-

'Amazing' feeling for Rees-Zammit on Wales return after NFL adventure

'Amazing' feeling for Rees-Zammit on Wales return after NFL adventure

-

'Cruel' police raids help, not hinder, Rio's criminal gangs: expert

-

S. African president eyes better US tariff deal 'soon'

S. African president eyes better US tariff deal 'soon'

-

Sinner cruises in Paris Masters opener, Zverev keeps title defence alive

-

Winter Olympics - 100 days to go to 'unforgettable Games'

Winter Olympics - 100 days to go to 'unforgettable Games'

-

Kiwi Plumtree to step down as Sharks head coach

-

France to charge Louvre heist suspects with theft and conspiracy

France to charge Louvre heist suspects with theft and conspiracy

-

US media mogul John Malone to step down as head of business empire

-

'Never been this bad': Jamaica surveys ruins in hurricane's wake

'Never been this bad': Jamaica surveys ruins in hurricane's wake

-

France adopts consent-based rape law

-

Zverev survives scare to kickstart Paris Masters title defence

Zverev survives scare to kickstart Paris Masters title defence

-

Rabat to host 2026 African World Cup play-offs

-

Wolvaardt-inspired South Africa crush England to reach Women's World Cup final

Wolvaardt-inspired South Africa crush England to reach Women's World Cup final

-

US says not withdrawing from Europe after troops cut

-

WHO urges Sudan ceasefire after alleged massacres in El-Fasher

WHO urges Sudan ceasefire after alleged massacres in El-Fasher

-

Under-fire UK govt deports migrant sex offender with £500

-

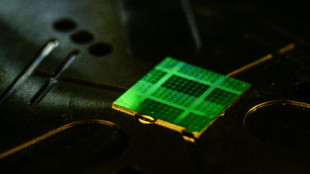

AI chip giant Nvidia becomes world's first $5 trillion company

AI chip giant Nvidia becomes world's first $5 trillion company

-

Arsenal depth fuels Saka's belief in Premier League title charge

-

Startup Character.AI to ban direct chat for minors after teen suicide

Startup Character.AI to ban direct chat for minors after teen suicide

-

132 killed in massive Rio police crackdown on gang: public defender

-

Pedri joins growing Barcelona sickbay

Pedri joins growing Barcelona sickbay

-

Zambia and former Chelsea manager Grant part ways

-

Russia sends teen who performed anti-war songs back to jail

Russia sends teen who performed anti-war songs back to jail

-

Caribbean reels from hurricane as homes, streets destroyed

-

Boeing reports $5.4-bn loss on large hit from 777X aircraft delays

Boeing reports $5.4-bn loss on large hit from 777X aircraft delays

-

Real Madrid's Vinicius says sorry for Clasico substitution huff

-

Dutch vote in snap election seen as test for Europe's far-right

Dutch vote in snap election seen as test for Europe's far-right

-

Jihadist fuel blockade makes daily life a struggle for Bamako residents

-

De Bruyne goes under the knife for hamstring injury

De Bruyne goes under the knife for hamstring injury

-

Wolvaardt's 169 fires South Africa to 319-7 in World Cup semis

-

EU seeks 'urgent solutions' with China over chipmaker Nexperia

EU seeks 'urgent solutions' with China over chipmaker Nexperia

-

Paris prosecutor promises update in Louvre heist probe

-

Funds for climate adaptation 'lifeline' far off track: UN

Funds for climate adaptation 'lifeline' far off track: UN

-

Record Vietnam rains kill seven and flood 100,000 homes

-

Markets extend record run as trade dominates

Markets extend record run as trade dominates

-

Sudan govt accuses RSF of attacking mosques in El-Fasher takeover

-

Rain washes out 1st Australia-India T20 match

Rain washes out 1st Australia-India T20 match

-

Spain's Santander bank posts record profit

-

FIA taken to court to block Ben Sulayem's uncontested candidacy

FIA taken to court to block Ben Sulayem's uncontested candidacy

-

Chemicals firm BASF urges EU to cut red tape as profit dips

-

Romania says US will cut some troops in Europe

Romania says US will cut some troops in Europe

-

Israel hits dozens of targets as Gaza sees deadliest night since truce

-

Mercedes-Benz reassures on Nexperia chips as profit plunges

Mercedes-Benz reassures on Nexperia chips as profit plunges

-

France tries Bulgarians over defacing memorial in Russia-linked case

-

BBC says journalist questioned and blocked from leaving Vietnam

BBC says journalist questioned and blocked from leaving Vietnam

-

UK drugmaker GSK lifts 2025 guidance despite US tariffs

-

Mercedes-Benz profit plunges on China slump and US tariffs

Mercedes-Benz profit plunges on China slump and US tariffs

-

South Korea gifts Trump replica of ancient golden crown

-

Record Vietnam rains kill four and flood 100,000 homes

Record Vietnam rains kill four and flood 100,000 homes

-

Norway's energy giant Equinor falls into loss

| CMSD | -0.28% | 24.57 | $ | |

| JRI | -1.59% | 13.83 | $ | |

| BCC | -2.74% | 70.44 | $ | |

| CMSC | 0.28% | 24.327 | $ | |

| RIO | 0.83% | 72.59 | $ | |

| SCS | -3.96% | 16.045 | $ | |

| NGG | -1.28% | 75.68 | $ | |

| RYCEF | -0.65% | 15.36 | $ | |

| RBGPF | -0.11% | 79 | $ | |

| BTI | -1.44% | 51.715 | $ | |

| AZN | -0.79% | 81.96 | $ | |

| BP | 2.27% | 35.26 | $ | |

| GSK | 4.9% | 45.95 | $ | |

| BCE | -0.62% | 23.425 | $ | |

| RELX | -3.31% | 44.75 | $ | |

| VOD | -2.86% | 11.895 | $ |

China cuts lending rates, boosting property firms

China further reduced bank lending costs Thursday in the latest move to boost its stuttering economy, providing some much-needed support to the country's beleaguered developers.

Property firm shares and bonds surged on the fresh rate cut from People's Bank of China -- the second in two months -- days after Beijing reported slower growth in the final months of 2021.

The slowing real estate industry has put downward pressure on growth, with several large companies including debt-laden development giant Evergrande defaulting in recent months.

The central bank said it had lowered the one-year loan prime rate (LPR) to 3.7 percent, from 3.8 percent in December.

It had reduced the LPR -- which guides how much interest commercial banks charge to corporate borrowers -- in December, for the first time in 20 months, as the economy was threatened by the real estate crisis and coronavirus flare-ups.

The launch of a regulatory drive last year to curb speculation and leverage had cut off avenues to crucially needed cash, sparking a crisis in the property sector.

But investors regained confidence amid expectations of regulatory easing with shares in Hong Kong-listed Agile Group up more than six percent and Country Garden climbing 7.4 percent.

Property developer bonds also surged Thursday on news of the rate cut, in what Bloomberg said was a record-breaking rally, highlighting the huge sums of money primed to flow into distressed securities if the property sector crackdown was eased.

Thursday's move comes after the world's second-biggest economy reported strong 8.1 percent growth in 2021, but with the first half of the year accounting for much of that growth.

The central bank also cut the interest rate on its one-year policy loans on Monday -- the first drop in the key rate for loans to financial institutions since early 2020.

- 'Targeted support' -

China was the only major economy to expand in 2020, after quickly bringing the outbreak under control.

But the country is now battling several localised virus clusters as it deals with the ongoing property market slump and fallout from a wide-ranging regulatory crackdown last year.

"Today's reductions to both the one-year and five-year Loan Prime Rates (LPR) continue the PBOC's efforts to push down borrowing costs," said Sheana Yue, China economist at Capital Economics.

She said the cuts mean "mortgages will now be slightly cheaper, which should help shore up housing demand."

"Targeted support for property buyers does appear to be limiting one of the more severe downside risks facing the economy."

Hong Kong-listed China Aoyuan Group became the latest major developer to miss bond payments, saying in a filing it would be unable to pay two notes due Thursday and Saturday, amounting to $688 million in total.

Fitch Ratings also downgraded its rating for real estate giant Sunac China Holdings, warning the developer would have to use its cash reserves to pay off debts maturing soon.

H.Jarrar--SF-PST