-

Bielle-Biarrey 'fit' for Top 14 final after suffering concussion

Bielle-Biarrey 'fit' for Top 14 final after suffering concussion

-

James Webb telescope discovers its first exoplanet

-

Kenya's Kipyegon seeks history with four minute mile attempt

Kenya's Kipyegon seeks history with four minute mile attempt

-

Gunmen kill 10 in crime-hit Mexican city

-

Olympic surfing venue battling erosion threat

Olympic surfing venue battling erosion threat

-

Relief, joy as Israel reopens after Iran war ceasefire

-

Spain upholds fine against Rubiales for Hermoso forced kiss

Spain upholds fine against Rubiales for Hermoso forced kiss

-

Iran hangs three more accused of spying as fears grow for Swede

-

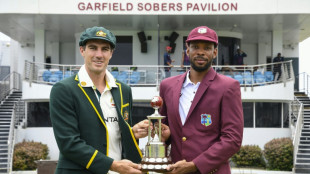

Australia choose to bat first in first Test against West Indies

Australia choose to bat first in first Test against West Indies

-

Gambhir backs India bowlers to 'deliver' despite first Test misery

-

Trump reassures allies as NATO agrees 'historic' spending hike

Trump reassures allies as NATO agrees 'historic' spending hike

-

England's Duckett says mindset change behind Test success

-

Trump sees 'progress' on Gaza, raising hopes for ceasefire

Trump sees 'progress' on Gaza, raising hopes for ceasefire

-

UK's Glastonbury Festival opens gates amid Kneecap controversy

-

Oil rebounds as markets track Iran-Israel ceasefire

Oil rebounds as markets track Iran-Israel ceasefire

-

Cable theft in north France disrupts Eurostar traffic

-

Cambodians at quiet Thai border plead for peace

Cambodians at quiet Thai border plead for peace

-

Trump plays nice as NATO eyes 'historic' spending hike

-

Barcelona announce Camp Nou return for August 10

Barcelona announce Camp Nou return for August 10

-

Trump insists Iran nuclear programme set back 'decades'

-

Armenia PM says foiled 'sinister' coup plot by senior cleric

Armenia PM says foiled 'sinister' coup plot by senior cleric

-

Turkey breathes easier as Iran-Israel truce eases fallout risk

-

Tesla sales skid in Europe in May despite EV rebound

Tesla sales skid in Europe in May despite EV rebound

-

'Not Test class': Pundits tear into India after England chase 371

-

Trump whirlwind tests NATO summit unity

Trump whirlwind tests NATO summit unity

-

Justice orders release of migrants deported to Costa Rica by Trump

-

Vietnam tycoon will not face death penalty over $27 bn fraud: lawyer

Vietnam tycoon will not face death penalty over $27 bn fraud: lawyer

-

Vietnam abolishes death penalty for spying, anti-state activities

-

Over 80,000 people flee severe flooding in southwest China

Over 80,000 people flee severe flooding in southwest China

-

AI fakes duel over Sara Duterte impeachment in Philippines

-

UK carbon emissions cut by half since 1990: experts

UK carbon emissions cut by half since 1990: experts

-

Delap off mark as Chelsea ease into Club World Cup last 16

-

UK to reintroduce nuclear weapon-capable aircraft under NATO

UK to reintroduce nuclear weapon-capable aircraft under NATO

-

Upstart socialist stuns political veteran in NYC mayoral primary

-

China's premier warns global trade tensions 'intensifying'

China's premier warns global trade tensions 'intensifying'

-

Chelsea through to Club World Cup knockouts, Benfica beat Bayern

-

Cummins says Green 'long-term option' as Australia face new-look Windies

Cummins says Green 'long-term option' as Australia face new-look Windies

-

Chelsea east past Esperance and into Club World Cup last 16

-

Stocks rally as Iran-Israel ceasefire holds, oil claws back some losses

Stocks rally as Iran-Israel ceasefire holds, oil claws back some losses

-

Trump whirlwind to test NATO summit unity

-

Israel claims victory as US intel says Iran nuclear sites not destroyed

Israel claims victory as US intel says Iran nuclear sites not destroyed

-

Benfica beat Bayern at Club World Cup as Auckland City hold Boca

-

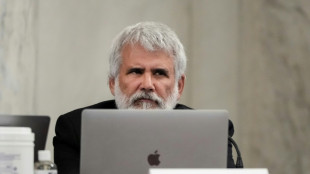

RFK Jr's medical panel to revisit debunked vaccine claims

RFK Jr's medical panel to revisit debunked vaccine claims

-

Sean Combs trial: Takeaways from testimony

-

Messi and Miami relishing reunion with PSG and Enrique

Messi and Miami relishing reunion with PSG and Enrique

-

At least 10 dead in Colombia landslide

-

Extreme heat, storms take toll at Club World Cup

Extreme heat, storms take toll at Club World Cup

-

France's Versailles unveils AI-powered talking statues

-

Child vaccine coverage faltering, threatening millions: study

Child vaccine coverage faltering, threatening millions: study

-

Club World Cup winners team who handles weather best: Dortmund's Kovac

Stocks mostly up on Ukraine peace hopes, shrugging off latest US tariff talk

Major stock markets mostly rose Thursday on hopes for an end to the war in Ukraine and as US President Trump announced a trade policy shake-up but held off on specific new levies.

London was a rare faller owing to sharp losses to share prices of big companies, including Unilever, Barclays and British American Tobacco, on mixed earnings. That overshadowed news that the UK economy surprisingly grew in late 2024.

US President Donald Trump's talks with Russian leader Vladimir Putin to start negotiating an end to the war in Ukraine "has fostered a risk-on attitude among investors", said Naeem Aslam, chief investment officer at Zaye Capital Markets.

The positive showing "is a result of the potential reduction in geopolitical risks", he added.

Paris and Frankfurt won solid gains. Major US indices joined them, with the S&P 500 winning one percent.

Trump unveiled a "fair and reciprocal plan" for trade, ordering a review of tariffs on US goods and directing officials to propose remedies, a step towards potentially wide-ranging tariffs on allies and competitors.

But Wall Street was encouraged that the plan did not include immediate levies.

Investors are "taking comfort" in the "idea that it's negotiable and not coming into effect immediately," said Tom Cahill of Ventura Wealth Management.

US investors also shrugged off data showing a bigger than expected uptick in US wholesale prices in January, adding to concerns about worsening pricing pressure after Wednesday's consumer price data also exceeded estimates.

Some analysts also noted that the details of Thursday's US inflation report were less troubling than the headline figures.

But the dollar weakened after traders concluded the reciprocal tariffs will "either be tolerable for partners, negotiated away or never implemented," said Adam Button, currency analyst at ForexLive.

Among individual stocks, Nestle surged more than six percent in Zurich after the Swiss food giant posted better-than-expected annual sales.

But Deere & Company fell 2.2 percent as it navigates a tough agriculture market with the depressed state of farm income and higher interest rates that make equipment purchases difficult.

The company's revenues fell more than 30 percent last year, while it projected broad-based decline again in 2025.

- Key figures around 2150 GMT -

New York - Dow: UP 0.8 percent at 44,711.43 (close)

New York - S&P 500: UP 1.0 percent at 6,115.07 (close)

New York - Nasdaq Composite: UP 1.5 percent at 19,945.64 (close)

London - FTSE 100: DOWN 0.5 percent at 8,764.72 (close)

Paris - CAC 40: UP 1.5 percent at 8,164.11 (close)

Frankfurt - DAX: UP 2.1 percent at 22,612.02 (close)

Tokyo - Nikkei 225: UP 1.3 percent at 39,461.47 (close)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 21,814.37 (close)

Shanghai - Composite: DOWN 0.4 percent at 3,332.48 (close)

Euro/dollar: UP at $1.0467 from $1.0383 on Wednesday

Pound/dollar: UP at $1.2586 from $1.2446

Dollar/yen: DOWN at 152.76 yen from 154.42 yen

Euro/pound: DOWN at 83.28 pence from 83.42 pence

West Texas Intermediate: DOWN 0.1 percent at $71.29 per barrel

Brent North Sea Crude: DOWN 0.2 percent at $75.02 per barrel

burs-jmb

W.AbuLaban--SF-PST