying'

China's premier warns global trade tensions 'intensifying'

-

Chelsea through to Club World Cup knockouts, Benfica beat Bayern

-

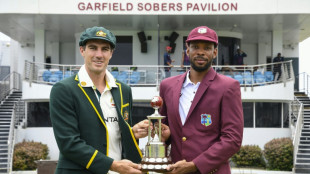

Cummins says Green 'long-term option' as Australia face new-look Windies

Cummins says Green 'long-term option' as Australia face new-look Windies

-

Chelsea east past Esperance and into Club World Cup last 16

-

Stocks rally as Iran-Israel ceasefire holds, oil claws back some losses

Stocks rally as Iran-Israel ceasefire holds, oil claws back some losses

-

Trump whirlwind to test NATO summit unity

-

Israel claims victory as US intel says Iran nuclear sites not destroyed

Israel claims victory as US intel says Iran nuclear sites not destroyed

-

Benfica beat Bayern at Club World Cup as Auckland City hold Boca

-

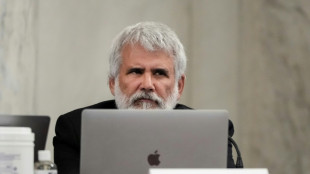

RFK Jr's medical panel to revisit debunked vaccine claims

RFK Jr's medical panel to revisit debunked vaccine claims

-

Sean Combs trial: Takeaways from testimony

-

Messi and Miami relishing reunion with PSG and Enrique

Messi and Miami relishing reunion with PSG and Enrique

-

At least 10 dead in Colombia landslide

-

Extreme heat, storms take toll at Club World Cup

Extreme heat, storms take toll at Club World Cup

-

France's Versailles unveils AI-powered talking statues

-

Child vaccine coverage faltering, threatening millions: study

Child vaccine coverage faltering, threatening millions: study

-

Club World Cup winners team who handles weather best: Dortmund's Kovac

-

FIFA launch probe into Rudiger racism allegation

FIFA launch probe into Rudiger racism allegation

-

Trump rattles NATO allies as he descends on summit

-

Three things we learned from the first Test between England and India

Three things we learned from the first Test between England and India

-

Saint Laurent, Vuitton kick off Paris men's fashion week

-

Amateurs Auckland City hold Boca Juniors to Club World Cup draw

Amateurs Auckland City hold Boca Juniors to Club World Cup draw

-

Neymar signs for six more months with Santos with an eye on World cup

-

Grok shows 'flaws' in fact-checking Israel-Iran war: study

Grok shows 'flaws' in fact-checking Israel-Iran war: study

-

Both sides in Sean Combs trial rest case, closing arguments next

-

Benfica beat Bayern to top group C

Benfica beat Bayern to top group C

-

Trump plays deft hand with Iran-Israel ceasefire but doubts remain

-

England knew they could 'blow match apart' says Stokes after India triumph

England knew they could 'blow match apart' says Stokes after India triumph

-

Lyon appeal relegation to Ligue 2 by financial regulator

-

US intel says strikes did not destroy Iran nuclear program

US intel says strikes did not destroy Iran nuclear program

-

Nearly half the US population face scorching heat wave

European markets rise ahead of Ukraine war talks

European markets rose on Monday as defence stocks surged ahead of a meeting between European leaders to address Washington's shock policy shift on the war in Ukraine.

US President Donald Trump sidelined Kyiv and its European backers last week by calling his Russian counterpart Vladimir Putin to talk about beginning negotiations to end the conflict.

With fears that Europe could be sidelined in negotiations to end the three-year war, European leaders are due to meet later in the day amid talk of greater defence spending.

London, Paris and Frankfurt stock markets all rose on Monday, with defence stocks driving most of the action.

Britain's BAE Systems was up nearly seven percent, topping London's FTSE 100 index, while French defence group Thales rose over five percent in Paris.

Shares in German arms maker Rheinmetall jumped eight percent on Frankfurt's DAX index.

However, traders were cautious over the prospect of higher defence spending and its economic consequences.

"There is a fear that the breakdown in military ties between the US and Europe will necessitate a huge ramp-up in defence spending, thus pushing debt and borrowing costs higher once again," said Joshua Mahony, chief market analyst at Scope markets.

It adds to the uncertainty on trading floors since Trump returned to the Oval Office last month announcing a series of tariffs against key trading partners.

While some of the measures have been delayed for negotiations, observers warn the imposition of huge levies on exports to the world's biggest economy could deal a hefty blow to financial markets.

After a tepid lead from Wall Street, Asian equities ended Monday on a mixed note.

Hong Kong was barely moved after last week's rally fuelled by a surge in tech firms following the release of Chinese startup DeepSeek's chatbot.

"DeepSeek proves that China's private sector remains innovative and competitive, and it also shows the possibility for China's continued AI advancement," said analysts at Bank of America Global Research.

Still, the mood in Hong Kong was improved by news that Chinese President Xi Jinping was meeting Alibaba co-founder Jack Ma and other top entrepreneurs this week.

The gathering fuelled hopes of fresh support for the private sector, which has been hit by a series of crackdowns by the government in the past few years, hammering share prices.

Ma's inclusion hints at the billionaire magnate's potential public rehabilitation after years out of the spotlight following a tangle with regulators.

Other participants included Ren Zhengfei -- the founder of tech titan Huawei -- and Wang Chuanfu, who established electric-vehicle giant BYD.

Tokyo edged up as data showed the Japanese economy slowed sharply last year but enjoyed a forecast-topping final quarter thanks to strong exports.

- Key figures around 1100 GMT -

London - FTSE 100: UP 0.2 percent at 8,752.96 points

Paris - CAC 40: UP 0.2 percent at 8,191.37

Frankfurt - DAX: UP 0.8 percent at 22,699.48

Tokyo - Nikkei 225: UP 0.1 percent at 39,174.25 (close)

Hong Kong - Hang Seng Index: FLAT at 22,616.23 (close)

Shanghai - Composite: UP 0.3 percent at 3,355.83 (close)

New York - Dow: DOWN 0.4 percent at 44,546.08 (close)

Euro/dollar: DOWN at $1.0487 from $1.0495 on Friday

Pound/dollar: UP at $1.2606 from $1.2587

Dollar/yen: DOWN at 151.63 from 152.25 yen

Euro/pound: DOWN at 83.22 pence from 83.36 pence

West Texas Intermediate: UP 0.3 percent at $70.92 per barrel

Brent North Sea Crude: UP 0.2 percent at $74.90 per barrel

N.Awad--SF-PST