-

Trump sees 'progress' on Gaza, raising hopes for ceasefire

Trump sees 'progress' on Gaza, raising hopes for ceasefire

-

UK's Glastonbury Festival opens gates amid Kneecap controversy

-

Oil rebounds as markets track Iran-Israel ceasefire

Oil rebounds as markets track Iran-Israel ceasefire

-

Cable theft in north France disrupts Eurostar traffic

-

Cambodians at quiet Thai border plead for peace

Cambodians at quiet Thai border plead for peace

-

Trump plays nice as NATO eyes 'historic' spending hike

-

Barcelona announce Camp Nou return for August 10

Barcelona announce Camp Nou return for August 10

-

Trump insists Iran nuclear programme set back 'decades'

-

Armenia PM says foiled 'sinister' coup plot by senior cleric

Armenia PM says foiled 'sinister' coup plot by senior cleric

-

Turkey breathes easier as Iran-Israel truce eases fallout risk

-

Tesla sales skid in Europe in May despite EV rebound

Tesla sales skid in Europe in May despite EV rebound

-

'Not Test class': Pundits tear into India after England chase 371

-

Trump whirlwind tests NATO summit unity

Trump whirlwind tests NATO summit unity

-

Justice orders release of migrants deported to Costa Rica by Trump

-

Vietnam tycoon will not face death penalty over $27 bn fraud: lawyer

Vietnam tycoon will not face death penalty over $27 bn fraud: lawyer

-

Vietnam abolishes death penalty for spying, anti-state activities

-

Over 80,000 people flee severe flooding in southwest China

Over 80,000 people flee severe flooding in southwest China

-

AI fakes duel over Sara Duterte impeachment in Philippines

-

UK carbon emissions cut by half since 1990: experts

UK carbon emissions cut by half since 1990: experts

-

Delap off mark as Chelsea ease into Club World Cup last 16

-

UK to reintroduce nuclear weapon-capable aircraft under NATO

UK to reintroduce nuclear weapon-capable aircraft under NATO

-

Upstart socialist stuns political veteran in NYC mayoral primary

-

China's premier warns global trade tensions 'intensifying'

China's premier warns global trade tensions 'intensifying'

-

Chelsea through to Club World Cup knockouts, Benfica beat Bayern

-

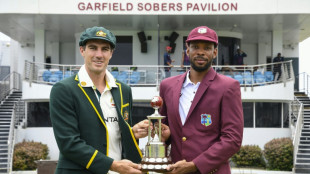

Cummins says Green 'long-term option' as Australia face new-look Windies

Cummins says Green 'long-term option' as Australia face new-look Windies

-

Chelsea east past Esperance and into Club World Cup last 16

-

Stocks rally as Iran-Israel ceasefire holds, oil claws back some losses

Stocks rally as Iran-Israel ceasefire holds, oil claws back some losses

-

Trump whirlwind to test NATO summit unity

-

Israel claims victory as US intel says Iran nuclear sites not destroyed

Israel claims victory as US intel says Iran nuclear sites not destroyed

-

Benfica beat Bayern at Club World Cup as Auckland City hold Boca

-

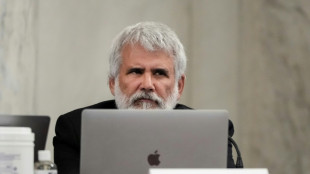

RFK Jr's medical panel to revisit debunked vaccine claims

RFK Jr's medical panel to revisit debunked vaccine claims

-

Sean Combs trial: Takeaways from testimony

-

Messi and Miami relishing reunion with PSG and Enrique

Messi and Miami relishing reunion with PSG and Enrique

-

At least 10 dead in Colombia landslide

-

Extreme heat, storms take toll at Club World Cup

Extreme heat, storms take toll at Club World Cup

-

France's Versailles unveils AI-powered talking statues

-

Child vaccine coverage faltering, threatening millions: study

Child vaccine coverage faltering, threatening millions: study

-

Club World Cup winners team who handles weather best: Dortmund's Kovac

-

FIFA launch probe into Rudiger racism allegation

FIFA launch probe into Rudiger racism allegation

-

Trump rattles NATO allies as he descends on summit

-

Three things we learned from the first Test between England and India

Three things we learned from the first Test between England and India

-

Saint Laurent, Vuitton kick off Paris men's fashion week

-

Amateurs Auckland City hold Boca Juniors to Club World Cup draw

Amateurs Auckland City hold Boca Juniors to Club World Cup draw

-

Neymar signs for six more months with Santos with an eye on World cup

-

Grok shows 'flaws' in fact-checking Israel-Iran war: study

Grok shows 'flaws' in fact-checking Israel-Iran war: study

-

Both sides in Sean Combs trial rest case, closing arguments next

-

Benfica beat Bayern to top group C

Benfica beat Bayern to top group C

-

Trump plays deft hand with Iran-Israel ceasefire but doubts remain

-

England knew they could 'blow match apart' says Stokes after India triumph

England knew they could 'blow match apart' says Stokes after India triumph

-

Lyon appeal relegation to Ligue 2 by financial regulator

Trump tariffs fuel US auto anxiety

A flood of presidential trade policy announcements has kept US automakers on edge since Donald Trump returned to the White House last month.

While some signature threats –- like 25 percent tariffs on Mexico and Canada -- have been wielded and then paused, Trump’s multipronged assault on the international trade order is building up incremental cost pressures, according to auto industry experts.

An additional 10 percent tariff on imports from China -- a major auto parts supplier -- has already been imposed, and a 25 percent tariff on steel and aluminum imports that takes effect March 12 is likely to add another layer to supply and manufacturing costs.

"It's like, a little here, a little there," Ford CEO Jim Farley said this week. "They won't be small together."

And there has been no letup in the stream of trade directives emanating from the Oval Office.

On Thursday, when Trump signed plans for sweeping "reciprocal tariffs" with trading partners, he highlighted an imbalance between US and European Union levies on car imports as a prime example of what he was targeting.

And the following day, the president said he planned to unveil tariffs on foreign cars in early April, though he did not specify how large the levies would be or which countries would be initially earmarked.

If the paused Mexico and Canada tariffs are eventually imposed, Farley said they would "blow a hole" in the US auto industry, which has been integrated with its neighbors since the 1990s North American Free Trade Agreement (NAFTA).

"Most folks recognize the threat, but they don't believe he's going to drop the bomb," said Cox Automotive economist Charlie Chesbrough.

Besides the Detroit giants, foreign automakers also have extensive investments in Mexico and Canada. Honda has factories in the United States, Canada and Mexico and none of the cars it sold in the US market in 2024 were imported from Japan, according to figures from the consultancy GlobalData.

- New US investment? -

Trump administration officials have characterized tariffs as a potential revenue source as well as an incentive for global companies to add manufacturing capacity in the United States.

Trump has placed tariffs at the center of his "America First" approach, describing the levies as a way to right past "unfair" treatment from trade allies.

A White House fact sheet released Thursday pointed out that the European Union imposes a 10 percent tariff on imported cars, while the United States levy stands at 2.5 percent.

Within the EU, German automakers are the biggest source of direct US car imports from Europe. This group includes luxury brands like BMW, Mercedes-Benz and Audi that either have or are part of companies that also operate manufacturing facilities in the United States.

Placating the Trump administration on the EU auto tariff could be relatively painless for Brussels, said Jeff Schuster, vice president of global research at GlobalData.

"US vehicles, especially the vehicles that are popular here, would not be popular in Europe," said Schuster, who expects eliminating the EU tariff would have little impact.

Auto analysts believe foreign automakers may in the coming months unveil plans to expand or build new factories in the United States. However, they face a dilemma about what kind of vehicles to manufacture due to the shifting winds of US politics.

At the same time the Trump administration is pursuing a shake-up to international trade, it is signaling a reversal on efforts to boost electric vehicle capacity, placing the United States out of step with Europe, China and other major markets.

The long lead-time in the auto industry means the cars resulting from current investment decisions may not hit the market for four or five years.

As global companies, "it's not efficient to have different strategies in every market," Schuster said.

F.AbuShamala--SF-PST