-

IMF urges US to work with partners to ease trade restrictions

IMF urges US to work with partners to ease trade restrictions

-

Brumbies not getting carried away by emphatic Super Rugby start

-

Cuba coast guard kills four on US-registered speedboat

Cuba coast guard kills four on US-registered speedboat

-

Juve lick wounds after painful Champions League exit

-

Real Madrid victory for 'everyone against racism': Tchouameni

Real Madrid victory for 'everyone against racism': Tchouameni

-

Wallabies skipper Wilson back from injury in clash of heavyweight coaches

-

PSG coach Luis Enrique calls on team to raise their game in Champions League last 16

PSG coach Luis Enrique calls on team to raise their game in Champions League last 16

-

Nvidia smashes forecasts with record quarter as AI boom rolls on

-

Vinicius seals Real Champions League progress as PSG edge out Monaco

Vinicius seals Real Champions League progress as PSG edge out Monaco

-

Galatasaray survive Juve scare to squeeze into Champions League last 16

-

PSG survive Monaco scare to reach Champions League last 16

PSG survive Monaco scare to reach Champions League last 16

-

Vinicius hits winner as Real Madrid eliminate Benfica after racism row

-

Harden fractures thumb in blow to in-form Cavaliers

Harden fractures thumb in blow to in-form Cavaliers

-

Hope fades in search for missing after Brazil rains kill 46

-

Trump, Zelensky speak before Ukraine-US talks in Geneva

Trump, Zelensky speak before Ukraine-US talks in Geneva

-

Scam centres 'destroying' Cambodia's economy, PM tells AFP

-

Last-gasp Atalanta eliminate Dortmund to reach Champions League last 16

Last-gasp Atalanta eliminate Dortmund to reach Champions League last 16

-

Iran negotiators arrive in Geneva for high-stakes US talks

-

Antonio Tejero, leader of Spain's failed 1981 coup, dies at 93

Antonio Tejero, leader of Spain's failed 1981 coup, dies at 93

-

Hakimi, set to face trial for rape, in PSG team for Champions League game

-

Eleven men lured into Russia war returned to South Africa

Eleven men lured into Russia war returned to South Africa

-

Brazil politicians convicted for ordering murder of black activist councilor

-

Ex-US Treasury chief Summers quits Harvard over Epstein ties

Ex-US Treasury chief Summers quits Harvard over Epstein ties

-

Modi says India stands 'firmly' with Israel during visit

-

New Zealand knock sorry Sri Lanka out of T20 World Cup

New Zealand knock sorry Sri Lanka out of T20 World Cup

-

Berlinale meet called over film director's anti-Israel speech

-

Hope fades in search for missing after Brazil rains kill 40

Hope fades in search for missing after Brazil rains kill 40

-

Van der Poel to make season bow at Omloop Het Nieuwsblad

-

Maria Grazia Chiuri's Fendi homecoming feted in Milan

Maria Grazia Chiuri's Fendi homecoming feted in Milan

-

Norway's King Harald to stay in hospital to treat infection: doctor

-

Mbappe season on ice ahead of silverware sprint, World Cup

Mbappe season on ice ahead of silverware sprint, World Cup

-

New Zealand produce late flurry to reach 168-7 against Sri Lanka

-

France appoints new Louvre chief after jewellery heist

France appoints new Louvre chief after jewellery heist

-

No Ahmedabad advantage for South Africa against West Indies: Maharaj

-

Scotland fans skirt World Cup rules for kilt bags

Scotland fans skirt World Cup rules for kilt bags

-

18 Egyptians missing after deadly boat capsize near Greece

-

Stock markets strike record highs as AI concerns ease

Stock markets strike record highs as AI concerns ease

-

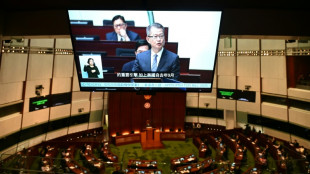

Hong Kong finance chief tips up to 3.5% growth this year

-

Arctic underdogs Bodo/Glimt topple Champions League giants in 'fairytale'

Arctic underdogs Bodo/Glimt topple Champions League giants in 'fairytale'

-

Bill Gates admits affairs but denies involvement in Epstein crimes

-

Hope fades in search for missing after deadly Brazil rains

Hope fades in search for missing after deadly Brazil rains

-

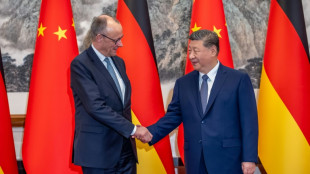

Germany's Merz meets Xi, announces Chinese Airbus order

-

Hakimi, set to face trial for rape, in PSG Champions League matchday squad

Hakimi, set to face trial for rape, in PSG Champions League matchday squad

-

Man Utd financial results show profit increase after job cuts

-

Guinness maker Diageo cuts outlook on weak US, China demand

Guinness maker Diageo cuts outlook on weak US, China demand

-

Swiss-EU deals package to be signed next week

-

Ice melt threatens emperor penguins during annual moult: researchers

Ice melt threatens emperor penguins during annual moult: researchers

-

Pope lines up trips to Central Africa, Algeria, Spain, Monaco

-

Stock markets hit record highs on easing AI concerns

Stock markets hit record highs on easing AI concerns

-

Samson in India's mix for high-stakes clash against Zimbabwe

European stocks rise tracking big corporate news, China growth

European stock markets climbed on Monday as China's unexpectedly muted growth slowdown and optimism over the impact of the Omicron coronavirus variant boosted investor confidence.

Oil rose modestly on limited supply concerns, while the dollar was up against major rivals as Wall Street was closed for a US public holiday.

The fast-spreading Omicron strain had initially sparked fears for the global economic recovery, but studies indicating that it causes milder illness and government booster vaccine programmes have calmed traders' nerves.

London, Paris and Frankfurt all ended the day higher.

"The relatively lower mortality rates, coupled with ongoing vaccinations efforts, has raised hopes we will transition to endemic and that the economy will recover strongly," said market analyst Fawad Razaqzada of ThinkMarkets.

Britain's benchmark FTSE 100 index climbed to new highs in 2022 after pharma giant GlaxoSmithKline rejected a bid worth £50 billion ($68 billion, 60 billion euros) from Pfizer for a consumer healthcare unit.

GlaxoSmithKline shares rose to the top of the index, while Pfizer's sank to the bottom as the US pharma behemoth said it would press on with a bid for GSK Consumer healthcare.

Concerns over soaring inflation and the US Federal Reserve's stance on hiking interest rates to counter it did not temper investor confidence in European stocks.

The trend was "due to a relatively more dovish central bank and the potential for a strong rebound in economic growth as nations ease travel restrictions amid ongoing booster vaccination efforts", said Razaqzada.

"As we head into 2022, we believe that the post-pandemic bull market remains broadly intact," added Bank of Singapore analyst Eli Lee.

"Historically, bull markets do not end at the beginning of rate hike cycles, and positive trends in global economic growth and earnings continue to be positive fundamental drivers for the market."

China on Monday defied expectations and posted growth figures of 8.1 percent in 2021, although this slowed in the final months amid fresh coronavirus outbreaks, disruptive regulatory crackdowns and property market crises.

Covid infections in the world's second-largest economy climbed to their highest level since March 2020 as Beijing pursues its zero-Covid policy ahead of the Winter Olympics.

But mainland China shares were supported by news that the country's central bank had cut interest rates for the first time since the height of the pandemic last year as officials look to kickstart stuttering growth.

"Rising infections in China just three weeks before the Winter Olympics could lead to widespread economic uncertainty, particularly if the situation is not handled effectively in the short term," said XTB market analyst Walid Koudmani.

Benchmark oil contract Brent North Sea briefly reached the highest level for more than three years at $86.71 per barrel, adding to strong inflation concerns.

"Markets remain focused on the delicate balance between supply and demand which has appeared to impact price fluctuations quite significantly throughout most of the post pandemic economic recovery," said Koudmani.

Credit Suisse fell almost 1.8 percent after the Swiss bank's chairman resigned less than a year after taking the reins following reports he had broken Covid quarantine rules.

Antonio Horta-Osorio's immediate departure adds to the bank's troubles after it was last year rocked by links to the multi-billion-dollar meltdowns at financial firms Greensill and Archegos.

- Key figures around 1630 GMT -

London - FTSE 100: UP 0.9 percent at 7,611.23 points (close)

Frankfurt - DAX: UP 0.3 percent at 15,934.62 (close)

Paris - CAC 40: UP 0.8 percent at 7,201.64 (close)

EURO STOXX 50: UP 0.7 percent at 4,302.11

Tokyo - Nikkei 225: UP 0.7 percent at 28,333.52 (close)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 24,218.03 (close)

Shanghai - Composite: UP 0.6 percent at 3,541.67 (close)

New York - DOW: Closed for a holiday

Euro/dollar: DOWN at $1.1407 from $1.1418 late on Friday

Pound/dollar: DOWN at $1.3652 from $1.3680

Euro/pound: UP at 83.55 pence from 83.43 pence

Dollar/yen: UP at 114.58 yen from 114.25 yen

Brent North Sea crude: UP 0.3 percent at $86.38 per barrel

West Texas Intermediate: UP 0.3 percent at $84.16 per barrel

B.AbuZeid--SF-PST