-

Novo Nordisk launches bidding war with Pfizer for obesity drugmaker Metsera

Novo Nordisk launches bidding war with Pfizer for obesity drugmaker Metsera

-

Universal says struck first licensing deal for AI music

-

France arrests five new suspects over Louvre heist: prosecutor

France arrests five new suspects over Louvre heist: prosecutor

-

Stocks fall as investors eye Trump-Xi talks, earnings

-

Record Vietnam floods kill 10, turn streets into canals

Record Vietnam floods kill 10, turn streets into canals

-

Trump orders US to start nuclear weapons testing

-

'Significant' Xi, Trump talks win cautious optimism in China

'Significant' Xi, Trump talks win cautious optimism in China

-

French justice minister visits jailed former president Sarkozy

-

Eurozone growth beats expectations in third quarter

Eurozone growth beats expectations in third quarter

-

Bali trial begins for 3 accused of Australian's murder

-

Dutch election a photo finish between far-right, centrists

Dutch election a photo finish between far-right, centrists

-

IOC removes Saudi Arabia as host of inaugural Esports Olympics

-

Russia batters Ukraine energy sites, killing two

Russia batters Ukraine energy sites, killing two

-

Shell's net profit jumps despite lower oil prices

-

Pakistani security source says Afghanistan talks 'likely' to resume

Pakistani security source says Afghanistan talks 'likely' to resume

-

Fentanyl, beans and Ukraine: takeaways from Trump-Xi's 'great meeting'

-

Asia markets fluctuate as investors examine Trump-Xi talks

Asia markets fluctuate as investors examine Trump-Xi talks

-

Branson's Virgin moves closer to launching Eurostar rival

-

Russia hits Ukraine energy sites, killing one, wounding children

Russia hits Ukraine energy sites, killing one, wounding children

-

Asia markets fluctuate as investors mull Trump-Xi talks

-

Trump, Xi ease fight on tariffs, rare earths

Trump, Xi ease fight on tariffs, rare earths

-

Volkswagen posts 1-billion-euro loss on tariffs, Porsche woes

-

'Fight fire with fire': California mulls skewing electoral map

'Fight fire with fire': California mulls skewing electoral map

-

Fentanyl, beans and Ukraine: Trump hails 'success' in talks with Xi

-

'Nowhere to sleep': Melissa upends life for Jamaicans

'Nowhere to sleep': Melissa upends life for Jamaicans

-

Irish octogenarian enjoys new lease on life making harps

-

Tanzania blackout after election chaos, deaths feared

Tanzania blackout after election chaos, deaths feared

-

G7 meets on countering China's critical mineral dominance

-

Trump hails tariff, rare earth deal with Xi

Trump hails tariff, rare earth deal with Xi

-

Court rules against K-pop group NewJeans in label dispute

-

India's Iyer says 'getting better by the day' after lacerated spleen

India's Iyer says 'getting better by the day' after lacerated spleen

-

Yesavage fairytale carries Blue Jays to World Series brink

-

Bank of Japan keeps interest rates unchanged

Bank of Japan keeps interest rates unchanged

-

Impoverished Filipinos forge a life among the tombstones

-

Jokic posts fourth straight triple-double as Nuggets rout Pelicans

Jokic posts fourth straight triple-double as Nuggets rout Pelicans

-

UN calls for end to Sudan siege after mass hospital killings

-

Teenage Australian cricketer dies after being hit by ball

Teenage Australian cricketer dies after being hit by ball

-

As Russia advances on Kupiansk, Ukrainians fear second occupation

-

Trade truce in balance as Trump meets 'tough negotiator' Xi

Trade truce in balance as Trump meets 'tough negotiator' Xi

-

China to send youngest astronaut, mice on space mission this week

-

Yesavage gem carries Blue Jays to brink of World Series as Dodgers downed

Yesavage gem carries Blue Jays to brink of World Series as Dodgers downed

-

With inflation under control, ECB to hold rates steady again

-

Asia stocks muted with all eyes on Trump-Xi meeting

Asia stocks muted with all eyes on Trump-Xi meeting

-

Personal tipping points: Four people share their climate journeys

-

Moto3 rider Dettwiler 'no longer critical' after crash: family

Moto3 rider Dettwiler 'no longer critical' after crash: family

-

US economy in the dark as government shutdown cuts off crucial data

-

Trump orders nuclear testing resumption ahead of Xi talks

Trump orders nuclear testing resumption ahead of Xi talks

-

'Utter madness': NZ farmers agree dairy sale to French group

-

Samsung posts 32% profit rise on-year in third quarter

Samsung posts 32% profit rise on-year in third quarter

-

30 years after cliffhanger vote, Quebec separatists voice hope for independence

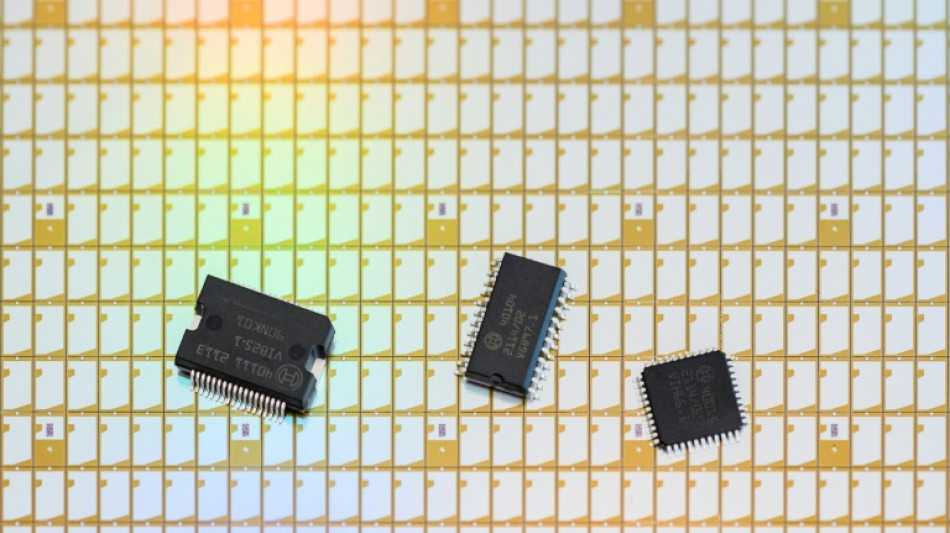

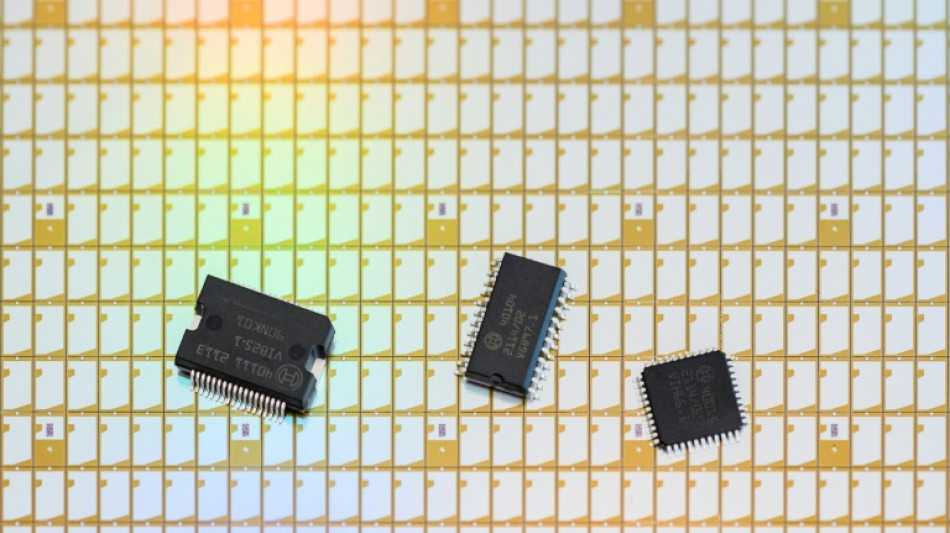

Taiwan chip firm's bid to buy German rival collapses

A Taiwanese semiconductor technology company's $4.5 billion deal to acquire a German rival collapsed on Tuesday after a deadline for Berlin to approve the bid passed without a decision.

The demise of GlobalWafers' attempt to buy Siltronic was welcomed by German politicians, who said the country had to protect its security interests.

The Taiwanese firm makes wafers, one-millimetre-thick sheets of silicon necessary for the manufacturing of semiconductors that are the backbone of the global technology sector.

GlobalWafers had signed an agreement with Siltronic in December 2020 to acquire all of the German company's outstanding shares at a 10 percent premium worth roughly $4.5 billion (4.0 billion euros).

But the deal needed regulatory approval from Berlin, which was not obtained by the January 31 deadline.

"Therefore, the takeover offer by GlobalWafers and the agreements which came into existence as a result of the offer will not be completed and will lapse," GlobalWafers said.

CEO Doris Hsu called it "disappointing" and said the Taiwanese company will work to "analyse the non-decision" by Berlin.

A spokeswoman for the German ministry for the economy and climate said in a statement that "not all the necessary investment review steps could be completed before the end of the period".

Siltronic said GlobalWafers will pay the German company a termination fee of 50 million euros ($56.1 million).

German politicians voiced support for the government's decision to drop the deal, according to local business newspaper Handelsblatt.

"We do not gain technological sovereignty by selling off our silverware," said Hannes Walter, vice chairman of the Economics Committee.

Julia Kloeckner, an economic policy spokeswoman for centre-right CDU/CSU parliamentary group, said the move was right to "keep our security interests in mind".

Governments are increasingly scrutinising huge takeovers in the global technology industry, rattled by growing national security concerns and supply chain crunches due to the pandemic.

US regulators filed a December lawsuit to block a $40 billion merger of graphics chip star Nvidia with mobile chip tech powerhouse Arm Ltd.

The Federal Trade Commission said it was fearful it could provide one of the largest semiconductor companies with control over computing technology and designs "that rival firms rely on to develop their own competing chips".

R.AbuNasser--SF-PST